Pershing Square Activist Presentation Deck

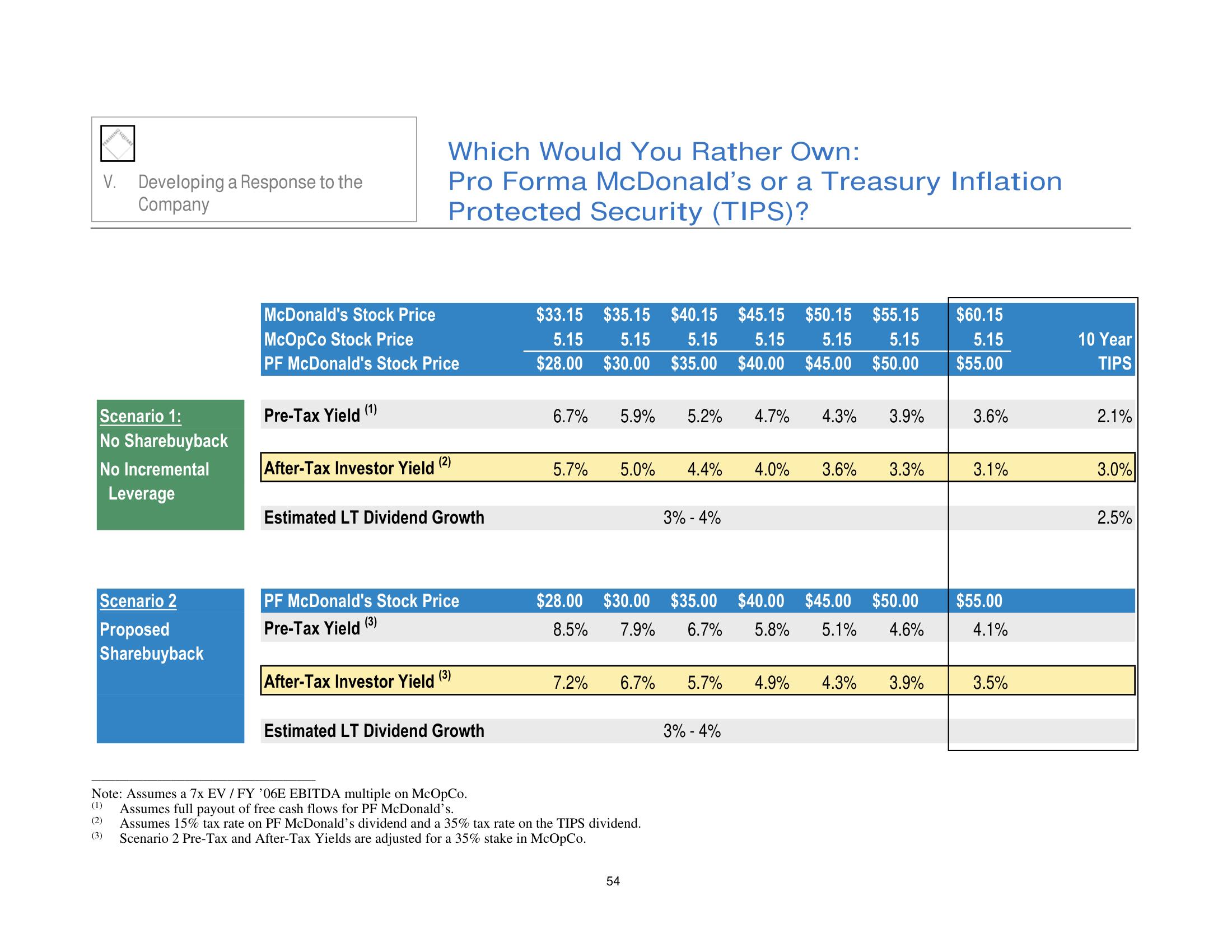

V. Developing a Response to the

Company

Scenario 1:

No Sharebuyback

No Incremental

Leverage

Scenario 2

Proposed

Sharebuyback

McDonald's Stock Price

McOpCo Stock Price

PF McDonald's Stock Price

Pre-Tax Yield (1)

After-Tax Investor Yield

Which Would You Rather Own:

Pro Forma McDonald's or a Treasury Inflation

Protected Security (TIPS)?

(2)

Estimated LT Dividend Growth

After-Tax Investor Yield

PF McDonald's Stock Price

Pre-Tax Yield (3)

(3)

Estimated LT Dividend Growth

$33.15 $35.15 $40.15 $45.15 $50.15 $55.15

5.15 5.15 5.15 5.15 5.15

$30.00 $35.00 $40.00 $45.00 $50.00

5.15

$28.00

6.7%

5.7%

5.9% 5.2% 4.7% 4.3%

7.2%

5.0%

4.4% 4.0%

Note: Assumes a 7x EV /FY '06E EBITDA multiple on McOpCo.

(1)

Assumes full payout of free cash flows for PF McDonald's.

(2)

Assumes 15% tax rate on PF McDonald's dividend and a 35% tax rate on the TIPS dividend.

(3)

Scenario 2 Pre-Tax and After-Tax Yields are adjusted for a 35% stake in McOpCo.

3% -4%

6.7% 5.7%

54

$28.00 $30.00 $35.00 $40.00 $45.00 $50.00

7.9% 6.7% 5.8% 5.1% 4.6%

8.5%

3.6%

3% -4%

3.9%

3.3%

4.9% 4.3% 3.9%

$60.15

5.15

$55.00

3.6%

3.1%

$55.00

4.1%

3.5%

10 Year

TIPS

2.1%

3.0%

2.5%View entire presentation