Credit Suisse Results Presentation Deck

Investment Bank

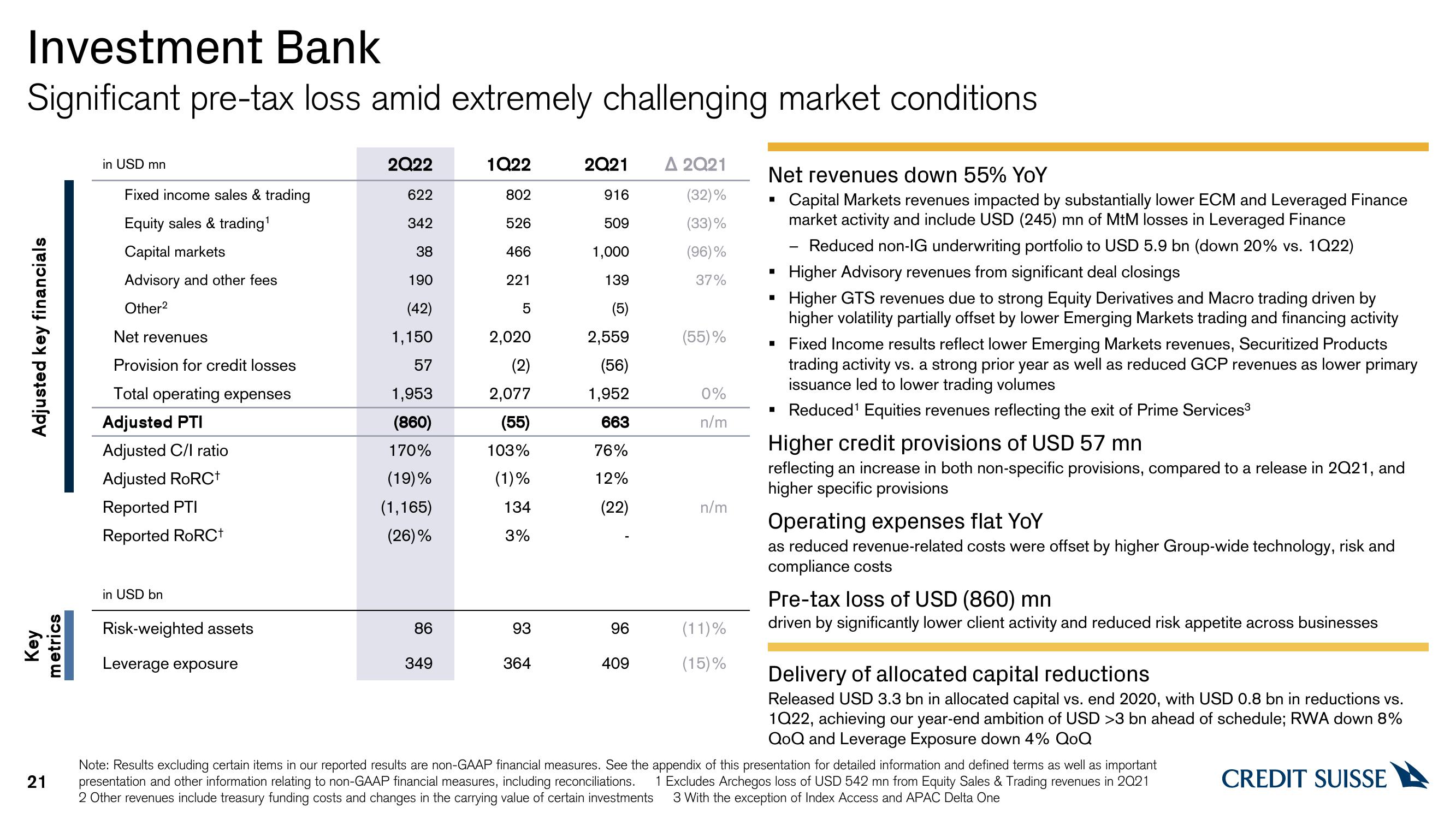

Significant pre-tax loss amid extremely challenging market conditions

Adjusted key financials

Key

metrics

21

in USD mn

Fixed income sales & trading

Equity sales & trading¹

Capital markets

Advisory and other fees

Other²

Net revenues

Provision for credit losses

Total operating expenses

Adjusted PTI

Adjusted C/I ratio

Adjusted RoRCt

Reported PTI

Reported RORC+

in USD bn

Risk-weighted assets

Leverage exposure

2Q22

622

342

38

190

(42)

1,150

57

1,953

(860)

170%

(19)%

(1,165)

(26)%

86

349

1Q22

802

526

466

221

5

2,020

(2)

2,077

(55)

103%

(1)%

134

3%

93

364

2Q21

916

509

1,000

139

(5)

2,559

(56)

1,952

663

76%

12%

(22)

96

409

Δ 2021

(32)%

(33)%

(96)%

37%

(55)%

0%

n/m

n/m

(11)%

(15)%

Net revenues down 55% YoY

Capital Markets revenues impacted by substantially lower ECM and Leveraged Finance

market activity and include USD (245) mn of MtM losses in Leveraged Finance

Reduced non-IG underwriting portfolio to USD 5.9 bn (down 20% vs. 1022)

▪ Higher Advisory revenues from significant deal closings

Higher GTS revenues due to strong Equity Derivatives and Macro trading driven by

higher volatility partially offset by lower Emerging Markets trading and financing activity

Fixed Income results reflect lower Emerging Markets revenues, Securitized Products

trading activity vs. a strong prior year as well as reduced GCP revenues as lower primary

issuance led to lower trading volumes

Reduced¹ Equities revenues reflecting the exit of Prime Services³

■

Higher credit provisions of USD 57 mn

reflecting an increase in both non-specific provisions, compared to a release in 2Q21, and

higher specific provisions

Operating expenses flat YoY

as reduced revenue-related costs were offset by higher Group-wide technology, risk and

compliance costs

Pre-tax loss of USD (860) mn

driven by significantly lower client activity and reduced risk appetite across businesses

Delivery of allocated capital reductions

Released USD 3.3 bn in allocated capital vs. end 2020, with USD 0.8 bn in reductions vs.

1Q22, achieving our year-end ambition of USD >3 bn ahead of schedule; RWA down 8%

QoQ and Leverage Exposure down 4% QOQ

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Excludes Archegos loss of USD 542 mn from Equity Sales & Trading revenues in 2021

2 Other revenues include treasury funding costs and changes in the carrying value of certain investments 3 With the exception of Index Access and APAC Delta One

CREDIT SUISSEView entire presentation