Credit Suisse Investment Banking Pitch Book

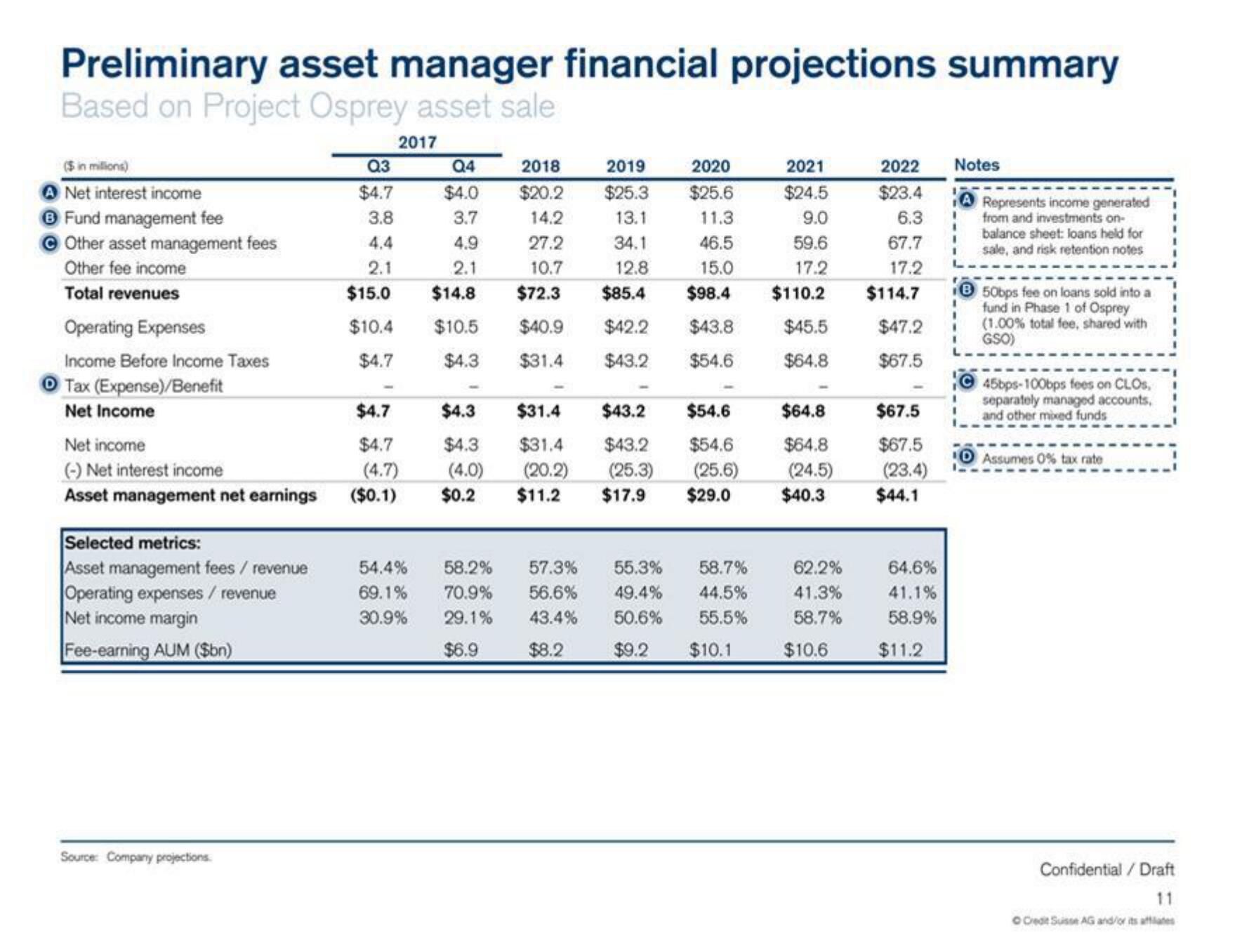

Preliminary asset manager financial projections summary

Based on Project Osprey asset sale

($ in millions)

Net interest income

6 Fund management fee

Other asset management fees

Other fee income

Total revenues

Operating Expenses

Income Before Income Taxes

Ⓒ Tax (Expense)/Benefit

Net Income

Net income

(-) Net interest income

Asset management net earnings

Selected metrics:

Asset management fees / revenue

Operating expenses / revenue

Net income margin

Fee-earning AUM ($bn)

Source: Company projections

Q3

$4.7

3.8

4.4

2.1

$15.0

$10.4

$4.7

2017

$4.7

$4.7

(4.7)

($0.1)

Q4

2018

2019

2020

2021

$4.0 $20.2 $25.3 $25.6

$24.5

3.7

14.2

13.1

11.3

9.0

4.9

34.1

46.5

59.6

2.1

12.8

15.0

17.2

$14.8

$85.4

$98.4 $110.2

$10.5

$42.2

$43.8

$45.5

$4.3

$43.2

$54.6

$64.8

-

27.2

10.7

$72.3

$40.9

$31.4

$4.3

$31.4

$43.2 $54.6

$4.3

$31.4

$43.2

$54.6

(4.0) (20.2) (25.3)

(25.6)

$0.2 $11.2 $17.9 $29.0

54.4% 58.2% 57.3% 55.3% 58.7%

69.1% 70.9% 56.6% 49.4% 44.5%

30.9% 29.1% 43.4%

50.6% 55.5%

$6.9

$8.2

$9.2 $10.1

$64.8

$64.8

(24.5)

$40.3

62.2%

41.3%

58.7%

$10.6

2022

$23.4

6.3

67.7

17.2

$114.7

$47.2

$67.5

$67.5

(23.4)

I

$67.5 I

$44.1

64.6%

41.1%

58.9%

Notes

A Represents income generated

from and investments on-

balance sheet: loans held for

sale, and risk retention notes

$11.2

1

B 50bps fee on loans sold into a

fund in Phase 1 of Osprey

(1.00% total fee, shared with

GSO)

45bps-100bps fees on CLOS,

separately managed accounts,

and other mixed funds

10 Assumes 0 % tax rate

Confidential / Draft

11

O Credit Suisse AG and/or its affiliatesView entire presentation