2011 and Fourth Quarter Results

IFRS - Estimated impact from adoption

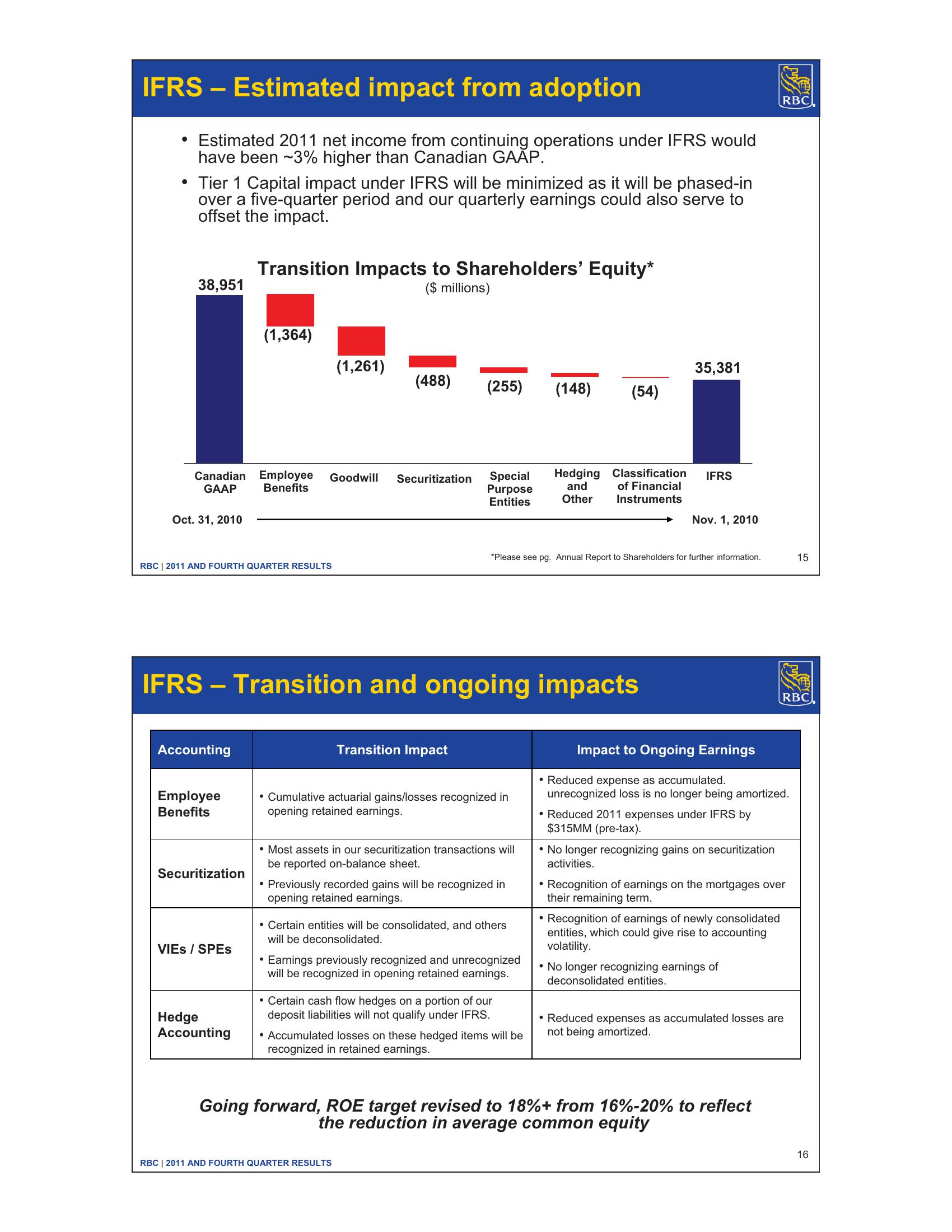

• Estimated 2011 net income from continuing operations under IFRS would

have been ~3% higher than Canadian GAAP.

• Tier 1 Capital impact under IFRS will be minimized as it will be phased-in

over a five-quarter period and our quarterly earnings could also serve to

offset the impact.

Transition Impacts to Shareholders' Equity*

38,951

($ millions)

(1,364)

(1,261)

35,381

(488)

(255) (148)

(54)

Canadian Employee Goodwill

GAAP

Benefits

Securitization Special Hedging Classification

Purpose

Entities

IFRS

and

Other

of Financial

Instruments

Oct. 31, 2010

Nov. 1, 2010

RBC 2011 AND FOURTH QUARTER RESULTS

*Please see pg. Annual Report to Shareholders for further information.

IFRS - Transition and ongoing impacts

RBC

15

RBC

Accounting

Employee

Benefits

Securitization

VIES / SPES

Hedge

Accounting

Transition Impact

• Cumulative actuarial gains/losses recognized in

opening retained earnings.

• Most assets in our securitization transactions will

be reported on-balance sheet.

• Previously recorded gains will be recognized in

opening retained earnings.

• Certain entities will be consolidated, and others

will be deconsolidated.

• Earnings previously recognized and unrecognized

will be recognized in opening retained earnings.

• Certain cash flow hedges on a portion of our

deposit liabilities will not qualify under IFRS.

• Accumulated losses on these hedged items will be

recognized in retained earnings.

Impact to Ongoing Earnings

• Reduced expense as accumulated.

unrecognized loss is no longer being amortized.

• Reduced 2011 expenses under IFRS by

$315MM (pre-tax).

• No longer recognizing gains on securitization

activities.

• Recognition of earnings on the mortgages over

their remaining term.

• Recognition of earnings of newly consolidated

entities, which could give rise to accounting

volatility.

• No longer recognizing earnings of

deconsolidated entities.

• Reduced expenses as accumulated losses are

not being amortized.

Going forward, ROE target revised to 18%+ from 16%-20% to reflect

the reduction in average common equity

RBC 2011 AND FOURTH QUARTER RESULTS

16View entire presentation