Deutsche Bank Results Presentation Deck

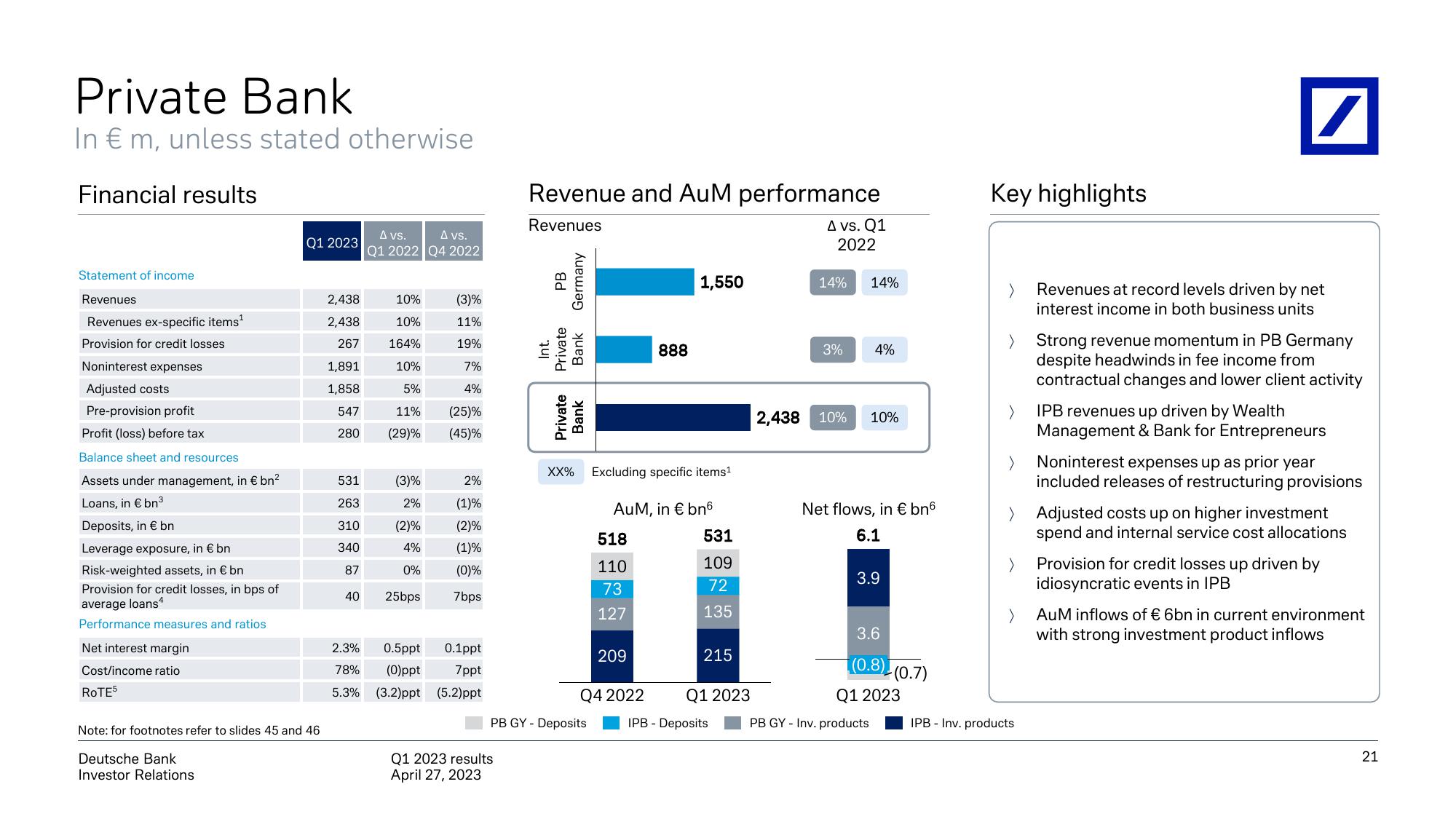

Private Bank

In € m, unless stated otherwise

Financial results

Statement of income

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Balance sheet and resources

Assets under management, in € bn²

Loans, in € bn³

Deposits, in € bn

Leverage exposure, in € bn.

Risk-weighted assets, in € bn

Provision for credit losses, in bps of

average loans4

Performance measures and ratios.

Net interest margin

Cost/income ratio.

ROTE5

Q1 2023

Note: for footnotes refer to slides 45 and 46

Deutsche Bank

Investor Relations

2,438

2,438

267

1,891

1,858

547

280

A vs.

A vs.

Q1 2022 Q4 2022

2.3%

78%

5.3%

10%

(3)%

10%

11%

164%

19%

10%

7%

5%

4%

11% (25)%

(29)% (45)%

531

2%

263

(1)%

310

(2)%

340

(1)%

87

(0)%

40 25bps 7bps

(3)%

2%

(2)%

4%

0%

0.5ppt 0.1ppt

(0)ppt

7ppt

(3.2)ppt (5.2)ppt

Revenue and AuM performance

Revenues

Q1 2023 results

April 27, 2023

PB

Germany

Int.

Private

Bank

Private

Bank

PB GY- Deposits

XX% Excluding specific items¹

518

110

73

127

888

AuM, in € bn6

209

Q4 2022

1,550

531

109

72

135

215

Q1 2023

IPB - Deposits

2,438

A vs. Q1

2022

14% 14%

3%

4%

10% 10%

Net flows, in € bn6

6.1

3.9

3.6

(0.8)

- (0.7)

Q1 2023

PB GY - Inv. products

Key highlights

IPB - Inv. products

/

Revenues at record levels driven by net

interest income in both business units

Strong revenue momentum in PB Germany

despite headwinds in fee income from

contractual changes and lower client activity

IPB revenues up driven by Wealth

Management & Bank for Entrepreneurs

Noninterest expenses up as prior year

included releases of restructuring provisions

Adjusted costs up on higher investment

spend and internal service cost allocations

Provision for credit losses up driven by

idiosyncratic events in IPB

AuM inflows of € 6bn in current environment

with strong investment product inflows

21View entire presentation