Marti Investor Presentation Deck

Detailed transaction overview

●

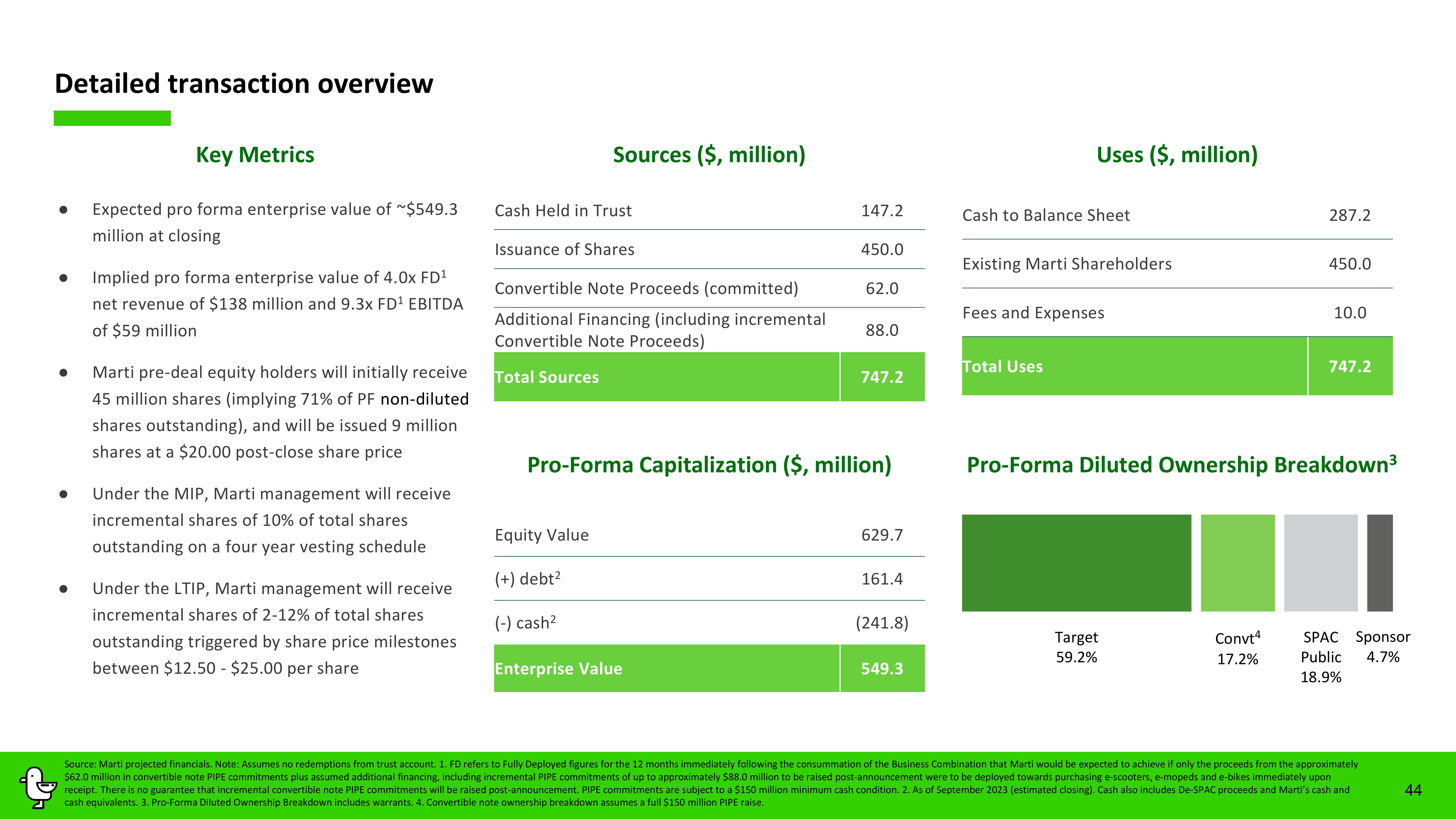

Key Metrics

Expected pro forma enterprise value of ~$549.3

million at closing

Implied pro forma enterprise value of 4.0x FD¹

net revenue of $138 million and 9.3x FD¹ EBITDA

of $59 million

Marti pre-deal equity holders will initially receive

45 million shares (implying 71% of PF non-diluted

shares outstanding), and will be issued 9 million

shares at a $20.00 post-close share price

Under the MIP, Marti management will receive

incremental shares of 10% of total shares

outstanding on a four year vesting schedule

Under the LTIP, Marti management will receive

incremental shares of 2-12% of total shares

outstanding triggered by share price milestones

between $12.50 - $25.00 per share

Cash Held in Trust

Sources ($, million)

Issuance of Shares

Convertible Note Proceeds (committed)

Additional Financing (including incremental

Convertible Note Proceeds)

Total Sources

Equity Value

(+) debt²

(-) cash²

147.2

Enterprise Value

450.0

62.0

88.0

Pro-Forma Capitalization ($, million)

747.2

629.7

161.4

(241.8)

549.3

Uses ($, million)

Cash to Balance Sheet

Existing Marti Shareholders

Fees and Expenses

Total Uses

Target

59.2%

287.2

Convt4

17.2%

450.0

10.0

Pro-Forma Diluted Ownership Breakdown³

747.2

SPAC Sponsor

Public 4.7%

18.9%

Source: Marti projected financials. Note: Assumes no redemptions from trust account. 1. FD refers to Fully Deployed figures for the 12 months immediately following the consummation of the Business Combination that Marti would be expected to achieve if only the proceeds from the approximately

$62.0 million in convertible note PIPE commitments plus assumed additional financing, including incremental PIPE commitments of up to approximately $88.0 million to be raised post-announcement were to be deployed towards purchasing e-scooters, e-mopeds and e-bikes immediately upon

receipt. There is no guarantee that incremental convertible note PIPE commitments will be raised post-announcement. PIPE commitments are subject to a $150 million minimum cash condition. 2. As of September 2023 (estimated closing). Cash also includes De-SPAC proceeds and Marti's cash and

cash equivalents. 3. Pro-Forma Diluted Ownership Breakdown includes warrants. 4. Convertible note ownership breakdown assumes a full $150 million PIPE raise.

44View entire presentation