Credit Suisse Investment Banking Pitch Book

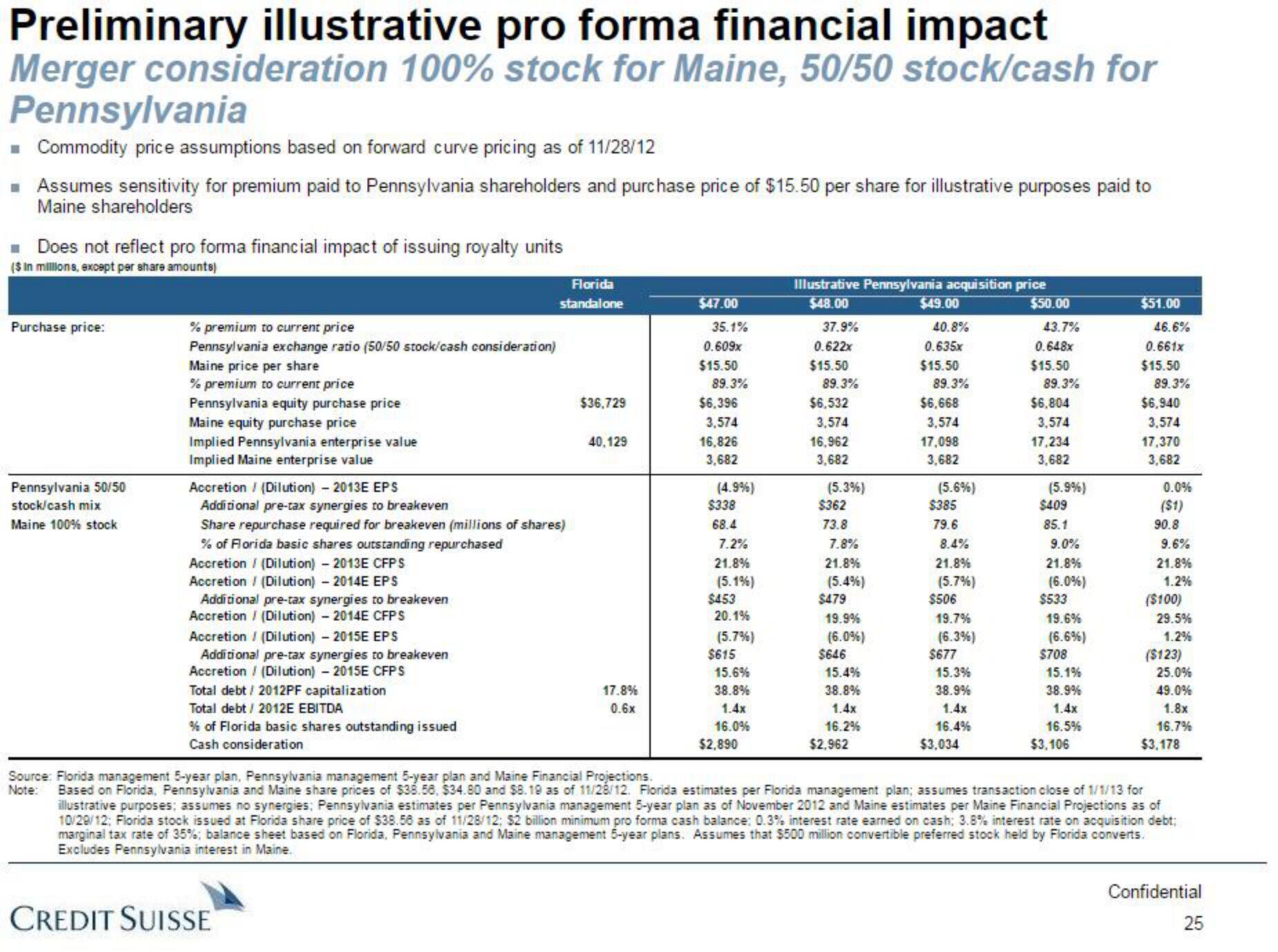

Preliminary illustrative pro forma financial impact

Merger consideration 100% stock for Maine, 50/50 stock/cash for

Pennsylvania

■ Commodity price assumptions based on forward curve pricing as of 11/28/12

■ Assumes sensitivity for premium paid to Pennsylvania shareholders and purchase price of $15.50 per share for illustrative purposes paid to

Maine shareholders

Does not reflect pro forma financial impact of issuing royalty units

($ In millions, except per share amounts)

Purchase price:

Pennsylvania 50/50

stock/cash mix

Maine 100% stock

% premium to current price

Pennsylvania exchange ratio (50/50 stock/cash consideration)

Maine price per share

% premium to current price

Pennsylvania equity purchase price

Maine equity purchase price

Implied Pennsylvania enterprise value

Implied Maine enterprise value

Accretion / (Dilution) - 2013E EPS

Additional pre-tax synergies to breakeven

Share repurchase required for breakeven (millions of shares)

% of Florida basic shares outstanding repurchased

Accretion / (Dilution) - 2013E CFPS

Accretion / (Dilution) - 2014E EPS

Additional pre-tax synergies to breakeven

Accretion / (Dilution) - 2014E CFPS

Accretion / (Dilution)-2015E EPS

Additional pre-tax synergies to breakeven

Accretion / (Dilution) - 2015E CFPS

Total debt 2012PF capitalization

Total debt / 2012E EBITDA

% of Florida basic shares outstanding issued

Cash consideration

Florida

standalone

CREDIT SUISSE

$36,729

40,129

17.8%

0.6x

$47.00

35.1%

0.609x

$15.50

89.3%

$6.396

3,574

16,826

3,682

(4.9%)

$338

68.4

7.2%

21.8%

(5.1%)

$453

20.1%

(5.7%)

$615

15.6%

38.8%

1.4x

16.0%

$2,890

Illustrative Pennsylvania acquisition price

$48.00

$50.00

37.9%

0.622x

$15.50

89.3%

$6,532

3,574

16,962

3,682

(5.3%)

$362

73.8

7.8%

21.8%

(5.4%)

$479

19.9%

(6.0%)

$646

15.4%

38.8%

1.4x

16.2%

$2,962

$49.00

40.8%

0.635x

$15.50

89.3%

$6,668

3,574

17,098

3,682

(5.6%)

$385

79.6

8.4%

21.8%

(5.7%)

$506

19.7%

(6.3%)

$677

15.3%

38.9%

1.4x

16.4%

$3,034

43.7%

0.648x

$15.50

89.3%

$6,804

3,574

17,234

3,682

(5.9%)

$409

85.1

9.0%

21.8%

(6.0%)

$533

19.6%

(6.6%)

$708

15.1%

38.9%

1.4x

16.5%

$3,106

$51.00

46.6%

0.661x

$15.50

89.3%

$6,940

3,574

17,370

3,682

0.0%

($1)

90.8

9.6%

21.8%

1.2%

($100)

29.5%

1.2%

($123)

25.0%

49.0%

1.8x

16.7%

$3,178

Source: Florida management 5-year plan, Pennsylvania management 5-year plan and Maine Financial Projections.

Note: Based on Florida, Pennsylvania and Maine share prices of $38.56, $34.80 and $8.19 as of 11/28/12. Florida estimates per Florida management plan; assumes transaction close of 1/1/13 for

illustrative purposes; assumes no synergies; Pennsylvania estimates per Pennsylvania management 5-year plan as of November 2012 and Maine estimates per Maine Financial Projections as of

10/29/12; Florida stock issued at Florida share price of $38.56 as of 11/28/12; $2 billion minimum pro forma cash balance: 0.3% interest rate earned on cash; 3.8% interest rate on acquisition debt;

marginal tax rate of 35%; balance sheet based on Florida, Pennsylvania and Maine management 5-year plans. Assumes that $500 million convertible preferred stock held by Florida converts.

Excludes Pennsylvania interest in Maine.

Confidential

25View entire presentation