Melrose Results Presentation Deck

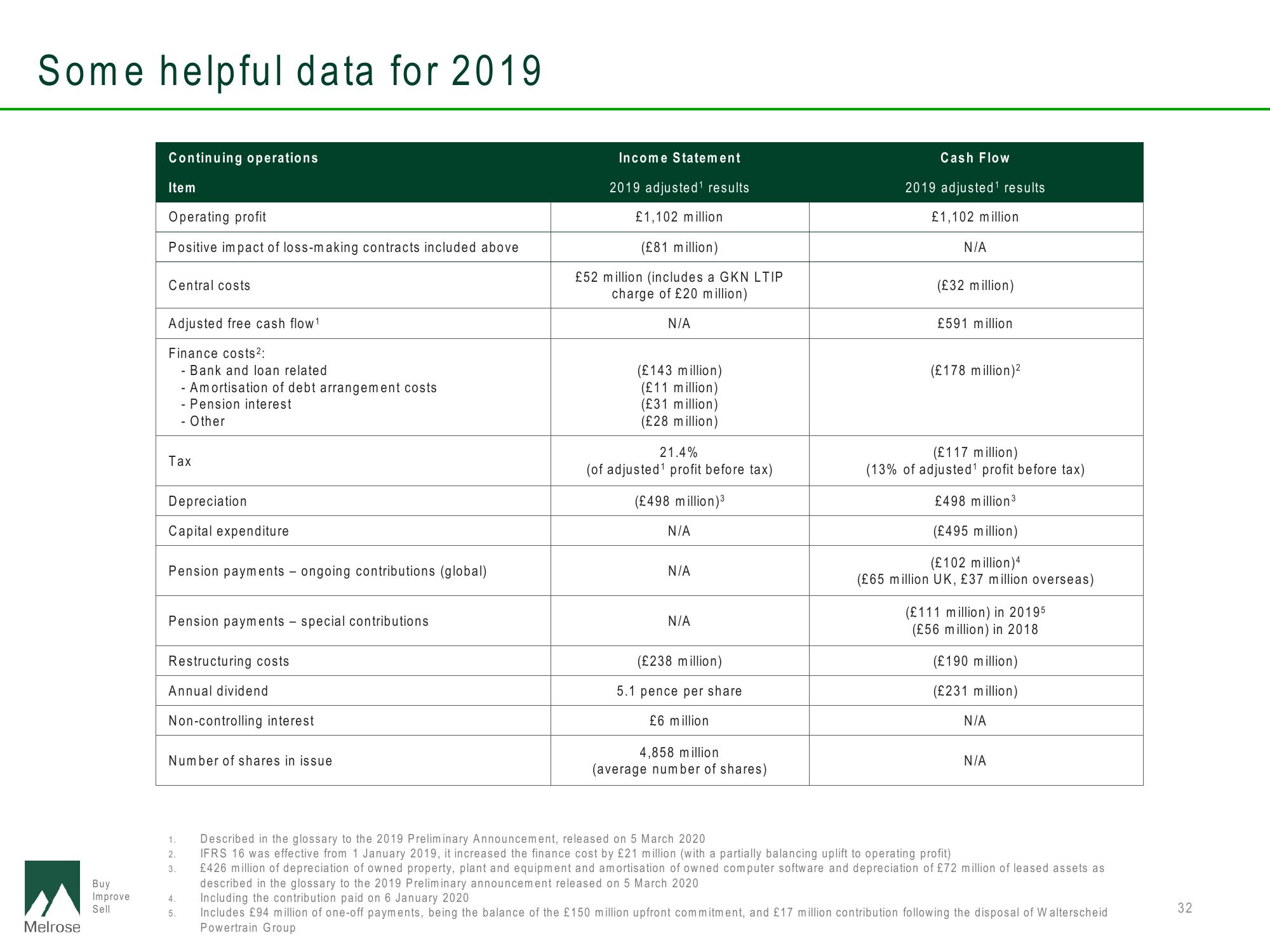

Some helpful data for 2019

Melrose

Buy

Improve

Sell

Continuing operations

Item

Operating profit

Positive impact of loss-making contracts included above

Central costs

Adjusted free cash flow ¹

Finance costs²:

- Bank and loan related

- Amortisation of debt arrangement costs

- Pension interest

- Other

Tax

Depreciation

Capital expenditure

Pension payments - ongoing contributions (global)

Pension payments - special contributions

Restructuring costs

Annual dividend

Non-controlling interest

Number of shares in issue

1.

2.

3.

Income Statement

2019 adjusted¹ results

£1,102 million

(£81 million)

£52 million (includes a GKN LTIP

charge of £20 million)

N/A

(£143 million)

(£11 million)

(£31 million)

(£28 million)

21.4%

(of adjusted¹ profit before tax)

(£498 million) ³

N/A

N/A

N/A

(£238 million)

5.1 pence per share

£6 million

4,858 million

(average number of shares)

Cash Flow

2019 adjusted¹ results

£1,102 million

N/A

(£32 million)

£591 million

(£178 million)²

(£117 million)

(13% of adjusted¹ profit before tax)

£498 million ³

(£495 million)

(£102 million) 4

(£65 million UK, £37 million overseas)

(£111 million) in 20195

(£56 million) in 2018

(£190 million)

(£231 million)

N/A

N/A

Described in the glossary to the 2019 Preliminary Announcement, released on 5 March 2020

IFRS 16 was effective from 1 January 2019, it increased the finance cost by £21 million (with a partially balancing uplift to operating profit)

£426 million of depreciation of owned property, plant and equipment and amortisation of owned computer software and depreciation of £72 million of leased assets as

described in the glossary to the 2019 Preliminary announcement released on 5 March 2020

4. Including the contribution paid on 6 January 2020

5.

Includes £94 million of one-off payments, being the balance of the £150 million upfront commitment, and £17 million contribution following the disposal of Walterscheid

Powertrain Group

32View entire presentation