Building a Leading P&C Insurer

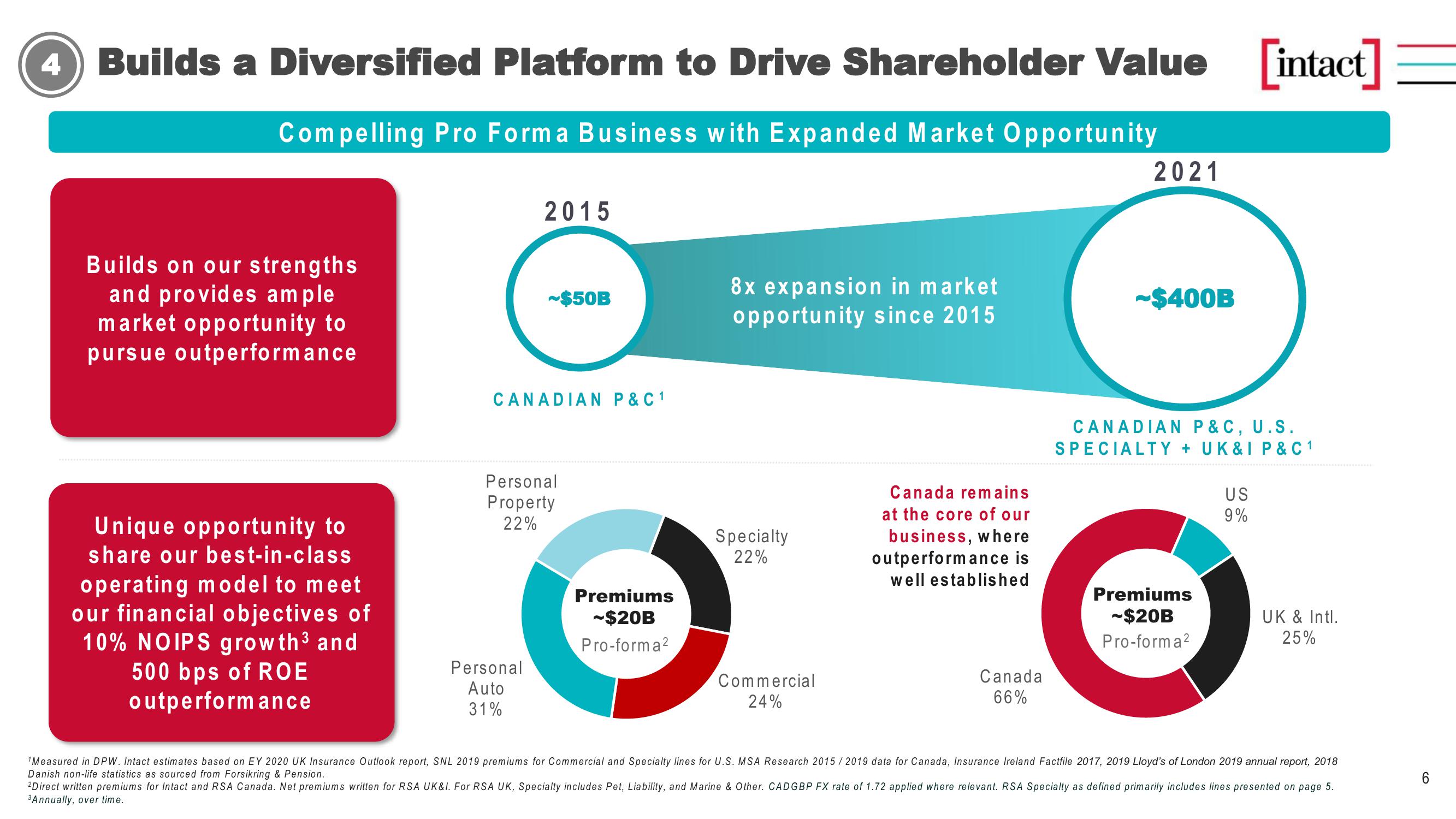

Builds a Diversified Platform to Drive Shareholder Value

Compelling Pro Forma Business with Expanded Market Opportunity

Builds on our strengths

and provides ample

market opportunity to

pursue outperformance

Unique opportunity to

share our best-in-class

operating model to meet

our financial objectives of

10% NOIPS growth³ and

500 bps of ROE

outperformance

2015

~$50B

CANADIAN P & C ¹

Personal

Auto

31%

Personal

Property

22%

Premiums

-$20B

Pro-forma²

8x expansion in market

opportunity since 2015

Specialty

22%

Commercial

24%

Canada remains

at the core of our

business, where

outperformance is

well established

Canada

66%

2021

~$400B

CANADIAN P&C, U.S.

SPECIALTY + UK&I P & C ¹

Premiums

~$20B

Pro-forma²

intact

US

9%

UK & Intl.

25%

¹Measured in DPW. Intact estimates based on EY 2020 UK Insurance Outlook report, SNL 2019 premiums for Commercial and Specialty lines for U.S. MSA Research 2015/2019 data for Canada, Insurance Ireland Factfile 2017, 2019 Lloyd's of London 2019 annual report, 2018

Danish non-life statistics as sourced from Forsikring & Pension.

2Direct written premiums for Intact and RSA Canada. Net premiums written for RSA UK&I. For RSA UK, Specialty includes Pet, Liability, and Marine & Other. CADGBP FX rate of 1.72 applied where relevant. RSA Specialty as defined primarily includes lines presented on page 5.

3 Annually, over time.

CO

6View entire presentation