Babylon Investor Conference Presentation Deck

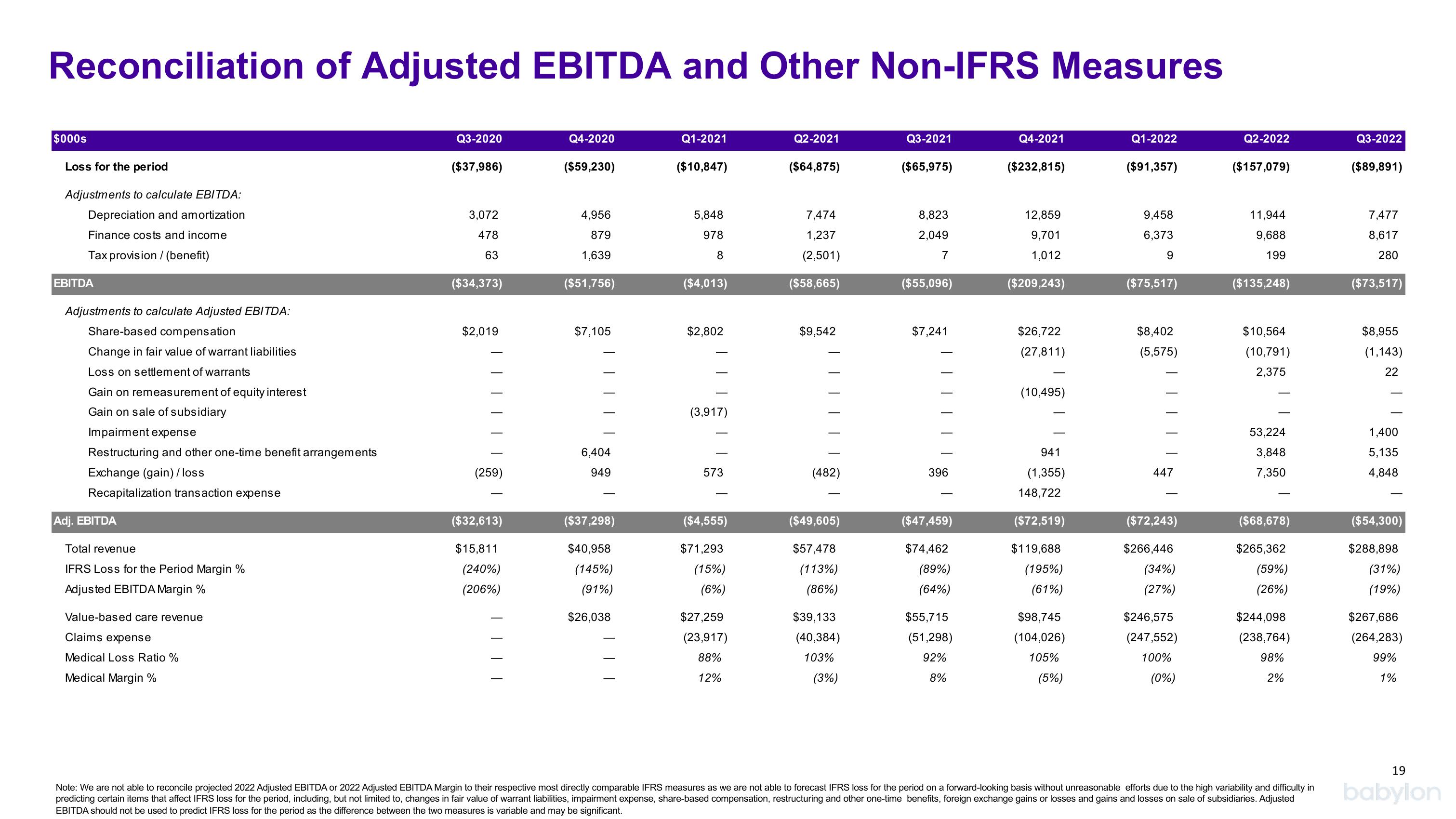

Reconciliation of Adjusted EBITDA and Other Non-IFRS Measures

Q2-2021

($64,875)

$000s

Loss for the period

Adjustments to calculate EBITDA:

Depreciation and amortization

Finance costs and income

Tax provision / (benefit)

EBITDA

Adjustments to calculate Adjusted EBITDA:

Share-based compensation

Change in fair value of warrant liabilities

Loss on settlement of warrants

Gain on remeasurement of equity interest

Gain on sale of subsidiary

Impairment expense

Restructuring and other one-time benefit arrangements

Exchange (gain) / loss

Recapitalization transaction expense

Adj. EBITDA

Total revenue

IFRS Loss for the Period Margin %

Adjusted EBITDA Margin %

Value-based care revenue

Claims expense

Medical Loss Ratio %

Medical Margin %

Q3-2020

($37,986)

3,072

478

63

($34,373)

$2,019

(259)

($32,613)

$15,811

(240%)

(206%)

Q4-2020

($59,230)

4,956

879

1,639

($51,756)

$7,105

6,404

949

($37,298)

$40,958

(145%)

(91%)

$26,038

Q1-2021

($10,847)

5,848

978

8

($4,013)

$2,802

(3,917)

573

($4,555)

$71,293

(15%)

(6%)

$27,259

(23,917)

88%

12%

7,474

1,237

(2,501)

($58,665)

$9,542

(482)

($49,605)

$57,478

(113%)

(86%)

$39,133

(40,384)

103%

(3%)

Q3-2021

($65,975)

8,823

2,049

7

($55,096)

$7,241

396

($47,459)

$74,462

(89%)

(64%)

$55,715

(51,298)

92%

8%

Q4-2021

($232,815)

12,859

9,701

1,012

($209,243)

$26,722

(27,811)

(10,495)

941

(1,355)

148,722

($72,519)

$119,688

(195%)

(61%)

$98,745

(104,026)

105%

(5%)

Q1-2022

($91,357)

9,458

6,373

9

($75,517)

$8,402

(5,575)

447

($72,243)

$266,446

(34%)

(27%)

$246,575

(247,552)

100%

(0%)

Q2-2022

($157,079)

11,944

9,688

199

($135,248)

$10,564

(10,791)

2,375

53,224

3,848

7,350

($68,678)

$265,362

(59%)

(26%)

$244,098

(238,764)

98%

2%

Note: We are not able to reconcile projected 2022 Adjusted EBITDA or 2022 Adjusted EBITDA Margin to their respective most directly comparable IFRS measures as we are not able to forecast IFRS loss for the period on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in

predicting certain items that affect IFRS loss for the period, including, but not limited to, changes in fair value of warrant liabilities, impairment expense, share-based compensation, restructuring and other one-time benefits, foreign exchange gains or losses and gains and losses on sale of subsidiaries. Adjusted

EBITDA should not be used to predict IFRS loss for the period as the difference between the two measures is variable and may be significant.

Q3-2022

($89,891)

7,477

8,617

280

($73,517)

$8,955

(1,143)

22

1,400

5,135

4,848

($54,300)

$288,898

(31%)

(19%)

$267,686

(264,283)

99%

1%

19

babylonView entire presentation