HSBC Results Presentation Deck

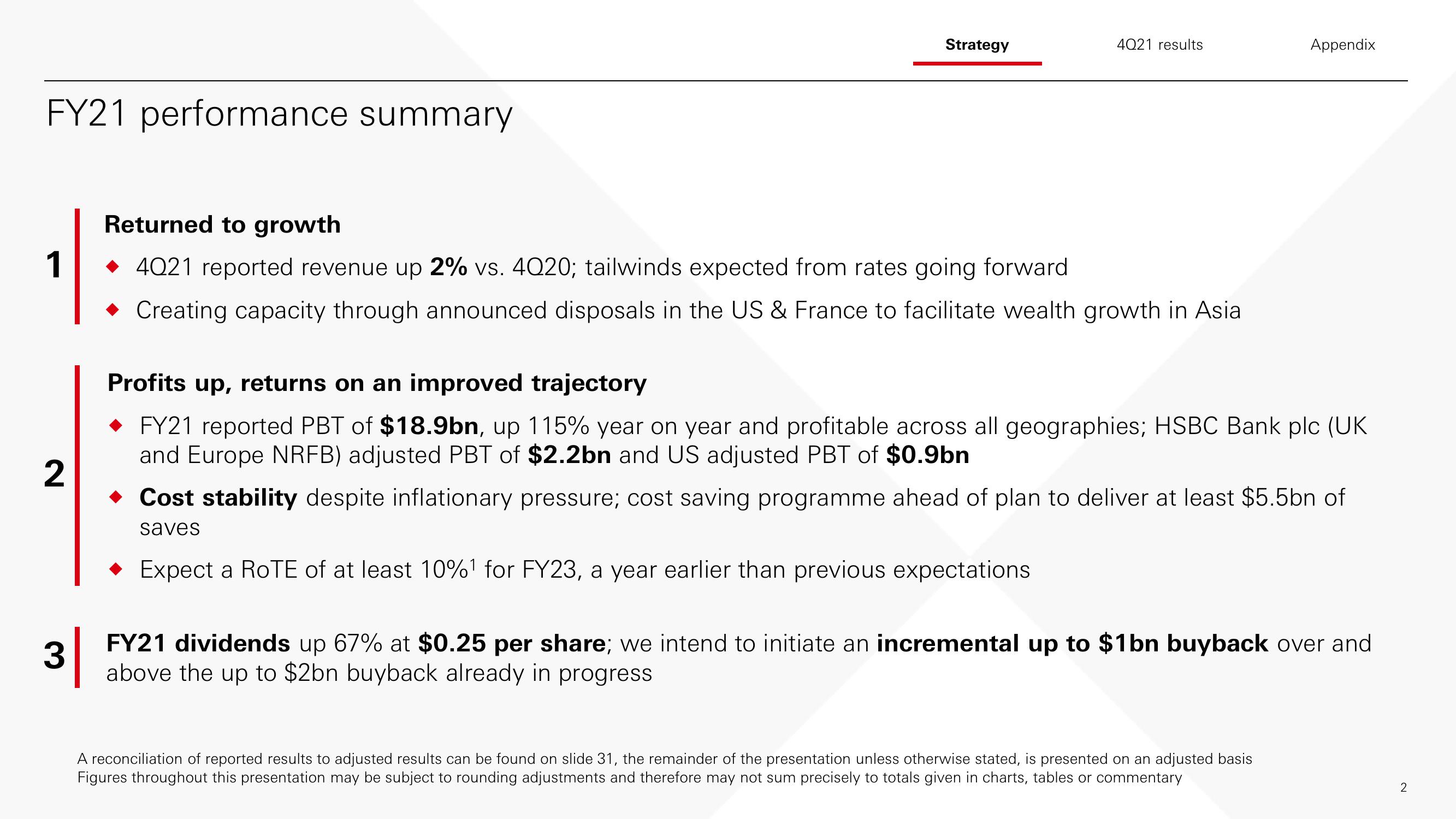

FY21 performance summary

Strategy

4021 results

Returned to growth

1

◆ 4021 reported revenue up 2% vs. 4020; tailwinds expected from rates going forward

Creating capacity through announced disposals in the US & France to facilitate wealth growth in Asia

3

Appendix

Profits up, returns on an improved trajectory

◆ FY21 reported PBT of $18.9bn, up 115% year on year and profitable across all geographies; HSBC Bank plc (UK

and Europe NRFB) adjusted PBT of $2.2bn and US adjusted PBT of $0.9bn

2

◆ Cost stability despite inflationary pressure; cost saving programme ahead of plan to deliver at least $5.5bn of

saves

◆ Expect a ROTE of at least 10%¹ for FY23, a year earlier than previous expectations

FY21 dividends up 67% at $0.25 per share; we intend to initiate an incremental up to $1bn buyback over and

above the up to $2bn buyback already in progress

A reconciliation of reported results to adjusted results can be found on slide 31, the remainder of the presentation unless otherwise stated, is presented on an adjusted basis

Figures throughout this presentation may be subject to rounding adjustments and therefore may not sum precisely to totals given in charts, tables or commentary

2View entire presentation