Porch SPAC Presentation Deck

Indicative Transaction Overview

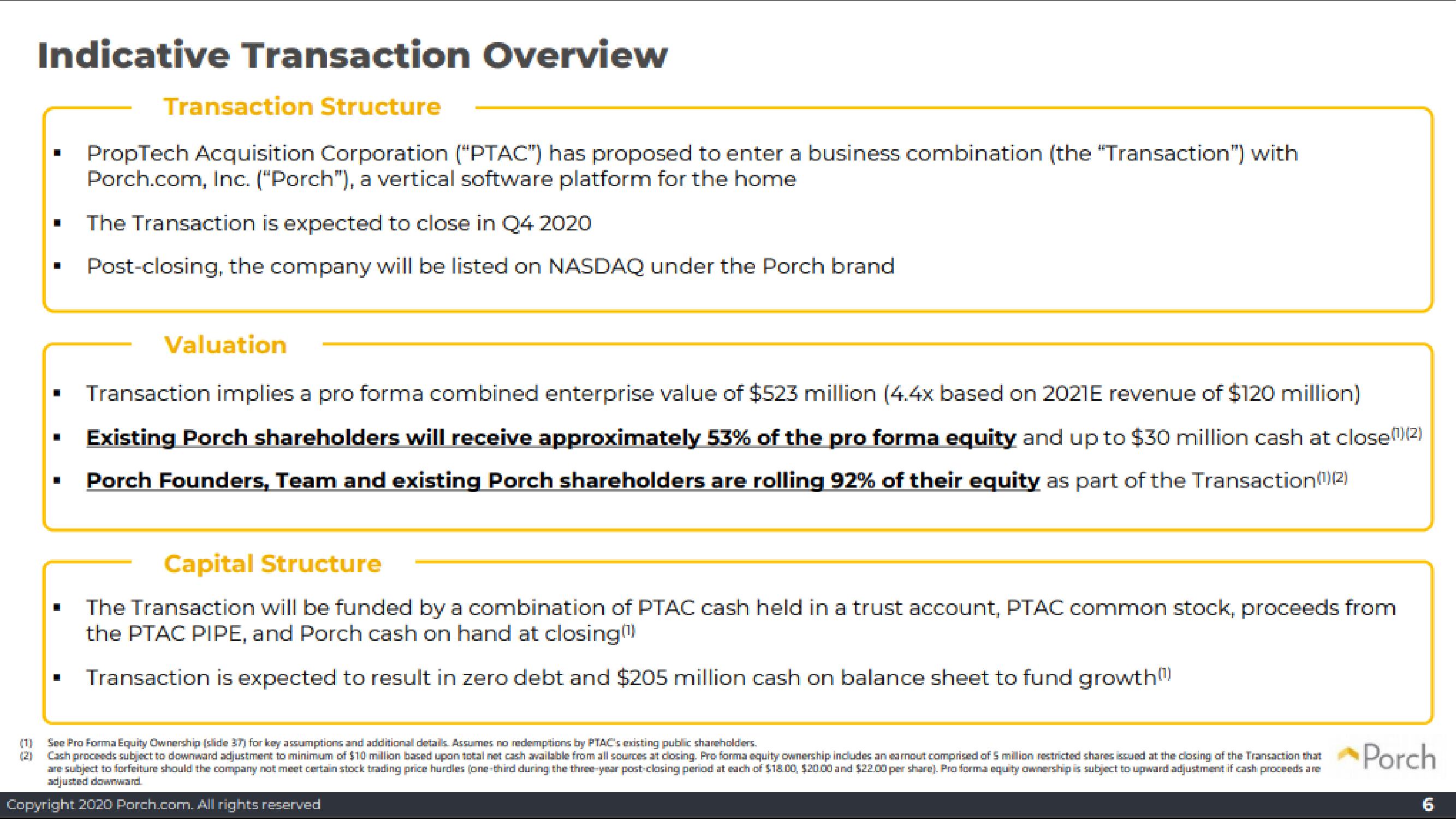

Transaction Structure

PropTech Acquisition Corporation ("PTAC") has proposed to enter a business combination (the "Transaction") with

Porch.com, Inc. ("Porch"), a vertical software platform for the home

(1)

The Transaction is expected to close in Q4 2020

Post-closing, the company will be listed on NASDAQ under the Porch brand

Valuation

Transaction implies a pro forma combined enterprise value of $523 million (4.4x based on 2021E revenue of $120 million)

Existing Porch shareholders will receive approximately 53% of the pro forma equity and up to $30 million cash at close (¹) (2)

Porch Founders, Team and existing Porch shareholders are rolling 92% of their equity as part of the Transaction(1¹)(2)

Capital Structure

The Transaction will be funded by a combination of PTAC cash held in a trust account, PTAC common stock, proceeds from

the PTAC PIPE, and Porch cash on hand at closing(¹)

Transaction is expected to result in zero debt and $205 million cash on balance sheet to fund growth

See Pro Forma Equity Ownership (slide 37) for key assumptions and additional details. Assumes no redemptions by PTAC's existing public shareholders.

Cash proceeds subject to downward adjustment to minimum of $10 million based upon total net cash available from all sources at closing. Pro forma equity ownership includes an arnout comprised of 5 million restricted shares issued at the closing of the Transaction that

are subject to forfeiture should the company not meet certain stock trading price hurdles (one-third during the three-year post-closing period at each of $18.00, $20.00 and $22.00 per share). Pro forma equity ownership is subject to upward adjustment if cash proceeds are

adjusted downward.

Copyright 2020 Porch.com. All rights reserved

Porch

6View entire presentation