Credit Suisse Investor Event Presentation Deck

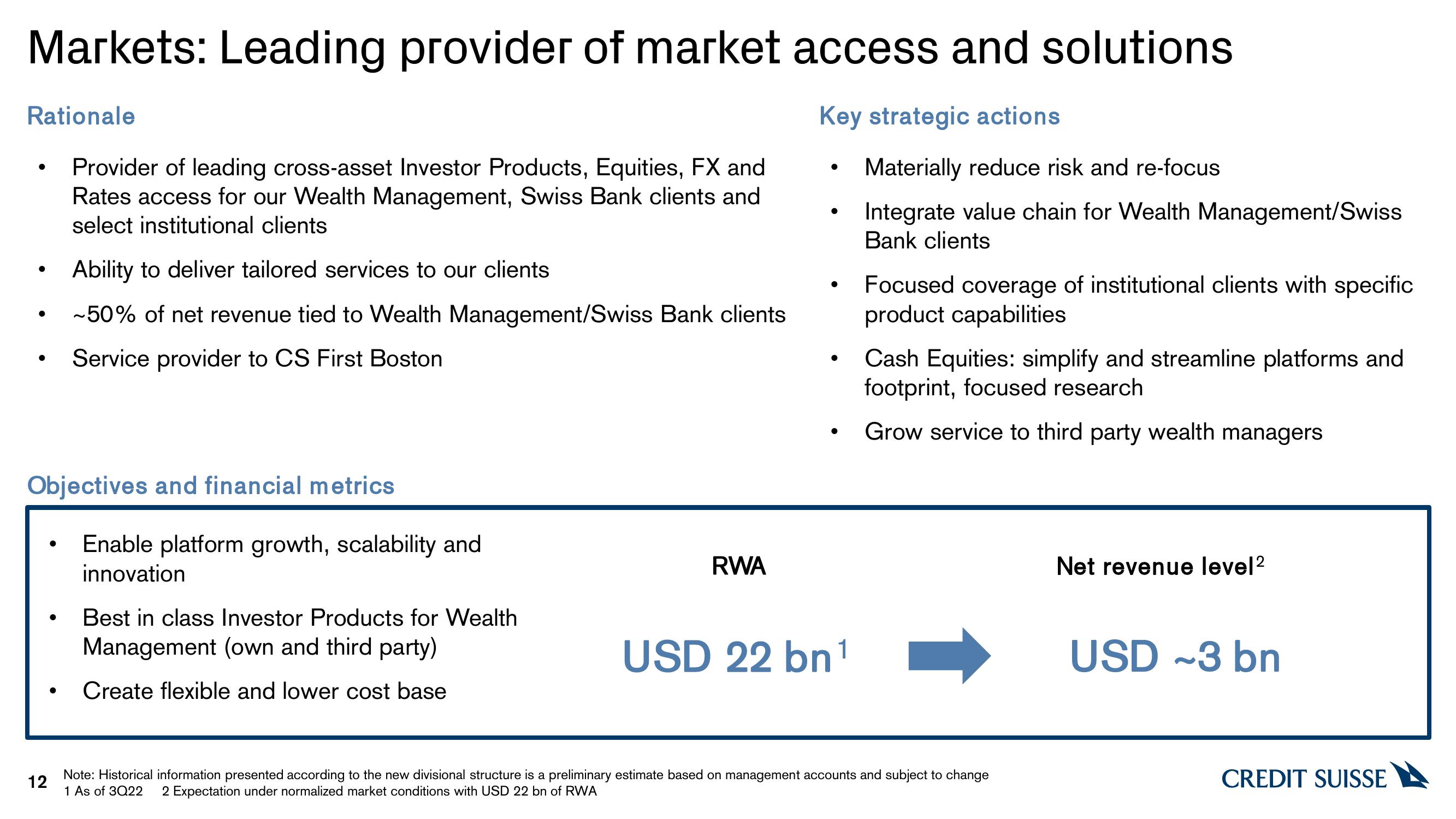

Markets: Leading provider of market access and solutions

Key strategic actions

Rationale

●

●

Provider of leading cross-asset Investor Products, Equities, FX and

Rates access for our Wealth Management, Swiss Bank clients and

select institutional clients

●

Ability to deliver tailored services to our clients

~50% of net revenue tied to Wealth Management/Swiss Bank clients

Service provider to CS First Boston

Objectives and financial metrics

Enable platform growth, scalability and

innovation

Best in class Investor Products for Wealth

Management (own and third party)

Create flexible and lower cost base

RWA

●

●

●

●

USD 22 bn¹1

Materially reduce risk and re-focus

Integrate value chain for Wealth Management/Swiss

Bank clients

Focused coverage of institutional clients with specific

product capabilities

Cash Equities: simplify and streamline platforms and

footprint, focused research

Grow service to third party wealth managers

12

Note: Historical information presented according to the new divisional structure is a preliminary estimate based on management accounts and subject to change

1 As of 3Q22 2 Expectation under normalized market conditions with USD 22 bn of RWA

Net revenue level²

USD ~3 bn

CREDIT SUISSEView entire presentation