Bakkt SPAC Presentation Deck

Bakkt Has Strong Institutional Support

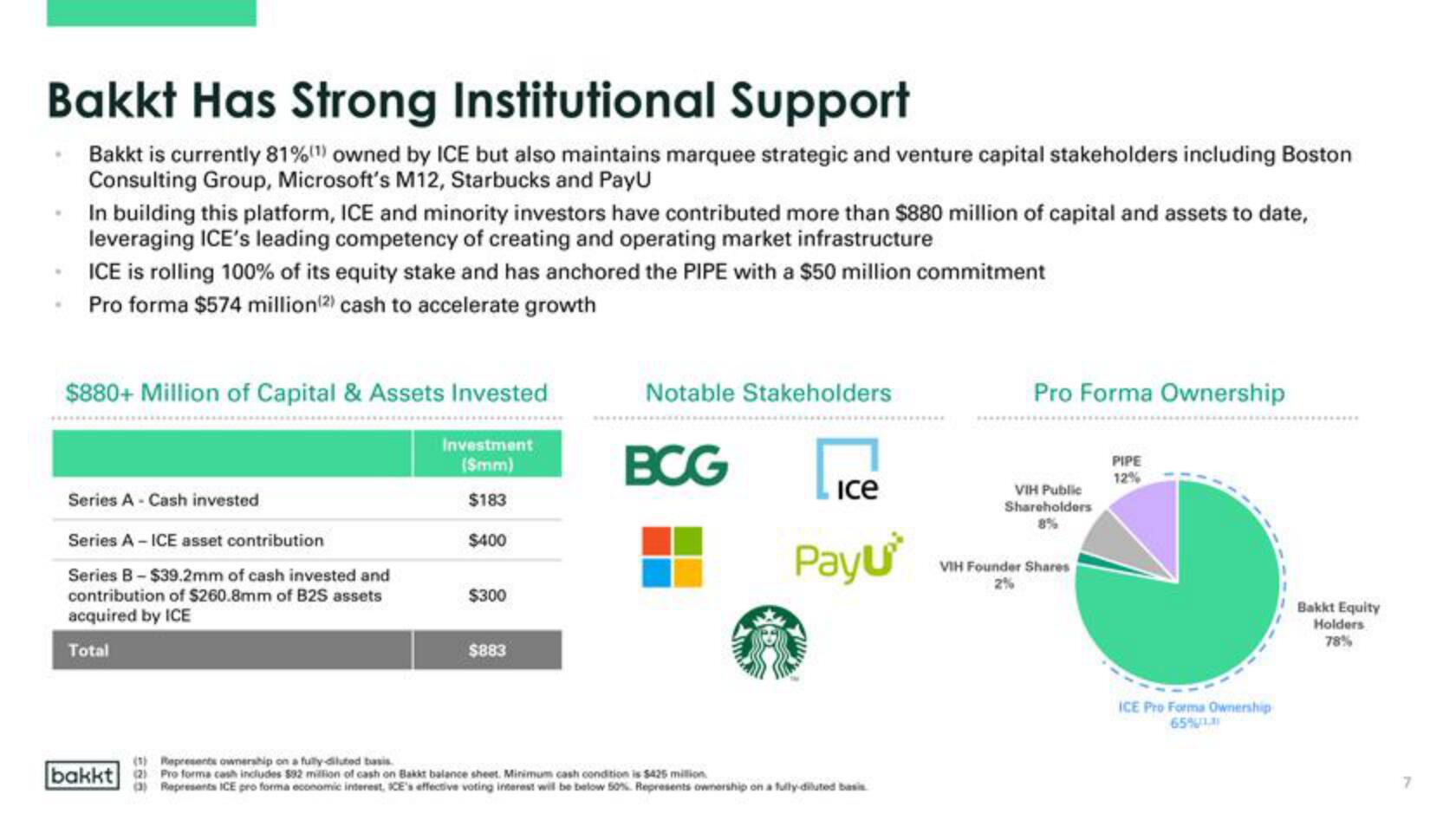

Bakkt is currently 81%(¹) owned by ICE but also maintains marquee strategic and venture capital stakeholders including Boston

Consulting Group, Microsoft's M12, Starbucks and PayU

. In building this platform, ICE and minority investors have contributed more than $880 million of capital and assets to date,

leveraging ICE's leading competency of creating and operating market infrastructure

ICE is rolling 100% of its equity stake and has anchored the PIPE with a $50 million commitment

Pro forma $574 million (2) cash to accelerate growth

.

.

$880+ Million of Capital & Assets Invested

Investment

(Smm)

$183

$400

Series A - Cash invested

Series A - ICE asset contribution

Series B - $39.2mm of cash invested and

contribution of $260.8mm of B2S assets

acquired by ICE

Total

$300

$883

Notable Stakeholders

BCG

(1) Represents ownership on a fully-diluted basis.

bakkt 2 Pro forma cash includes $92 million of cash on Bakkt balance sheet. Minimum cash condition is $425 million

Ice

Payu

Represents ICE pro forma economic interest, ICE's effective voting interest will be below 50% Represents ownership on a fully-diluted basis

Pro Forma Ownership

PIPE

12%

VIH Public

Shareholders

8%

VIH Founder Shares

2%

ICE Pro Forma Ownership

65%

Bakkt Equity

Holders

78%View entire presentation