3M Results Presentation Deck

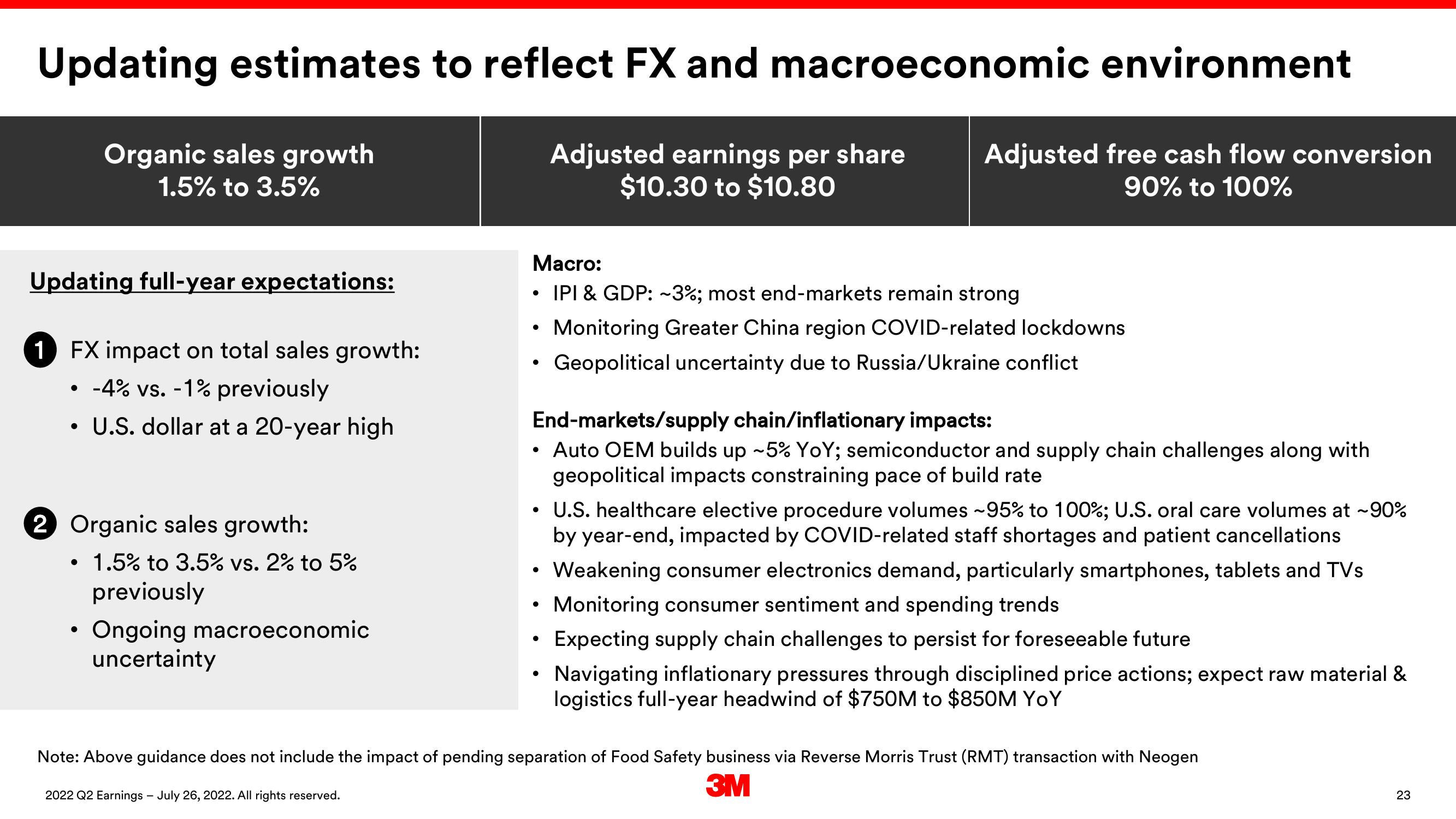

Updating estimates to reflect FX and macroeconomic environment

Adjusted earnings per share

$10.30 to $10.80

Adjusted free cash flow conversion

90% to 100%

Updating full-year expectations:

Organic sales growth

1.5% to 3.5%

1 FX impact on total sales growth:

• -4% vs. -1% previously

U.S. dollar at a 20-year high

●

2 Organic sales growth:

●

1.5% to 3.5% vs. 2% to 5%

previously

Ongoing macroeconomic

uncertainty

Macro:

IPI & GDP: ~3%; most end-markets remain strong

Monitoring Greater China region COVID-related lockdowns

Geopolitical uncertainty due to Russia/Ukraine conflict

●

End-markets/supply chain/inflationary impacts:

• Auto OEM builds up ~5% YoY; semiconductor and supply chain challenges along with

geopolitical impacts constraining pace of build rate

U.S. healthcare elective procedure volumes ~95% to 100%; U.S. oral care volumes at ~90%

by year-end, impacted by COVID-related staff shortages and patient cancellations

Weakening consumer electronics demand, particularly smartphones, tablets and TVs

Monitoring consumer sentiment and spending trends

Expecting supply chain challenges to persist for foreseeable future

Navigating inflationary pressures through disciplined price actions; expect raw material &

logistics full-year headwind of $750M to $850M YOY

Note: Above guidance does not include the impact of pending separation of Food Safety business via Reverse Morris Trust (RMT) transaction with Neogen

2022 Q2 Earnings - July 26, 2022. All rights reserved.

3M

23View entire presentation