MSR Value Growth & Market Trends

SUMMARY 3Q'21 FINANCIAL RESULTS (CONT'D)

●

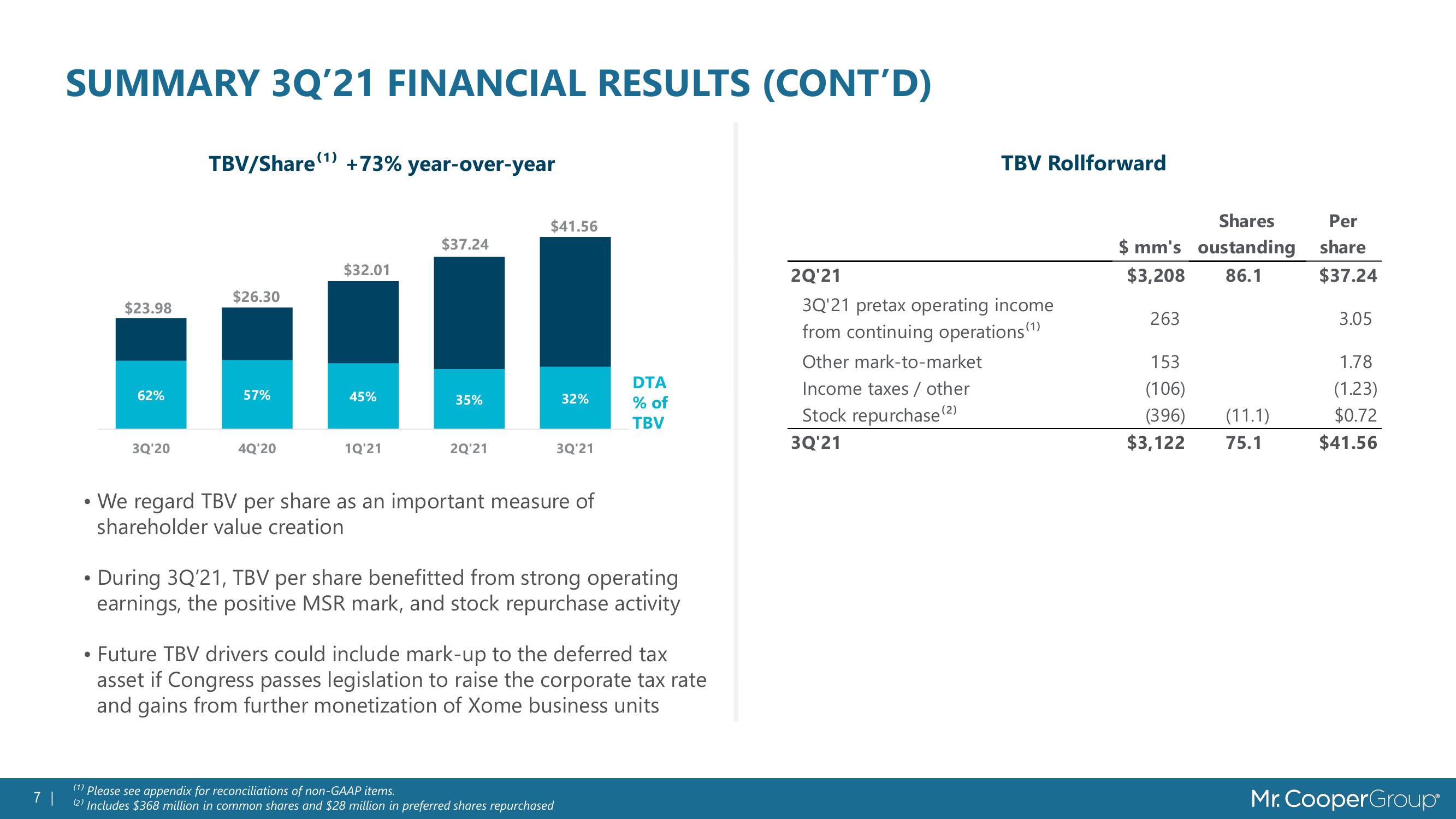

$23.98

62%

3Q'20

TBV/Share(1) +73% year-over-year

$26.30

57%

4Q'20

$32.01

45%

1Q'21

$37.24

35%

2Q'21

$41.56

32%

3Q'21

We regard TBV per share as an important measure of

shareholder value creation

7 |

(1) Please see appendix for reconciliations of non-GAAP items.

(2) Includes $368 million in common shares and $28 million in preferred shares repurchased

DTA

% of

TBV

• During 3Q'21, TBV per share benefitted from strong operating

earnings, the positive MSR mark, and stock repurchase activity

• Future TBV drivers could include mark-up to the deferred tax

asset if Congress passes legislation to raise the corporate tax rate

and gains from further monetization of Xome business units

TBV Rollforward

2Q'21

3Q'21 pretax operating income

from continuing operations (¹)

Other mark-to-market

Income taxes / other

Stock repurchase (²)

3Q'21

Shares

$ mm's oustanding

$3,208 86.1

263

153

(106)

(396)

$3,122

(11.1)

75.1

Per

share

$37.24

3.05

1.78

(1.23)

$0.72

$41.56

Mr. CooperGroupView entire presentation