WeWork Investor Presentation Deck

(1)

(2)

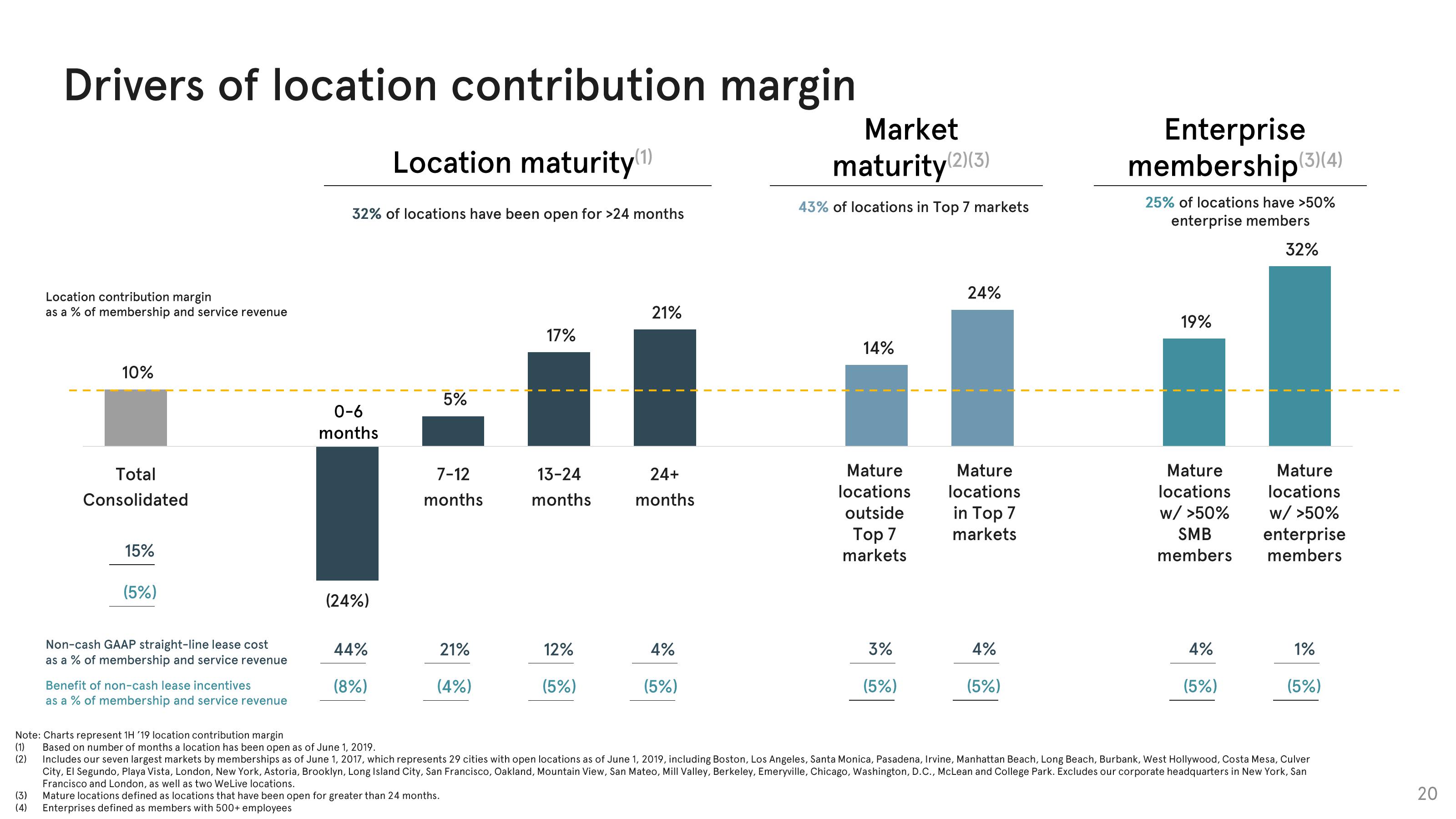

Drivers of location contribution margin

Location maturity (1)

(3)

(4)

Location contribution margin

as a % of membership and service revenue

10%

Total

Consolidated

15%

(5%)

Non-cash GAAP straight-line lease cost

as a % of membership and service revenue

Benefit of non-cash lease incentives

as a % of membership and service revenue

32% of locations have been open for >24 months

0-6

months

(24%)

44%

(8%)

5%

7-12

months

21%

(4%)

17%

13-24

months

12%

(5%)

21%

24+

months

4%

(5%)

Market

maturity(2)(3)

43% of locations in Top 7 markets

14%

Mature

locations

outside

Top 7

markets

3%

(5%)

24%

Mature

locations

in Top 7

markets

4%

(5%)

Enterprise

membership (3) (4)

25% of locations have >50%

enterprise members

32%

19%

Mature

locations

w/ >50%

SMB

members

4%

(5%)

Mature

locations

w/ >50%

enterprise

members

1%

Note: Charts represent 1H '19 location contribution margin

Based on number of months a location has been open as of June 1, 2019.

Includes our seven largest markets by memberships as of June 1, 2017, which represents 29 cities with open locations as of June 1, 2019, including Boston, Los Angeles, Santa Monica, Pasadena, Irvine, Manhattan Beach, Long Beach, Burbank, West Hollywood, Costa Mesa, Culver

City, El Segundo, Playa Vista, London, New York, Astoria, Brooklyn, Long Island City, San Francisco, Oakland, Mountain View, San Mateo, Mill Valley, Berkeley, Emeryville, Chicago, Washington, D.C., McLean and College Park. Excludes our corporate headquarters in New York, San

Francisco and London, as well as two WeLive locations.

Mature locations defined as locations that have been open for greater than 24 months.

Enterprises defined as members with 500+ employees

(5%)

20View entire presentation