zSpace SPAC

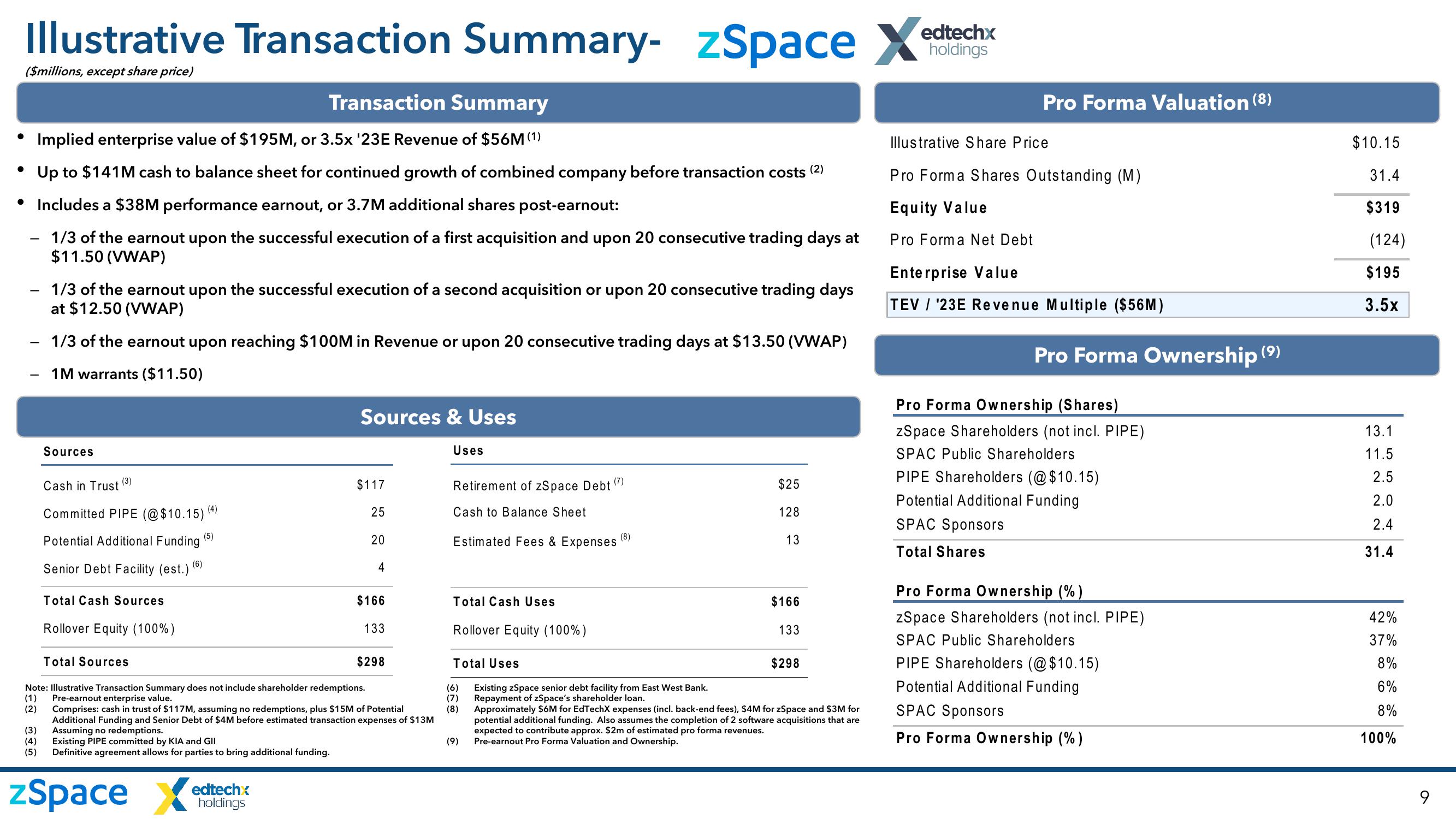

Illustrative Transaction Summary- zSpace

($millions, except share price)

Transaction Summary

Implied enterprise value of $195M, or 3.5x '23E Revenue of $56M (1)

Up to $141M cash to balance sheet for continued growth of combined company before transaction costs (2)

• Includes a $38M performance earnout, or 3.7M additional shares post-earnout:

1/3 of the earnout upon the successful execution of a first acquisition and upon 20 consecutive trading days at

$11.50 (VWAP)

1/3 of the earnout upon the successful execution of a second acquisition or upon 20 consecutive trading days

at $12.50 (VWAP)

1/3 of the earnout upon reaching $100M in Revenue or upon 20 consecutive trading days at $13.50 (VWAP)

1M warrants ($11.50)

Sources

Cash in Trust

(3)

Committed PIPE (@$10.15) (4)

Potential Additional Funding (5)

Senior Debt Facility (est.) (6

Total Cash Sources

Rollover Equity (100%)

Total Sources.

Existing PIPE committed by KIA and GII

Definitive agreement allows for parties to bring additional funding.

Sources & Uses

zSpace edtechx

X

holdings

$117

25

20

4

$166

133

Note: Illustrative Transaction Summary does not include shareholder redemptions.

Pre-earnout enterprise value.

(1)

(2)

Comprises: cash in trust of $117M, assuming no redemptions, plus $15M of Potential

Additional Funding and Senior Debt of $4M before estimated transaction expenses of $13M

(3) Assuming no redemptions.

(4)

(5)

$298

Uses

Retirement of zSpace Debt (7)

Cash to Balance Sheet

Estimated Fees & Expenses

Total Cash Uses

Rollover Equity (100%)

Total Uses

(6)

(7)

(8)

(9)

(8)

Existing zSpace senior debt facility from East West Bank.

Repayment of zSpace's shareholder loan.

$25

128

13

$166

133

$298

Approximately $6M for EdTechX expenses (incl. back-end fees), $4M for zSpace and $3M for

potential additional funding. Also assumes the completion of 2 software acquisitions that are

expected to contribute approx. $2m of estimated pro forma revenues.

Pre-earnout Pro Forma Valuation and Ownership.

X

edtechx

holdings

Pro Forma Valuation (8)

Illustrative Share Price

Pro Forma Shares Outstanding (M)

Equity Value

Pro Forma Net Debt

Enterprise Value

TEV '23E Revenue Multiple ($56M)

Pro Forma Ownership (⁹)

Pro Forma Ownership (Shares)

zSpace Shareholders (not incl. PIPE)

SPAC Public Shareholders

PIPE Shareholders (@$10.15)

Potential Additional Funding

SPAC Sponsors

Total Shares

Pro Forma Ownership (%)

zSpace Shareholders (not incl. PIPE)

SPAC Public Shareholders

PIPE Shareholders (@$10.15)

Potential Additional Funding

SPAC Sponsors

Pro Forma Ownership (%)

$10.15

31.4

$319

(124)

$195

3.5x

13.1

11.5

2.5

2.0

2.4

31.4

42%

37%

8%

6%

8%

100%

9View entire presentation