Engine No. 1 Activist Presentation Deck

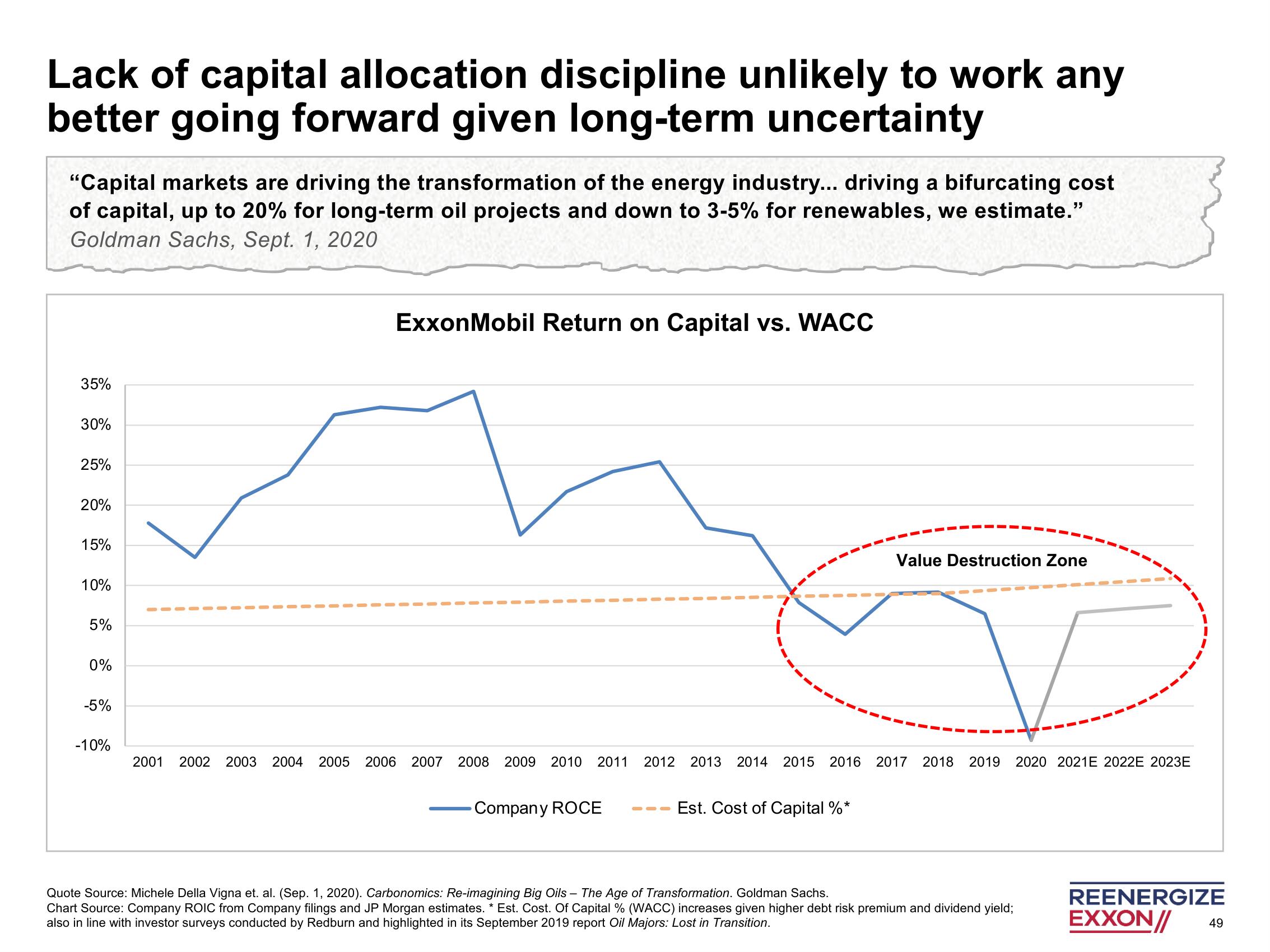

Lack of capital allocation discipline unlikely to work any

better going forward given long-term uncertainty

the tra

"Capital markets are driving the transformation of the energy industry... driving a bifurcating cost

of capital, up to 20% for long-term oil projects and down to 3-5% for renewables, we estimate."

Goldman Sachs, Sept. 1, 2020

35%

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

ExxonMobil Return on Capital vs. WACC

2001 2002 2003 2004 2005 2006 2007 2008

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 E 2022E 2023E

Company ROCE

Value Destruction Zone

Est. Cost of Capital %*

Quote Source: Michele Della Vigna et. al. (Sep. 1, 2020). Carbonomics: Re-imagining Big Oils - The Age of Transformation. Goldman Sachs.

Chart Source: Company ROIC from Company filings and JP Morgan estimates. * Est. Cost. Of Capital % (WACC) increases given higher debt risk premium and dividend yield;

also in line with investor surveys conducted by Redburn and highlighted in its September 2019 report Oil Majors: Lost in Transition.

REENERGIZE

EXXON// 49View entire presentation