Uber Results Presentation Deck

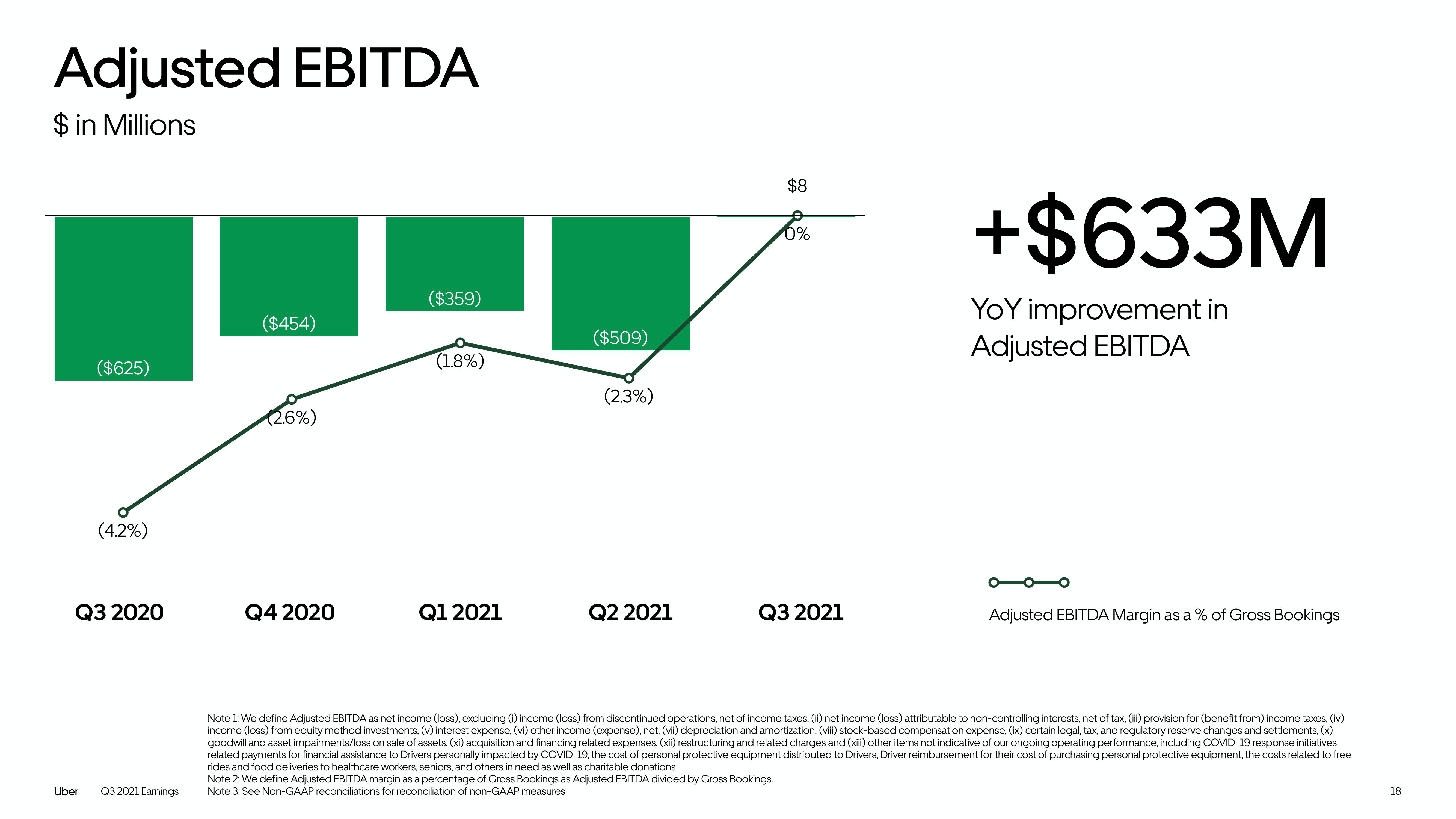

Adjusted EBITDA

$ in Millions

($625)

Uber

(4.2%)

Q3 2020

Q3 2021 Earnings

($454)

(2.6%)

Q4 2020

($359)

(1.8%)

Q1 2021

($509)

(2.3%)

Q2 2021

$8

0%

Q3 2021

+$633M

YoY improvement in

Adjusted EBITDA

Adjusted EBITDA Margin as a % of Gross Bookings

Note 1: We define Adjusted EBITDA as net income (loss), excluding (i) income (loss) from discontinued operations, net of income taxes, (ii) net income (loss) attributable to non-controlling interests, net of tax, (iii) provision for (benefit from) income taxes, (iv)

income (loss) from equity method investments, (v) interest expense, (vi) other income (expense), net, (vii) depreciation and amortization, (viii) stock-based compensation expense, (ix) certain legal, tax, and regulatory reserve changes and settlements, (x)

goodwill and asset impairments/loss on sale of assets, (xi) acquisition and financing related expenses, (xii) restructuring and related charges and (xiii) other items not indicative of our ongoing operating performance, including COVID-19 response initiatives

related payments for financial assistance to Drivers personally impacted by COVID-19, the cost of personal protective equipment distributed to Drivers, Driver reimbursement for their cost of purchasing personal protective equipment, the costs related to free

rides and food deliveries to healthcare workers, seniors, and others in need as well as charitable donations

Note 2: We define Adjusted EBITDA margin as a percentage of Gross Bookings as Adjusted EBITDA divided by Gross Bookings.

Note 3: See Non-GAAP reconciliations for reconciliation of non-GAAP measures

18View entire presentation