Kinnevik Results Presentation Deck

Intro

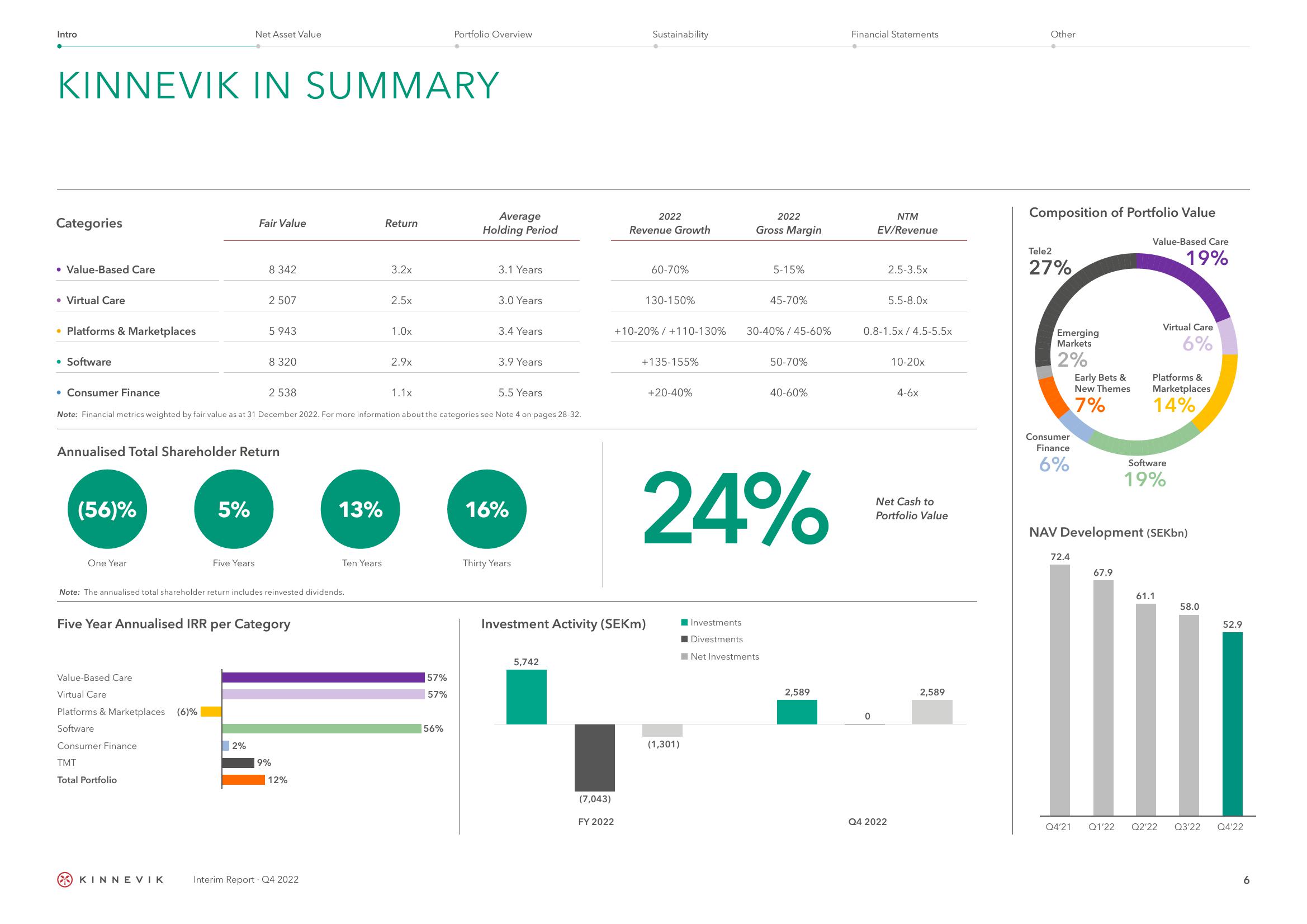

Categories

KINNEVIK IN SUMMARY

• Value-Based Care

• Virtual Care

• Platforms & Marketplaces

• Software

(56)%

One Year

Value-Based Care

Virtual Care

Platforms & Marketplaces (6)%

Software

Consumer Finance

Net Asset Value

Annualised Total Shareholder Return

5%

TMT

Total Portfolio

Five Years

KINNEVIK

Fair Value

8 342

2 507

2%

5 943

8 320

Five Year Annualised IRR per Category

Note: The annualised total shareholder return includes reinvested dividends.

2 538

• Consumer Finance

5.5 Years

Note: Financial metrics weighted by fair value as at 31 December 2022. For more information about the categories see Note 4 on pages 28-32.

9%

12%

13%

Interim Report. Q4 2022

Ten Years

Return

3.2x

2.5x

1.0x

2.9x

1.1x

Portfolio Overview

57%

57%

56%

Average

Holding Period

3.1 Years

3.0 Years

3.4 Years

3.9 Years.

16%

Thirty Years

5,742

(7,043)

FY 2022

Sustainability

2022

Revenue Growth

Investment Activity (SEKm)

60-70%

130-150%

+10-20%/ +110-130%

+135-155%

+20-40%

(1,301)

2022

Gross Margin

Investments

Divestments

5-15%

45-70%

30-40% / 45-60%

24%

Net Investments

50-70%

40-60%

2,589

Financial Statements

NTM

EV/Revenue

0

2.5-3.5x

0.8-1.5x/4.5-5.5x

5.5-8.0x

Q4 2022

10-20x

4-6x

Net Cash to

Portfolio Value

2,589

Other

Composition of Portfolio Value

Tele2

27%

Emerging

Markets

2%

Consumer

Finance

6%

Early Bets &

New Themes

7%

72.4

67.9

Value-Based Care

19%

Q4'21 Q1'22

NAV Development (SEKbn)

Virtual Care

6%

Platforms &

Marketplaces

14%

Software

19%

61.1

58.0

52.9

Q2'22 Q3'22 Q4'22

6View entire presentation