J.P.Morgan 2Q23 Investor Results

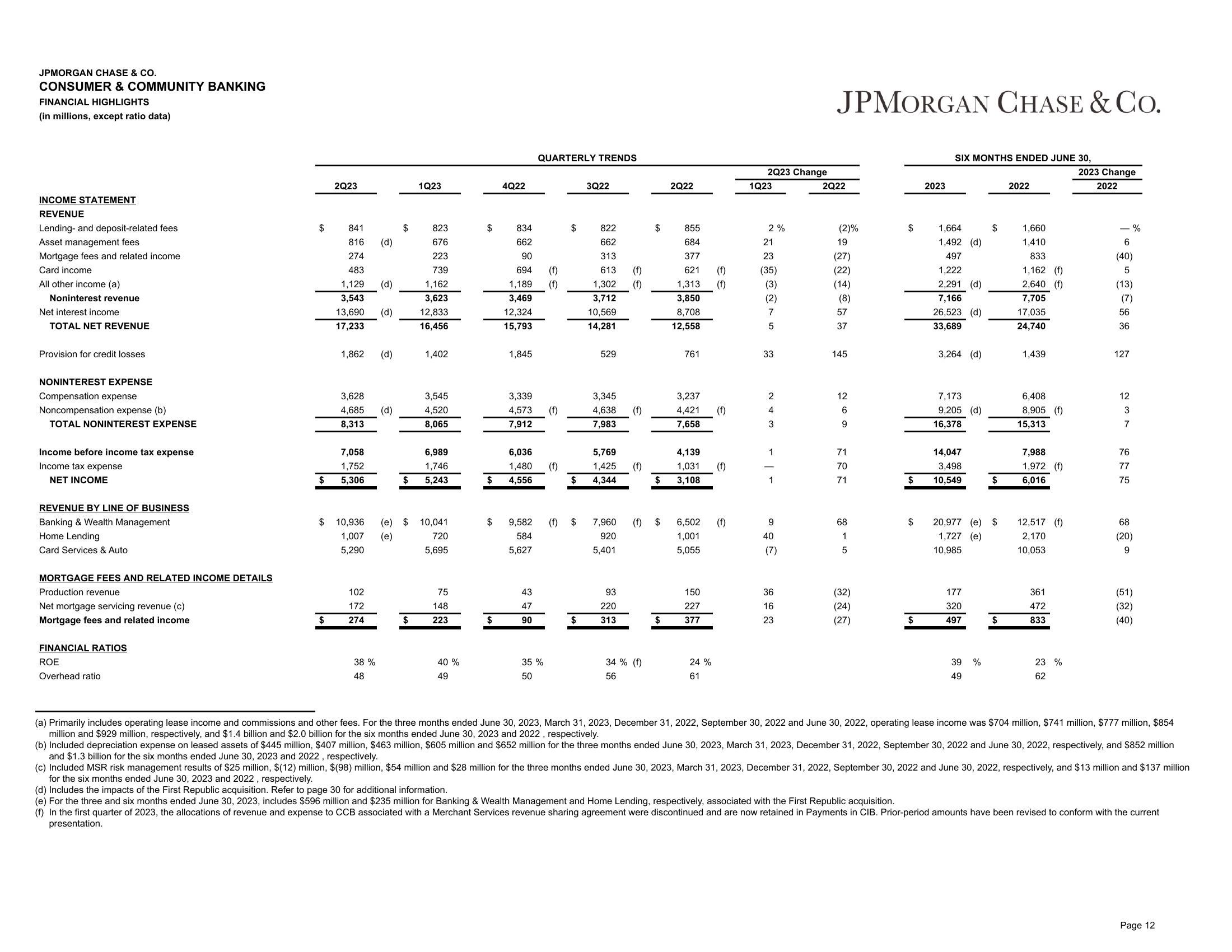

JPMORGAN CHASE & CO.

CONSUMER & COMMUNITY BANKING

FINANCIAL HIGHLIGHTS

(in millions, except ratio data)

INCOME STATEMENT

REVENUE

Lending- and deposit-related fees

Asset management fees

Mortgage fees and related income

Card income

All other income (a)

Noninterest revenue

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense (b)

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

REVENUE BY LINE OF BUSINESS

Banking & Wealth Management

Home Lending

Card Services & Auto

MORTGAGE FEES AND RELATED INCOME DETAILS

Production revenue

Net mortgage servicing revenue (c)

Mortgage fees and related income

FINANCIAL RATIOS

ROE

Overhead ratio

$

$

2Q23

$

841

816 (d)

274

483

1,129 (d)

3,543

13,690 (d)

17,233

1,862 (d)

3,628

4,685

8,313

7,058

1,752

5,306

102

172

274

(d)

38 %

48

$

1Q23

823

676

223

739

$

1,162

3,623

12,833

16,456

$ 10,936 (e) $ 10,041

1,007 (e)

5,290

720

5,695

1,402

3,545

4,520

8,065

6,989

1,746

$ 5,243

75

148

223

40 %

49

$

4Q22

$

834

662

90

694 (f)

1,189 (f)

3,469

12,324

15,793

1,845

QUARTERLY TRENDS

3,339

4,573 (f)

7,912

6,036

1,480 (f)

4,556

43

47

90

$ 9,582 (f) $

584

5,627

$

35 %

50

$

$

3Q22

822

662

313

613

1,302

3,712

10,569

14,281

529

3,345

4,638

7,983

5,769

1,425

4,344

7,960

920

5,401

93

220

313

(f)

(f)

(f)

$

34 % (f)

56

$

(f) $

$

2Q22

855

684

377

621 (f)

(f)

1,313

3,850

8,708

12,558

761

3,237

4,421 (f)

7,658

4,139

1,031

3,108

6,502

1,001

5,055

150

227

377

24 %

61

(f)

(f)

2Q23 Change

1Q23

2%

N

21

23

(35)

(3)

(2)

7

5

33

2

WAN

1

1

9

40

(7)

36

16

23

JPMORGAN CHASE & Co.

2Q22

(2)%

19

(27)

(22)

(14)

(8)

57

37

145

12

6

9

71

70

71

68

1

5

(32)

(24)

(27)

$

$

$

$

2023

SIX MONTHS ENDED JUNE 30,

1,664

$

1,492 (d)

497

1,222

2,291 (d)

7,166

26,523 (d)

33,689

3,264 (d)

7,173

9,205 (d)

16,378

14,047

3,498

10,549

20,977 (e) $

1,727 (e)

10,985

177

320

497

$

39 %

49

$

2022

1,660

1,410

833

1,162 (f)

2,640 (f)

7,705

17,035

24,740

1,439

6,408

8,905 (f)

15,313

7,988

1,972 (f)

6,016

12,517 (f)

2,170

10,053

361

472

833

23 %

62

2023 Change

2022

6

(40)

5

(13)

(7)

56

36

127

12

%

3

7

76 77 75

68

(20)

9

(51)

(32)

(40)

(a) Primarily includes operating lease income and commissions and other fees. For the three months ended June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, operating lease income was $704 million, $741 million, $777 million, $854

million and $929 million, respectively, and $1.4 billion and $2.0 billion for the six months ended June 30, 2023 and 2022, respectively.

(b) Included depreciation expense on leased assets of $445 million, $407 million, $463 million, $605 million and $652 million for the three months ended June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, respectively, and $852 million

and $1.3 billion for the six months ended June 30, 2023 and 2022, respectively.

(c) Included MSR risk management results of $25 million, $(12) million, $(98) million, $54 million and $28 million for the three months ended June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, respectively, and $13 million and $137 million

for the six months ended June 30, 2023 and 2022, respectively.

(d) Includes the impacts of the First Republic acquisition. Refer to page 30 for additional information.

(e) For the three and six months ended June 30, 2023, includes $596 million and $235 million for Banking & Wealth Management and Home Lending, respectively, associated with the First Republic acquisition.

(f) In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with the current

presentation.

Page 12View entire presentation