Privia Health IPO Presentation Deck

6

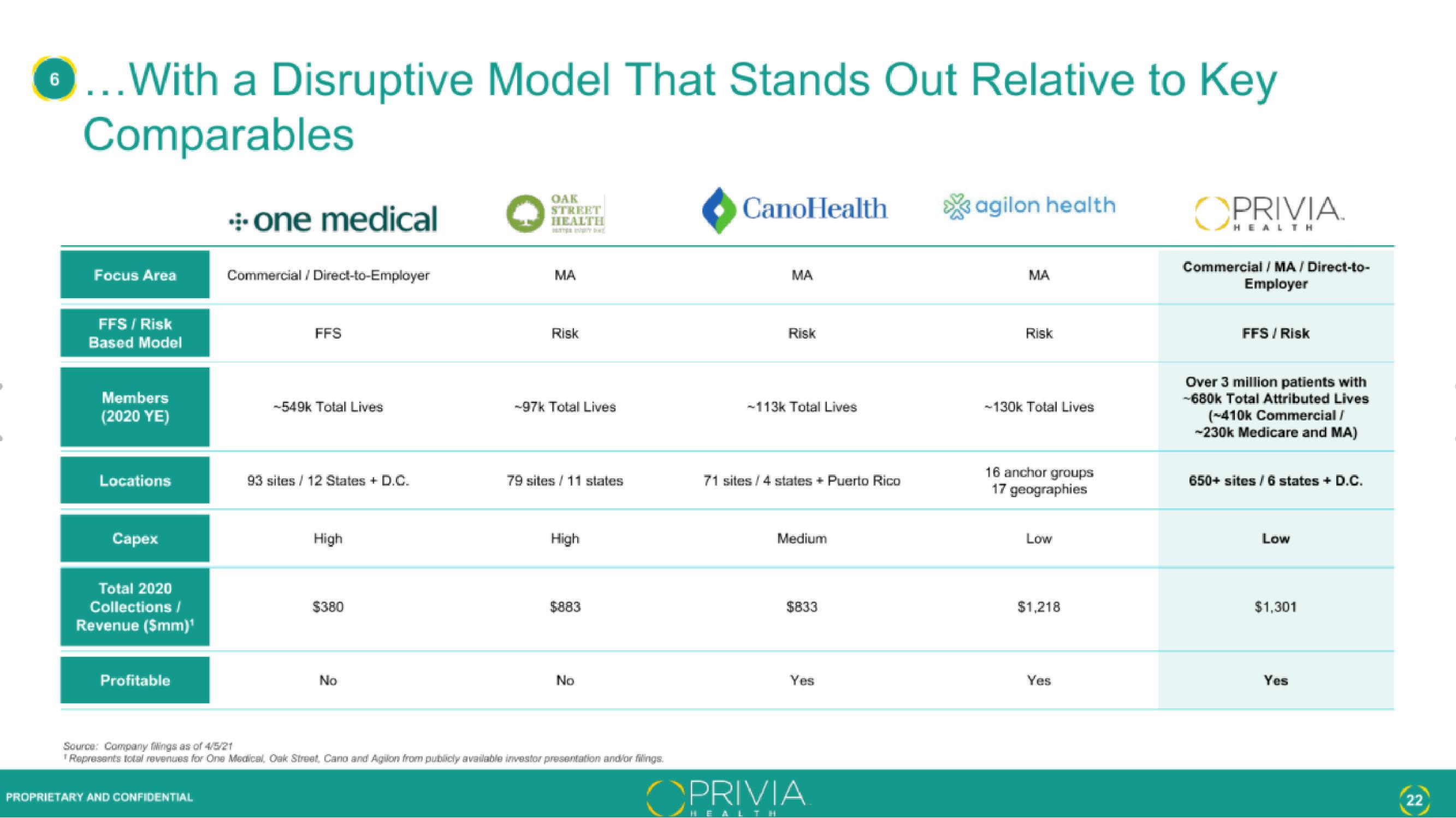

...With a Disruptive Model That Stands Out Relative to Key

Comparables

Focus Area

FFS / Risk

Based Model

Members

(2020 YE)

Locations

Capex

Total 2020

Collections/

Revenue ($mm)¹

Profitable

one medical

PROPRIETARY AND CONFIDENTIAL

Commercial / Direct-to-Employer

FFS

-549k Total Lives

93 sites / 12 States + D.C.

High

$380

No

OA.K

STREET

HEALTH

MA

Risk

-97k Total Lives

79 sites / 11 states

High

$883

No

Source: Company Wings as of 4/5/21

Represents total revenues for One Medical, Oak Street, Cano and Agilon from publicly available investor presentation and/or filings.

CanoHealth

MA

Risk

-113k Total Lives

71 sites / 4 states + Puerto Rico

Medium

$833

Yes

OPRIVIA

agilon health

MA

Risk

-130k Total Lives

16 anchor groups

17 geographies

Low

$1,218

Yes

OPRIVIA.

HEALTH

Commercial / MA/ Direct-to-

Employer

FFS / Risk

Over 3 million patients with

-680k Total Attributed Lives

(-410k Commercial /

-230k Medicare and MA)

650+ sites / 6 states + D.C.

Low

$1,301

Yes

22View entire presentation