UBS Results Presentation Deck

Investment Bank

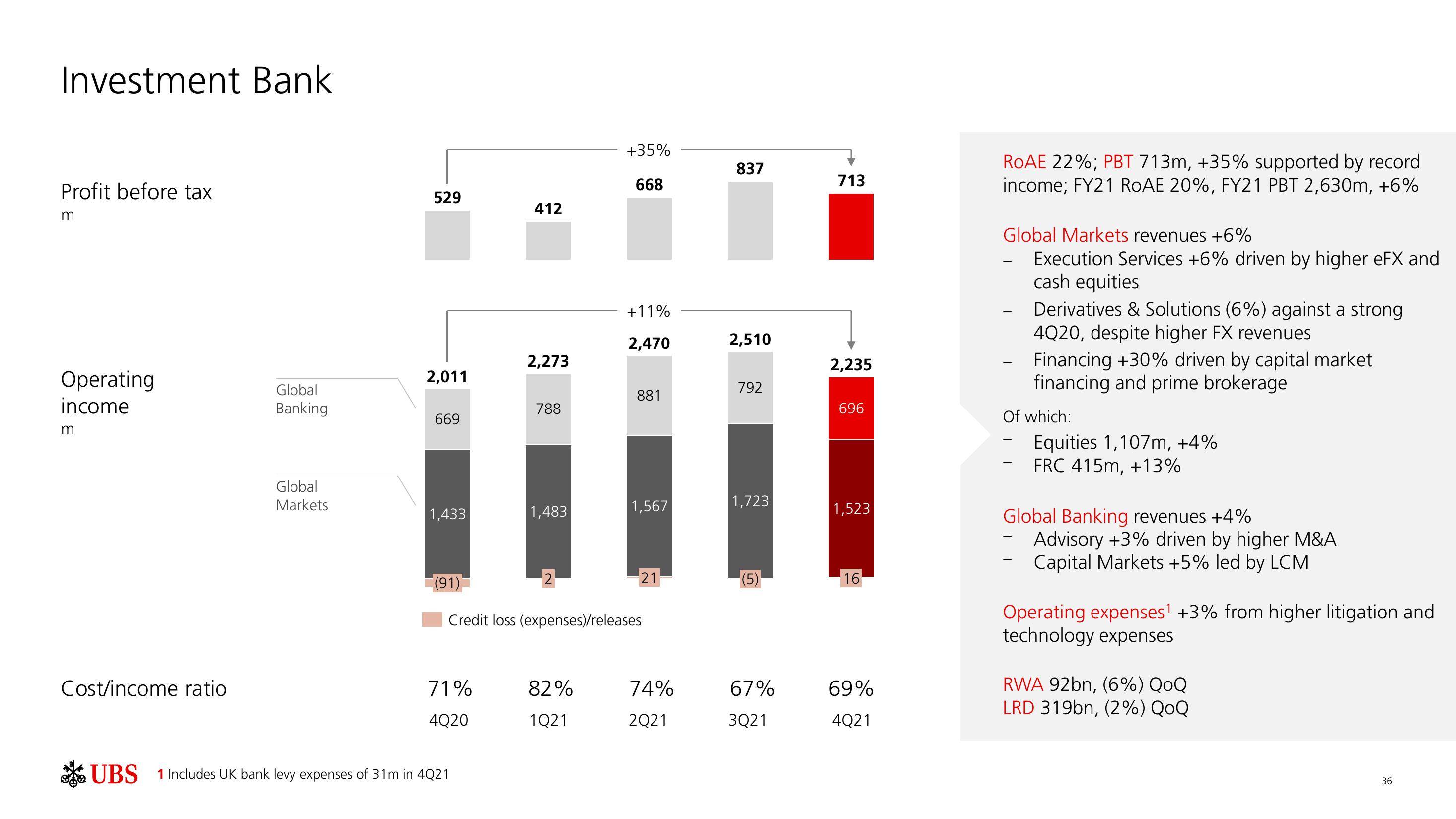

Profit before tax

m

Operating

income

m

Cost/income ratio

Global

Banking

Global

Markets

529

2,011

669

1,433

(91)

71%

4Q20

UBS 1 Includes UK bank levy expenses of 31m in 4Q21

412

2,273

788

1,483

2

+35%

668

82%

1Q21

+11%

2,470

881

1,567

Credit loss (expenses)/releases

21

74%

2Q21

837

2,510

792

1,723

(5)

67%

3Q21

713

2,235

696

1,523

16

69%

4Q21

ROAE 22%; PBT 713m, +35% supported by record

income; FY21 ROAE 20%, FY21 PBT 2,630m, +6%

Global Markets revenues +6%

Execution Services +6% driven by higher eFX and

cash equities

-

-

Derivatives & Solutions (6%) against a strong

4Q20, despite higher FX revenues

Of which:

Financing +30% driven by capital market

financing and prime brokerage

-

Equities 1,107m, +4%

FRC 415m, +13%

Global Banking revenues +4%

Advisory +3% driven by higher M&A

Capital Markets +5% led by LCM

Operating expenses¹ +3% from higher litigation and

technology expenses

RWA 92bn, (6%) QoQ

LRD 319bn, (2%) QoQ

36View entire presentation