Matterport Results Presentation Deck

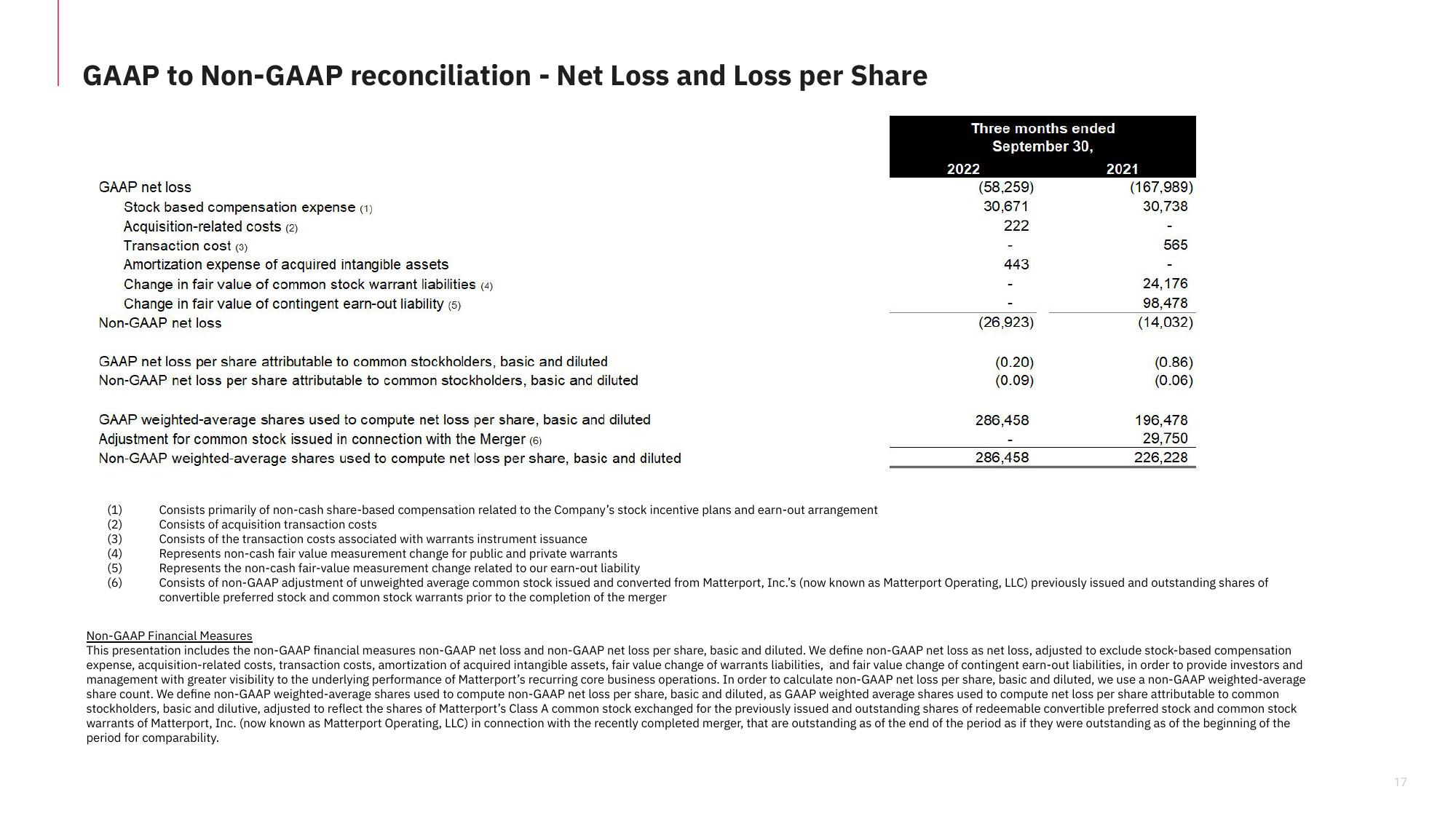

GAAP to Non-GAAP reconciliation - Net Loss and Loss per Share

GAAP net loss

Stock based compensation expense (1)

Acquisition-related costs (2)

Transaction cost (3)

Amortization expense of acquired intangible assets

Change in fair value of common stock warrant liabilities (4)

Change in fair value of contingent earn-out liability (5)

Non-GAAP net loss

GAAP net loss per share attributable to common stockholders, basic and diluted

Non-GAAP net loss per share attributable to common stockholders, basic and diluted

GAAP weighted-average shares used to compute net loss per share, basic and diluted

Adjustment for common stock issued in connection with the Merger (6)

Non-GAAP weighted-average shares used to compute net loss per share, basic and diluted

(2)

(3)

(4)

(5)

(6)

Consists primarily of non-cash share-based compensation related to the Company's stock incentive plans and earn-out arrangement

Consists of acquisition transaction costs

Consists of the transaction costs associated with warrants instrument issuance

Three months ended

September 30,

2022

(58,259)

30,671

222

443

(26,923)

(0.20)

(0.09)

286,458

286,458

2021

(167,989)

30,738

565

24,176

98,478

(14,032)

(0.86)

(0.06)

196,478

29,750

226,228

Represents non-cash fair value measurement change for public and private warrants

Represents the non-cash fair-value measurement change related to our earn-out liability

Consists of non-GAAP adjustment of unweighted average common stock issued and converted from Matterport, Inc.'s (now known as Matterport Operating, LLC) previously issued and outstanding shares of

convertible preferred stock and common stock warrants prior to the completion of the merger

Non-GAAP Financial Measures

This presentation includes the non-GAAP financial measures non-GAAP net loss and non-GAAP net loss per share, basic and diluted. We define non-GAAP net loss as net loss, adjusted to exclude stock-based compensation

expense, acquisition-related costs, transaction costs, amortization of acquired intangible assets, fair value change of warrants liabilities, and fair value change of contingent earn-out liabilities, in order to provide investors and

management with greater visibility to the underlying performance of Matterport's recurring core business operations. In order to calculate non-GAAP net loss per share, basic and diluted, we use a non-GAAP weighted-average

share count. We define non-GAAP weighted-average shares used to compute non-GAAP net loss per share, basic and diluted, as GAAP weighted average shares used to compute net loss per share attributable to common

stockholders, basic and dilutive, adjusted to reflect the shares of Matterport's Class A common stock exchanged for the previously issued and outstanding shares of redeemable convertible preferred stock and common stock

warrants of Matterport, Inc. (now known as Matterport Operating, LLC) in connection with the recently completed merger, that are outstanding as of the end of the period as if they were outstanding as of the beginning of the

period for comparability.

17View entire presentation