Bunzl Investor Day Presentation Deck

DISCIPLINED CAPITAL ALLOCATION

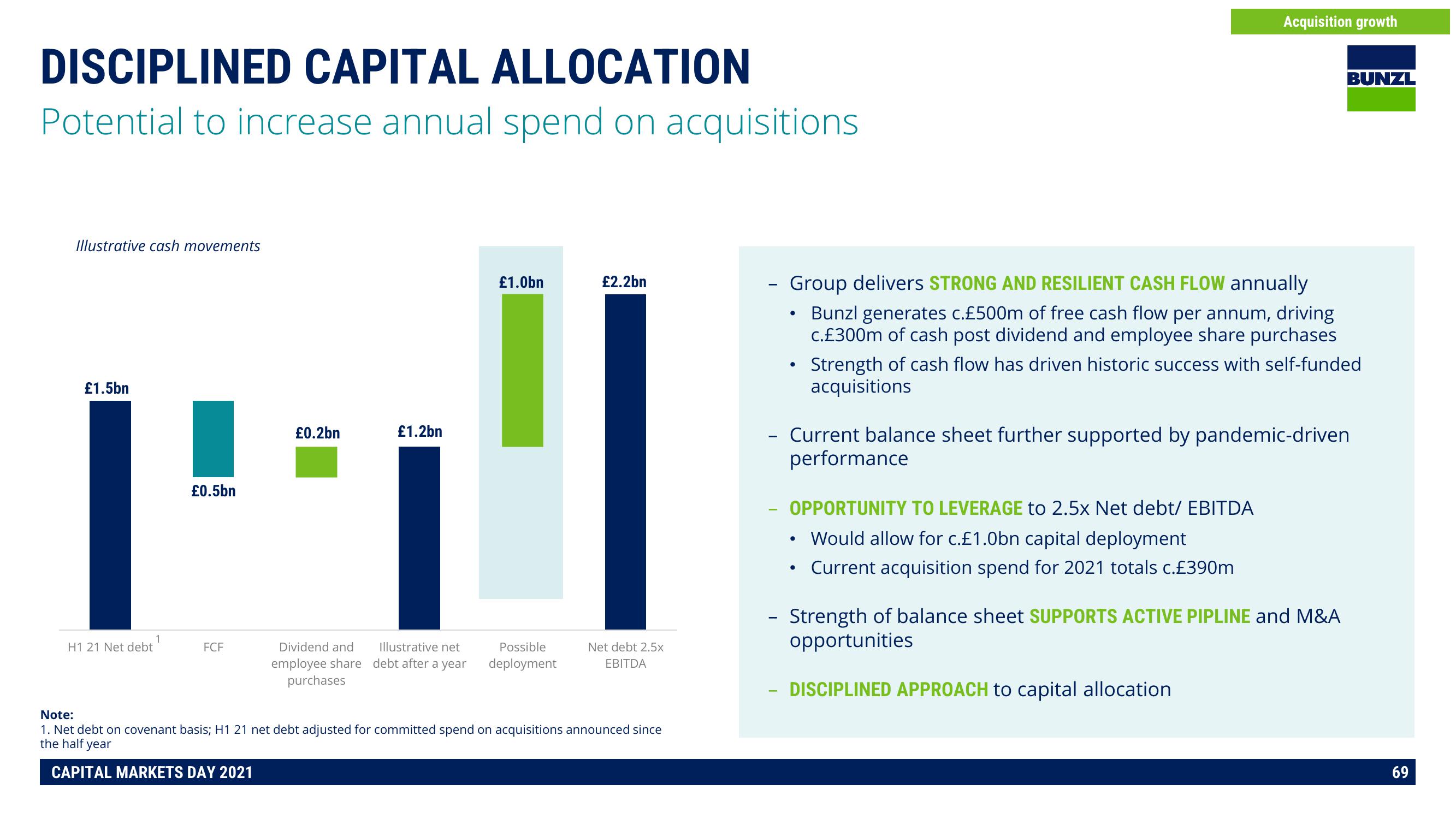

Potential to increase annual spend on acquisitions

Illustrative cash movements

£1.5bn

1

H1 21 Net debt

£0.5bn

FCF

£0.2bn

£1.0bn

£1.2bn

¡¶

Dividend and Illustrative net

employee share debt after a year

purchases

Possible

deployment

£2.2bn

Net debt 2.5x

EBITDA

Note:

1. Net debt on covenant basis; H1 21 net debt adjusted for committed spend on acquisitions announced since

the half year

CAPITAL MARKETS DAY 2021

-

-

●

Group delivers STRONG AND RESILIENT CASH FLOW annually

Bunzl generates c.£500m of free cash flow per annum, driving

c.£300m of cash post dividend and employee share purchases

Strength of cash flow has driven historic success with self-funded

acquisitions

OPPORTUNITY TO LEVERAGE to 2.5x Net debt/ EBITDA

Would allow for c.£1.0bn capital deployment

Current acquisition spend for 2021 totals c.£390m

Acquisition growth

Current balance sheet further supported by pandemic-driven

performance

●

●

BUNZL

- Strength of balance sheet SUPPORTS ACTIVE PIPLINE and M&A

opportunities

DISCIPLINED APPROACH to capital allocation

69View entire presentation