KinderCare IPO Presentation Deck

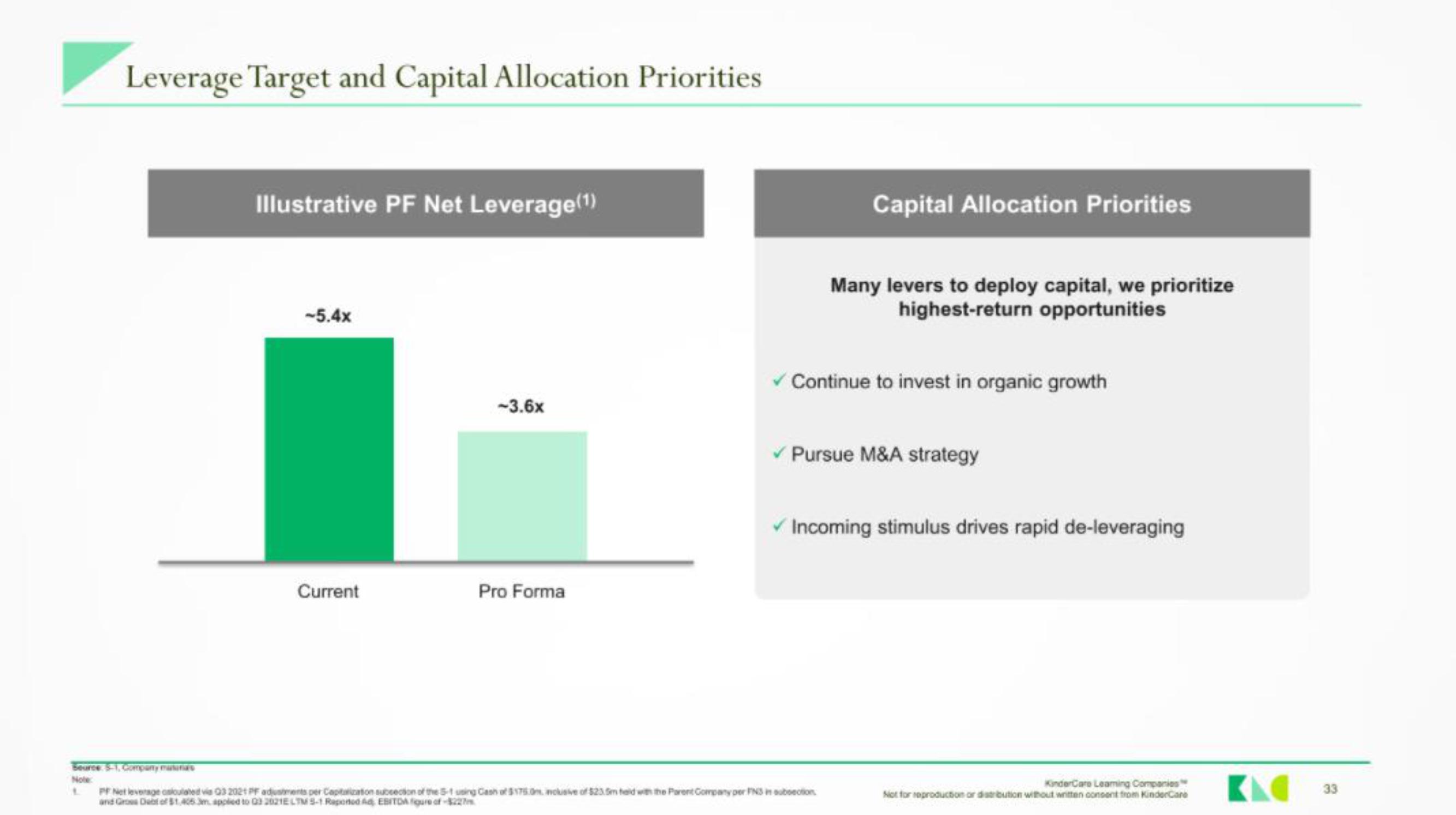

Leverage Target and Capital Allocation Priorities

Beurce S-1, Company malaries

Note:

Illustrative PF Net Leverage(¹)

-5.4x

Current

-3.6x

Pro Forma

Capital Allocation Priorities

Many levers to deploy capital, we prioritize

highest-return opportunities

✓Continue to invest in organic growth

✓ Pursue M&A strategy

PF Net leverage calculated via 03 2021 PF adjustments per Captarization subsection of the 5-1 using Cash of $175. Ons molusive of $23.5m teld with the Parent Company per FN3 in subsection

and Gross Debt of $1,405 3m. applied to 03 2021ELTM 5-1 Reported Ad EBITDA figure of-$227

✓ Incoming stimulus drives rapid de-leveraging

KinderCare Leaming Companies

Not for reproduction or distribution without written consent from KinderCare

33View entire presentation