First Foundation Investor Presentation Deck

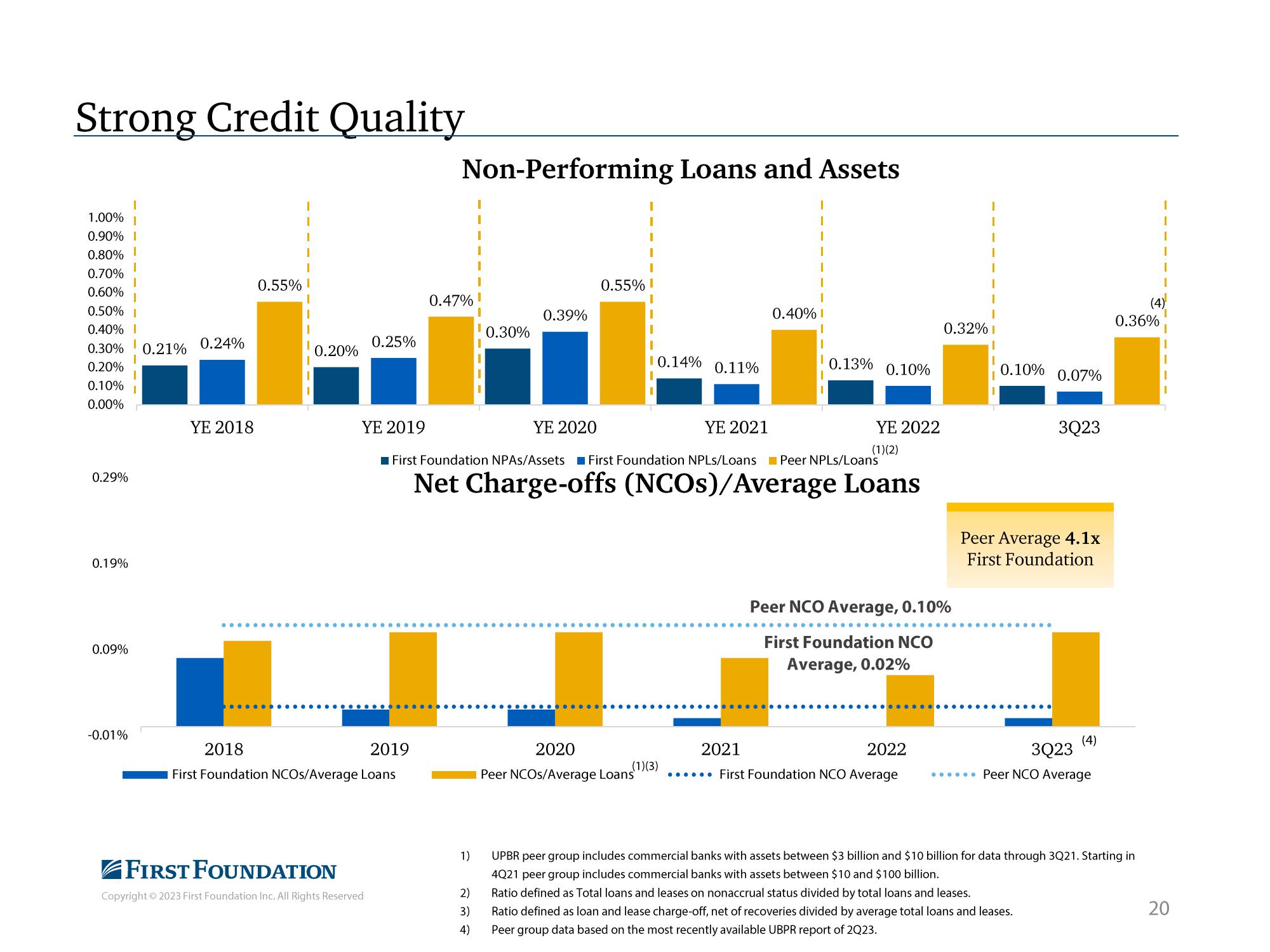

Strong Credit Quality

1.00%

0.90% I

0.80% 1

0.70%

0.60%

0.50% I

0.40% I

0.30% 0.21%

0.20%

0.10%

0.00%

0.29%

0.19%

0.09%

-0.01%

0.24%

YE 2018

0.55% !

..........

0.20%

0.25%

2018

2019

First Foundation NCOS/Average Loans

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

Non-Performing Loans and Assets

0.47%

1)

0.30%

2)

3)

4)

0.39%

YE 2020

0.55% !

......

10.14%

YE 2019

■First Foundation NPAS/Assets First Foundation NPLs/Loans Peer NPLs/Loans

Net Charge-offs (NCOs)/Average Loans

2020

Peer NCOS/Average Loans

0.11%

(1)(3)

YE 2021

0.40% I

0.13%

0.10%

YE 2022

(1)(2)

0.32% I

Peer NCO Average, 0.10%

...............

First Foundation NCO

Average, 0.02%

2021

2022

...... First Foundation NCO Average

0.10% 0.07%

Peer Average 4.1x

First Foundation

.........

3Q23

....

(4)

3Q23

...... Peer NCO Average

(4)

0.36%

UPBR peer group includes commercial banks with assets between $3 billion and $10 billion for data through 3Q21. Starting in

4Q21 peer group includes commercial banks with assets between $10 and $100 billion.

Ratio defined as Total loans and leases on nonaccrual status divided by total loans and leases.

Ratio defined as loan and lease charge-off, net of recoveries divided by average total loans and leases.

Peer group data based on the most recently available UBPR report of 2Q23.

20View entire presentation