Better Results Presentation Deck

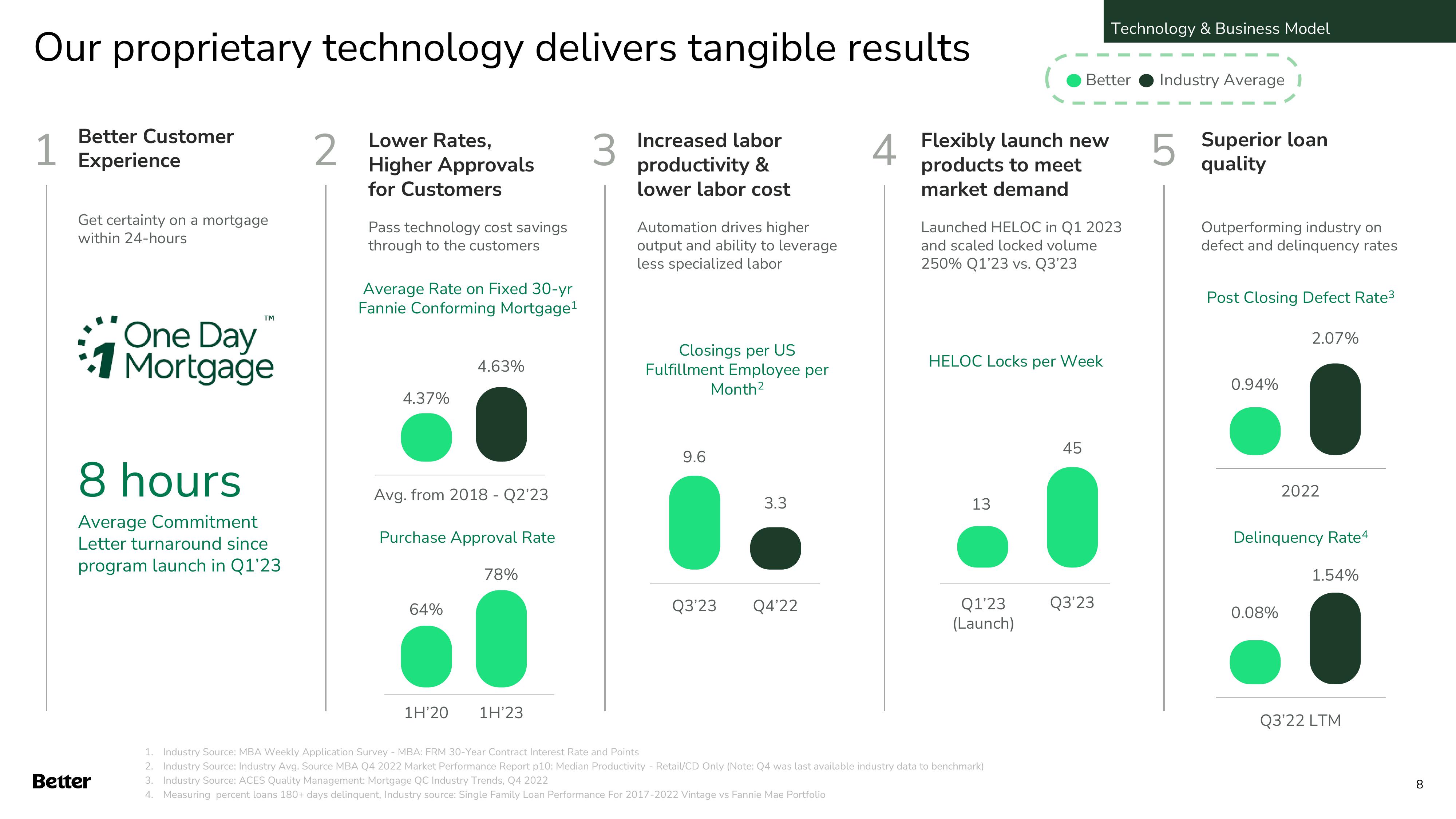

Our proprietary technology delivers tangible results

Better Customer

Experience

Lower Rates,

Higher Approvals

for Customers

3

Increased labor

productivity &

lower labor cost

1

Get certainty on a mortgage

within 24-hours

TM

Better

One Day

Mortgage

8 hours

Average Commitment

Letter turnaround since

program launch in Q1'23

2

Pass technology cost savings

through to the customers

Average Rate on Fixed 30-yr

Fannie Conforming Mortgage¹

4.37%

Avg. from 2018 - Q2'23

4.63%

Purchase Approval Rate

64%

1H'20

78%

1H'23

Automation drives higher

output and ability to leverage

less specialized labor

Closings per US

Fulfillment Employee per

Month²

9.6

Q3'23

3.3

Q4'22

4

Flexibly launch new

products to meet

market demand

Launched HELOC in Q1 2023

and scaled locked volume

250% Q1'23 vs. Q3'23

HELOC Locks per Week

13.

Q1'23

(Launch)

Better

1. Industry Source: MBA Weekly Application Survey - MBA: FRM 30-Year Contract Interest Rate and Points

2. Industry Source: Industry Avg. Source MBA Q4 2022 Market Performance Report p10: Median Productivity - Retail/CD Only (Note: Q4 was last available industry data to benchmark)

3. Industry Source: ACES Quality Management: Mortgage QC Industry Trends, Q4 2022

4. Measuring percent loans 180+ days delinquent, Industry source: Single Family Loan Performance For 2017-2022 Vintage vs Fannie Mae Portfolio

45

Technology & Business Model

Q3'23

Industry Average

5

Superior loan

quality

Outperforming industry on

defect and delinquency rates

Post Closing Defect Rate³

0.94%

2.07%

0.08%

2022

Delinquency Rate4

1.54%

Q3'22 LTM

8View entire presentation