jetBlue Results Presentation Deck

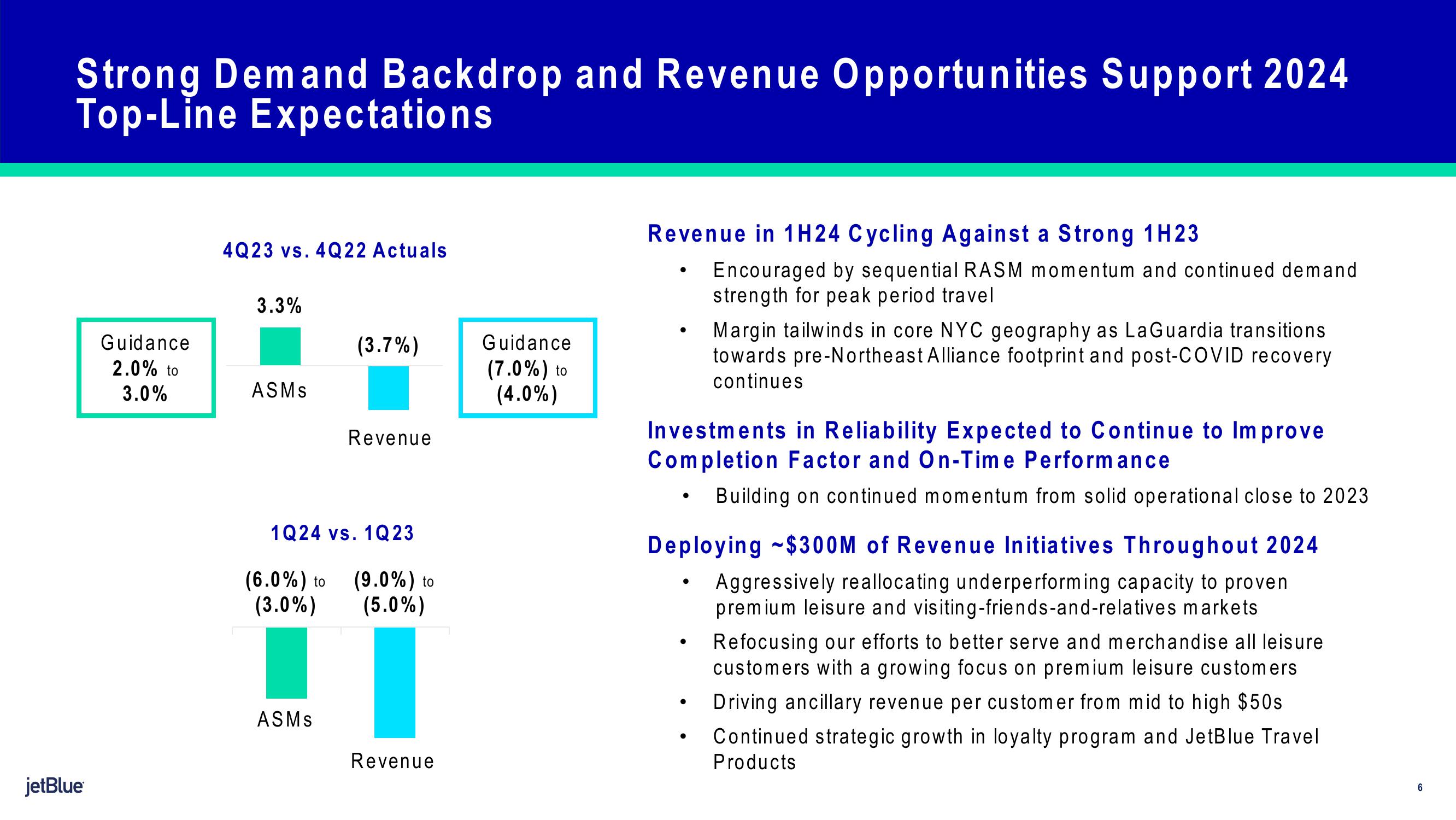

Strong Demand Backdrop and Revenue Opportunities Support 2024

Top-Line Expectations

jetBlue

Guidance

2.0% to

3.0%

4Q23 vs. 4Q22 Actuals

3.3%

ASMS

(3.7%)

Revenue

1Q24 vs. 1Q 23

ASMS

(6.0%) to (9.0%) to

(3.0%) (5.0%)

Revenue

Guidance

(7.0%) to

(4.0%)

Revenue in 1H24 Cycling Against a Strong 1H23

●

Investments in Reliability Expected to Continue to Improve

Completion Factor and On-Time Performance

• Building on continued momentum from solid operational close to 2023

●

Encouraged by sequential RASM momentum and continued demand

strength for peak period travel

Deploying $300M of Revenue Initiatives Throughout 2024

Aggressively reallocating underperforming capacity to proven

premium leisure and visiting-friends-and-relatives markets.

Refocusing our efforts to better serve and merchandise all leisure

customers with a growing focus on premium leisure customers

Driving ancillary revenue per customer from mid to high $50s

Continued strategic growth in loyalty program and JetBlue Travel

Products

●

Margin tailwinds in core NYC geography as LaGuardia transitions

towards pre-Northeast Alliance footprint and post-COVID recovery

continues

●

6View entire presentation