Main Street Capital Investor Day Presentation Deck

Dividend Paying BDCs

Public for > 2 Years (3)

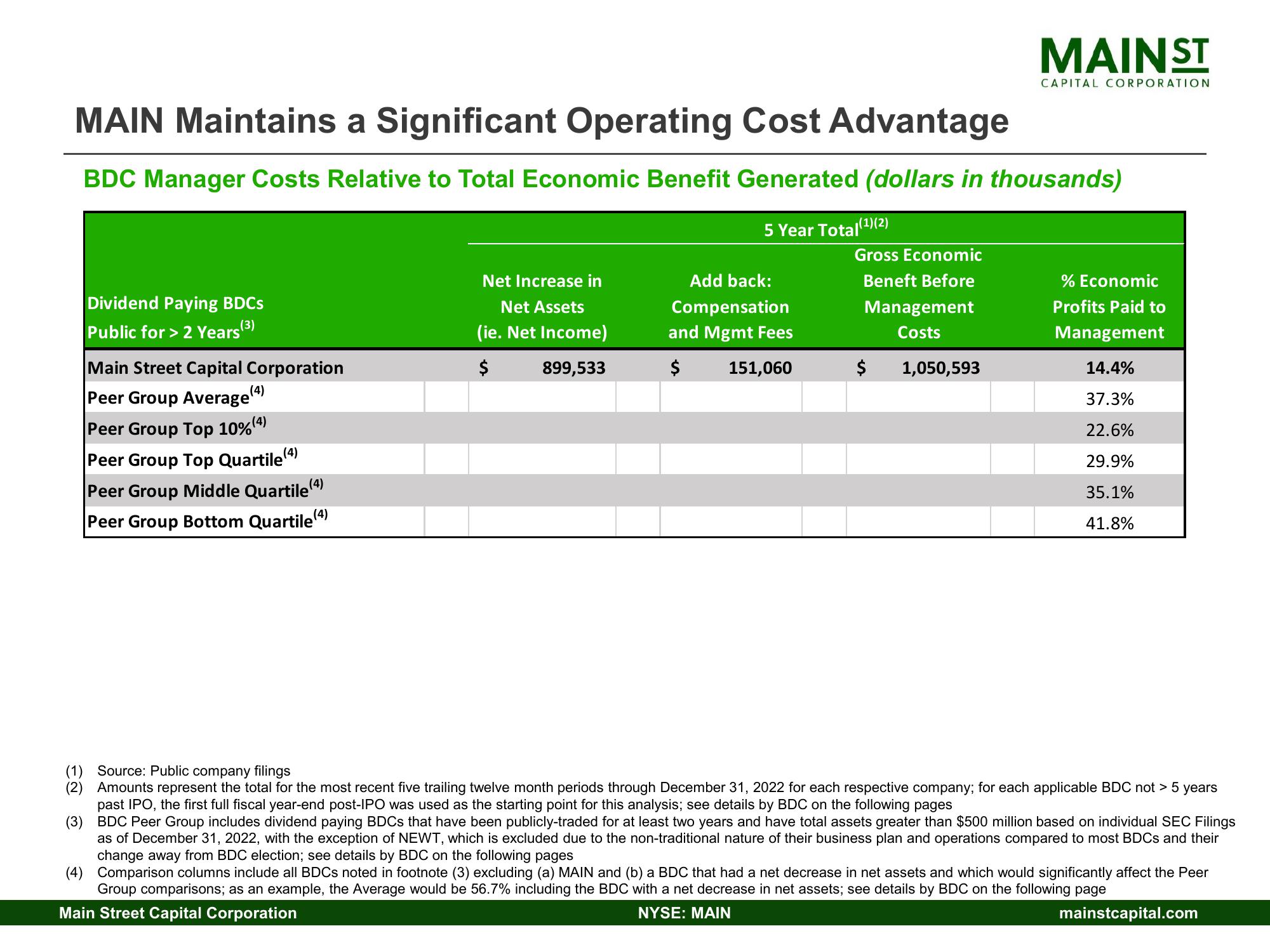

MAIN Maintains a Significant Operating Cost Advantage

BDC Manager Costs Relative to Total Economic Benefit Generated (dollars in thousands)

5 Year Total(¹)(2)

Main Street Capital Corporation

Peer Group Average (4)

Peer Group Top 10%(4)

Peer Group Top Quartile(4)

Peer Group Middle Quartile (4

Peer Group Bottom Quartile (4

Net Increase in

Net Assets

(ie. Net Income)

$

899,533

Add back:

Compensation

and Mgmt Fees

$ 151,060

Gross Economic

Beneft Before

Management

Costs

$

MAINST

1,050,593

CAPITAL CORPORATION

% Economic

Profits Paid to

Management

14.4%

37.3%

22.6%

29.9%

35.1%

41.8%

(1) Source: Public company filings

(2) Amounts represent the total for the most recent five trailing twelve month periods through December 31, 2022 for each respective company; for each applicable BDC not > 5 years

past IPO, the first full fiscal year-end post-IPO was used as the starting point for this analysis; see details by BDC on the following pages

(3)

BDC Peer Group includes dividend paying BDCs that have been publicly-traded for at least two years and have total assets greater than $500 million based on individual SEC Filings

as of December 31, 2022, with the exception of NEWT, which is excluded due to the non-traditional nature of their business plan and operations compared to most BDCs and their

change away from BDC election; see details by BDC on the following pages

(4) Comparison columns include all BDCs noted in footnote (3) excluding (a) MAIN and (b) a BDC that had a net decrease in net assets and which would significantly affect the Peer

Group comparisons; as an example, the Average would be 56.7% including the BDC with a net decrease in net assets; see details by BDC on the following page

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation