Energy Vault SPAC Presentation Deck

_

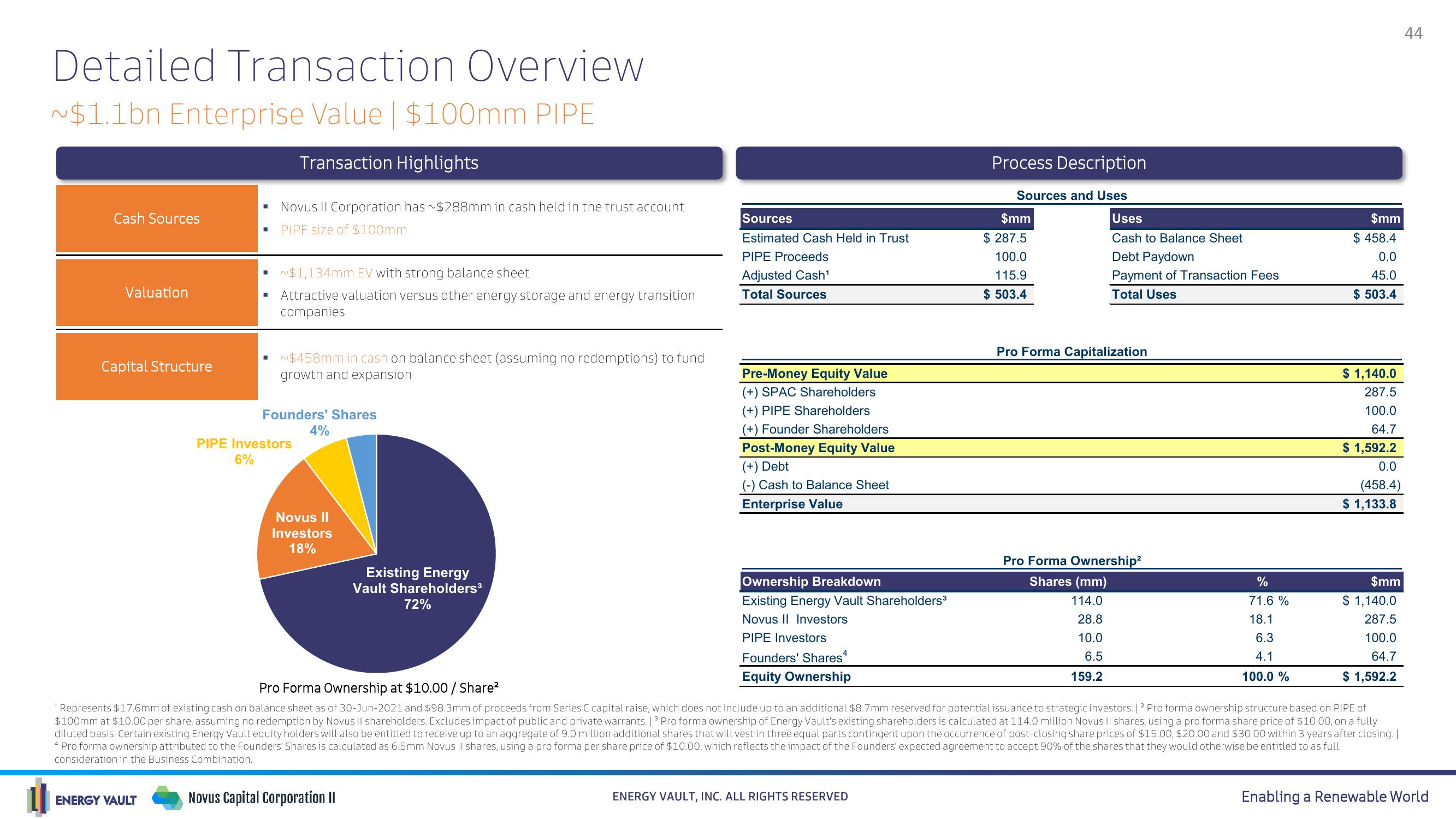

Detailed Transaction Overview

~$1.1bn Enterprise Value | $100mm PIPE

Transaction Highlights

Cash Sources

Valuation

Capital Structure

■

ENERGY VAULT

Novus II Corporation has ~$288mm in cash held in the trust account

PIPE size of $100mm

~$1,134mm EV with strong balance sheet

Attractive valuation versus other energy storage and energy transition

companies

~$458mm in cash on balance sheet (assuming no redemptions) to fund

growth and expansion

Founders' Shares

4%

PIPE Investors

6%

Novus II

Investors

18%

Existing Energy

Vault Shareholders³

72%

Novus Capital Corporation II

Sources

Estimated Cash Held in Trust

PIPE Proceeds

Adjusted Cash¹

Total Sources

Pre-Money Equity Value

(+) SPAC Shareholders

(+) PIPE Shareholders

(+) Founder Shareholders

Post-Money Equity Value

(+) Debt

(-) Cash to Balance Sheet

Enterprise Value

Ownership Breakdown

Existing Energy Vault Shareholders³

Novus II Investors

PIPE Investors

Founders' Shares

Equity Ownership

Process Description

ENERGY VAULT, INC. ALL RIGHTS RESERVED

Sources and Uses

$mm

$287.5

100.0

115.9

$ 503.4

Uses

Cash to Balance Sheet

Debt Paydown

Payment of Transaction Fees

Total Uses

Pro Forma Capitalization

Pro Forma Ownership²

Shares (mm)

114.0

28.8

10.0

6.5

159.2

%

71.6 %

18.1

6.3

4.1

100.0 %

$mm

$ 458.4

0.0

45.0

$ 503.4

$ 1,140.0

287.5

100.0

64.7

$ 1,592.2

Pro Forma Ownership at $10.00 / Share²

¹ Represents $17.6mm of existing cash on balance sheet as of 30-Jun-2021 and $98.3mm proceeds from Series C capital raise, which does not include up to an additional $8.7mm reserved for potential issuance to strategic investors. | 2 Pro forma ownership structure based on PIPE of

$100mm at $10.00 per share, assuming no redemption by Novus II shareholders. Excludes impact of public and private warrants. | ³ Pro forma ownership of Energy Vault's existing shareholders is calculated at 114.0 million Novus II shares, using a pro forma share price of $10.00, on a fully

diluted basis. Certain existing Energy Vault equity holders will also be entitled to receive up to an aggregate of 9.0 million additional shares that will vest in three equal parts contingent upon the occurrence of post-closing share prices of $15.00, $20.00 and $30.00 within 3 years after closing. |

4 Pro forma ownership attributed to the Founders' Shares is calculated as 6.5mm Novus II shares, using a pro forma per share price of $10.00, which reflects the impact of the Founders' expected agreement to accept 90% of the shares that they would otherwise be entitled to as full

consideration in the Business Combination.

0.0

(458.4)

$ 1,133.8

$mm

$ 1,140.0

287.5

100.0

64.7

$ 1,592.2

44

Enabling a Renewable WorldView entire presentation