J.P. Morgan 2016 Auto Conference

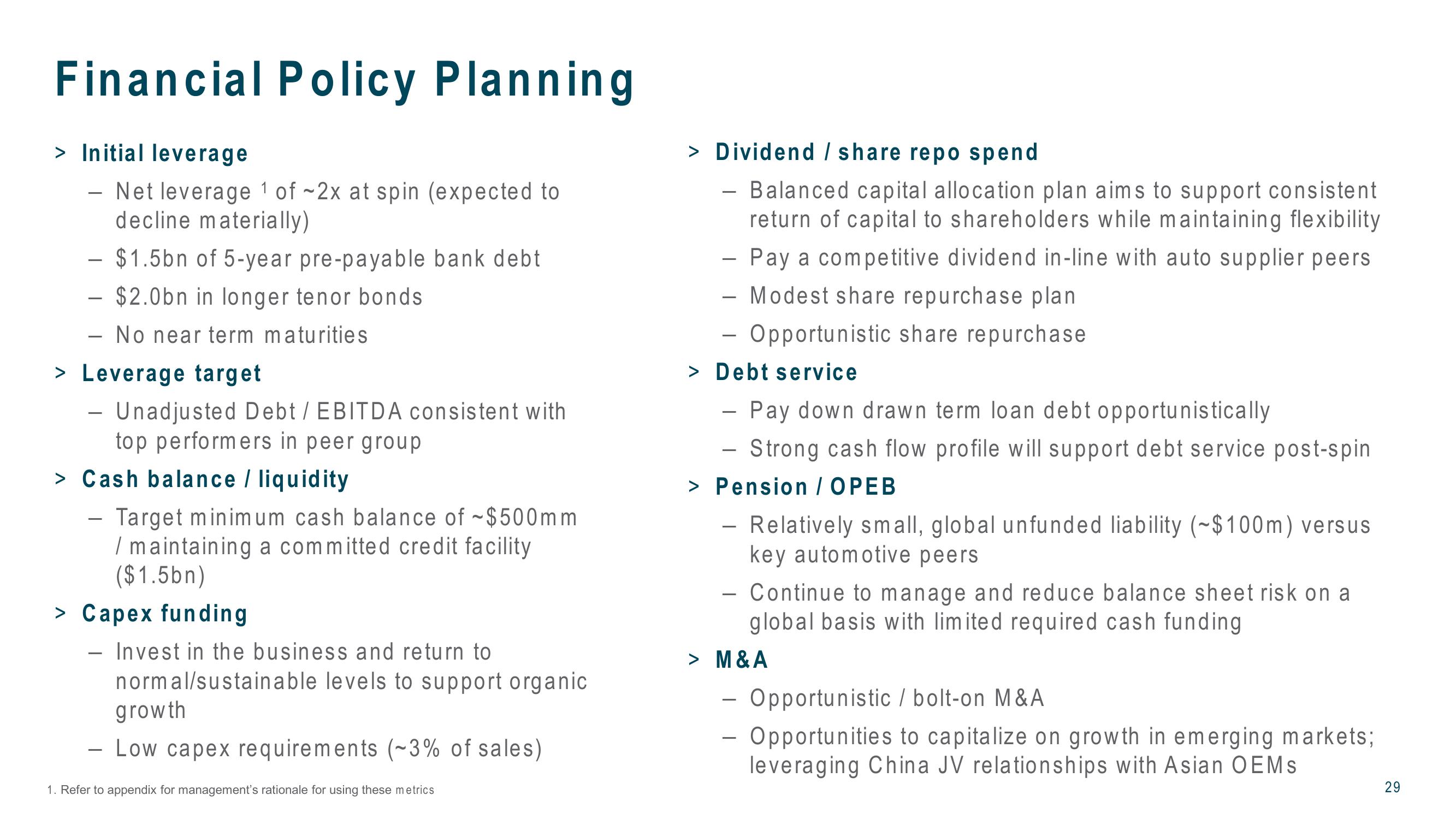

Financial Policy Planning

> Initial leverage

- Net leverage 1 of ~2x at spin (expected to

decline materially)

$1.5bn of 5-year pre-payable bank debt

- $2.0bn in longer tenor bonds

No near term maturities

> Leverage target

-

- Unadjusted Debt / EBITDA consistent with

top performers in peer group

> Cash balance / liquidity

-

Target minimum cash balance of ~$500mm

/ maintaining a committed credit facility

($1.5bn)

> Capex funding

- Invest in the business and return to

normal/sustainable levels to support organic

growth

Low capex requirements (~3% of sales)

1. Refer to appendix for management's rationale for using these metrics

> Dividend share repo spend

-

-

Balanced capital allocation plan aims to support consistent

return of capital to shareholders while maintaining flexibility

Pay a competitive dividend in-line with auto supplier peers

Modest share repurchase plan

Opportunistic share repurchase

> Debt service

-

Pay down drawn term loan debt opportunistically

Strong cash flow profile will support debt service post-spin

> Pension / OPEB

-

-

Relatively small, global unfunded liability (~$100m) versus

key automotive peers

Continue to manage and reduce balance sheet risk on a

global basis with limited required cash funding

> M&A

Opportunistic/bolt-on M&A

- Opportunities to capitalize on growth in emerging markets;

leveraging China JV relationships with Asian OEMS

29View entire presentation