Q2 Quarter 2023

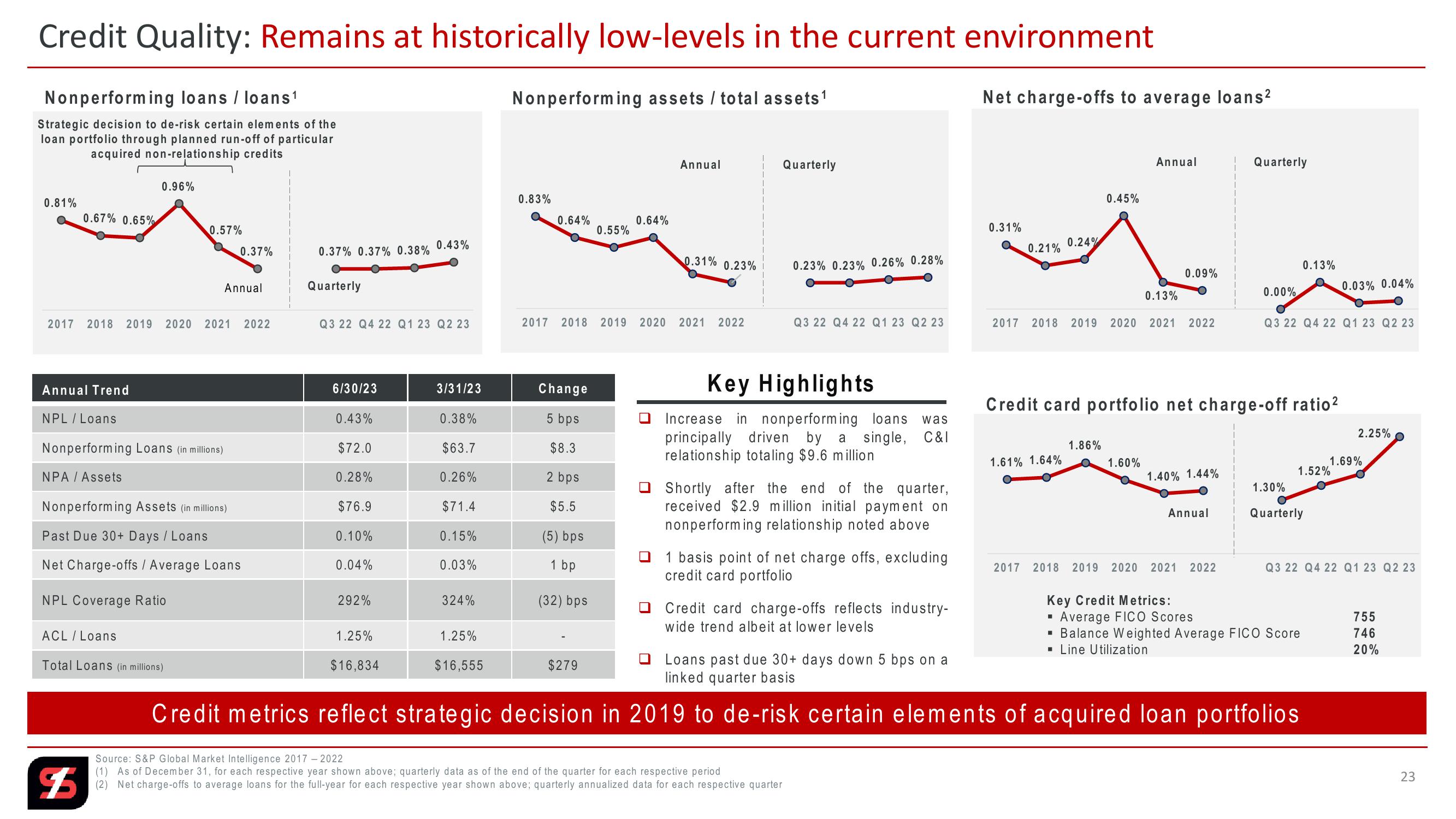

Credit Quality: Remains at historically low-levels in the current environment

Nonperforming loans / loans1

Strategic decision to de-risk certain elements of the

loan portfolio through planned run-off of particular

acquired non-relationship credits

Nonperforming assets/total assets¹

Net charge-offs to average loans²

Annual

Quarterly

Annual

Quarterly

0.96%

0.81%

0.67% 0.65%

0.57%

0.43%

0.37%

0.37% 0.37% 0.38%

Annual

Quarterly

0.83%

0.64%

0.64%

0.55%

0.45%

0.31%

0.24%

0.21%

0.31% 0.23%

0.23% 0.23% 0.26% 0.28%

0.13%

0.09%

0.03% 0.04%

0.13%

0.00%

2017 2018 2019 2020 2021 2022

Q3 22 Q4 22 Q1 23 Q2 23

2017

2018 2019 2020 2021 2022

Q3 22 Q4 22 Q1 23 Q2 23

2017 2018 2019 2020 2021 2022

Q3 22 Q4 22 Q1 23 Q2 23

Annual Trend

6/30/23

3/31/23

Change

NPL / Loans

0.43%

0.38%

5 bps

Nonperforming Loans (in millions)

$72.0

$63.7

$8.3

NPA / Assets

0.28%

0.26%

2 bps

Nonperforming Assets (in millions)

$76.9

$71.4

$5.5

Past Due 30+ Days / Loans

0.10%

0.15%

(5) bps

☐

Net Charge-offs / Average Loans

0.04%

0.03%

1 bp

NPL Coverage Ratio

292%

324%

(32) bps

ACL / Loans

Total Loans (in millions)

1.25%

$16,834

1.25%

$16,555

$279

Key Highlights

Increase in nonperforming loans was

principally driven by a single, C&I

relationship totaling $9.6 million

Shortly after the end of the quarter,

received $2.9 million initial payment on

nonperforming relationship noted above

1 basis point of net charge offs, excluding

credit card portfolio

Credit card charge-offs reflects industry-

wide trend albeit at lower levels

Loans past due 30+ days down 5 bps on a

linked quarter basis

Credit card portfolio net charge-off ratio²

2.25%

1.86%

1.61% 1.64%

1.60%

1.69%

1.40% 1.44%

1.52%

1.30%

Annual

Quarterly

2017 2018 2019 2020 2021 2022

Q3 22 Q4 22 Q1 23 Q2 23

Key Credit Metrics:

Average FICO Scores

■ Balance Weighted Average FICO Score

■ Line Utilization

Credit metrics reflect strategic decision in 2019 to de-risk certain elements of acquired loan portfolios

Source: S&P Global Market Intelligence 2017-2022

(1) As of December 31, for each respective year shown above; quarterly data as of the end of the quarter for each respective period

$5

(2) Net charge-offs to average loans for the full-year for each respective year shown above; quarterly annualized data for each respective quarter

755

746

20%

23View entire presentation