Engine No. 1 Activist Presentation Deck

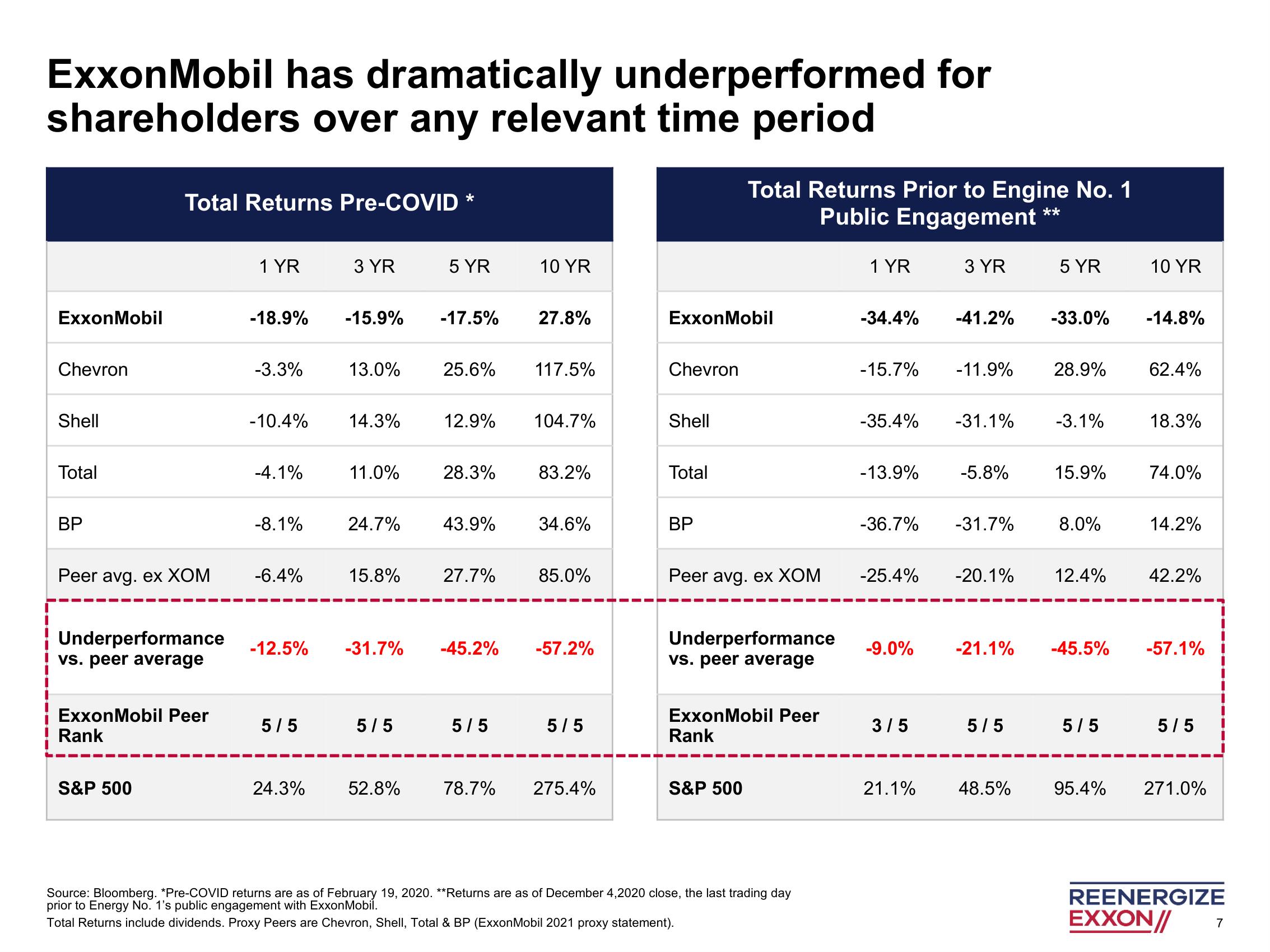

ExxonMobil has dramatically underperformed for

shareholders over any relevant time period

ExxonMobil

Chevron

Shell

Total

BP

Total Returns Pre-COVID*

Peer avg. ex XOM

Underperformance

vs. peer average

ExxonMobil Peer

Rank

S&P 500

1 YR

-18.9%

-3.3%

-10.4%

-4.1%

-8.1%

-6.4%

-12.5%

5/5

24.3%

3 YR

-15.9%

13.0%

14.3%

11.0%

24.7%

15.8%

5/5

5 YR

52.8%

-17.5%

25.6%

12.9%

28.3%

43.9%

27.7%

5/5

10 YR

78.7%

27.8%

117.5%

104.7%

-31.7% -45.2% -57.2%

83.2%

34.6%

85.0%

5/5

275.4%

ExxonMobil

Chevron

Shell

Total

BP

Total Returns Prior to Engine No. 1

Public Engagement

**

Peer avg. ex XOM

Underperformance

vs. peer average

ExxonMobil Peer

Rank

S&P 500

Source: Bloomberg. *Pre-COVID returns are as of February 19, 2020. **Returns are as of December 4,2020 close, the last trading day

prior to Energy No. 1's public engagement with ExxonMobil.

Total Returns include dividends. Proxy Peers are Chevron, Shell, Total & BP (ExxonMobil 2021 proxy statement).

1 YR

-34.4%

-15.7%

-35.4%

-13.9%

-36.7%

-25.4%

-9.0%

3/5

21.1%

3 YR

-41.2% -33.0%

-11.9% 28.9%

-31.1%

-5.8%

-31.7%

-20.1%

5 YR

5/5

48.5%

-3.1%

15.9%

8.0%

12.4%

5/5

10 YR

95.4%

-14.8%

62.4%

18.3%

-21.1% -45.5% -57.1%

74.0%

14.2%

42.2%

5/5

271.0%

REENERGIZE

EXXON//

7View entire presentation