Missfresh IPO Presentation Deck

Ge

优鲜

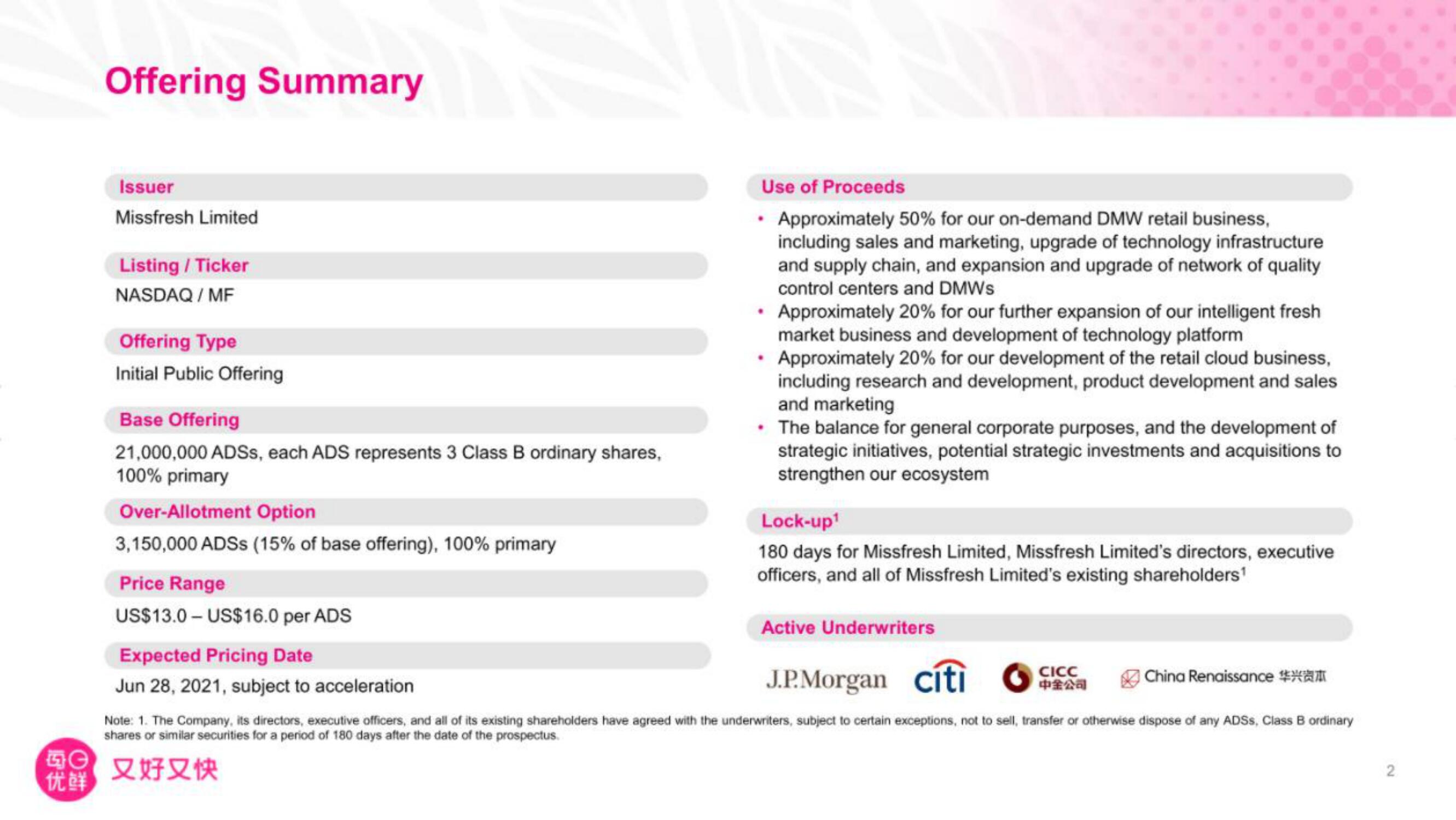

Offering Summary

Issuer

Missfresh Limited

Listing / Ticker

NASDAQ / MF

Offering Type

Initial Public Offering

Base Offering

21,000,000 ADSs, each ADS represents 3 Class B ordinary shares,

100% primary

Over-Allotment Option

3,150,000 ADSS (15% of base offering), 100% primary

Price Range

US$13.0 - US$16.0 per ADS

Expected Pricing Date

Jun 28, 2021, subject to acceleration

Use of Proceeds

• Approximately 50% for our on-demand DMW retail business,

including sales and marketing, upgrade of technology infrastructure

and supply chain, and expansion and upgrade of network of quality

control centers and DMWs

• Approximately 20% for our further expansion of our intelligent fresh

market business and development of technology platform

• Approximately 20% for our development of the retail cloud business,

including research and development, product development and sales

and marketing

• The balance for general corporate purposes, and the development of

strategic initiatives, potential strategic investments and acquisitions to

strengthen our ecosystem

Lock-up¹

180 days for Missfresh Limited, Missfresh Limited's directors, executive

officers, and all of Missfresh Limited's existing shareholders¹

Active Underwriters

J.P. Morgan

citi

Note: 1. The Company, its directors, executive officers, and all of its existing shareholders have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or otherwise dispose of any ADSS, Class B ordinary

shares or similar securities for a period of 180 days after the date of the prospectus.

又好又快

CICC

中金公司

| China Renaissance 华兴资本

2View entire presentation