Commercial Metals Company Investor Presentation Deck

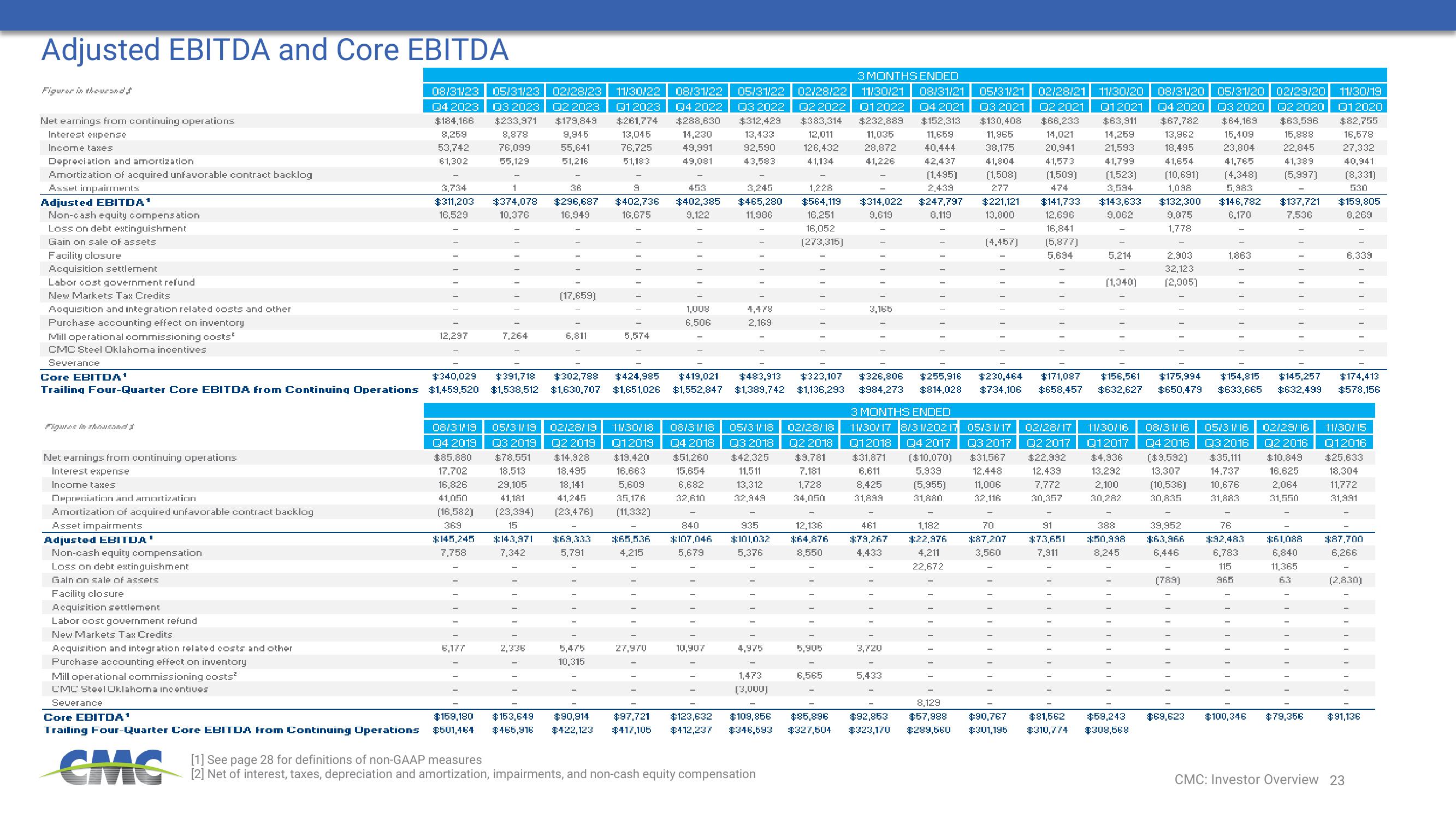

Adjusted EBITDA and Core EBITDA

Figures in thousand &

Net earnings from continuing operations

Interest expense

Income taxes

Depreciation and amortization

Amortization of acquired unfavorable contract backlog

Asset impairments

Adjusted EBITDA¹

Non-cash equity compensation

Loss on debt extinguishment

Gain on sale of assets

Facility closure

Acquisition settlement

Labor cost government refund

New Markets Tax Credits

Acquisition and integration related costs and other

Purchase accounting effect on inventory

Mill operational commissioning costs

CMC Steel Oklahoma incentives

Severance

Fligures in thousand J

Net earnings from continuing operations

Interest expense

Income taxes

Depreciation and amortization

Amortization of acquired unfavorable contract backlog

Asset impairments

Adjusted EBITDA ¹

Non-cash equity compensation

Core EBITDA¹

Trailing Four-Quarter Core EBITDA from Continuing Operations $1,459,520

Loss on debt extinguishment

Gain on sale of assets

Facility closure

Acquisition settlement

Labor cost government refund

New Markets Tax Credits

08/31/23 05/31/23 02/28/23

Q2 2023

$179,849

9,945

55,641

51,216

Acquisition and integration related costs and other

Purchase accounting effect on inventory

Mill operational commissioning costs²

CMC Steel Oklahoma incentives

Severance

Q4 2023

$184,166

8,259

53,742

61,302

3,734

$311,203

16,529

|

12,297

Q3 2023

$233,971

8,878

76,099

55,129

$145,245

7,758

1

$374,078

10.376

6,177

7,264

36

$296,687

16,949

||||II

(17,659)

2,336

6,811

$340,029 $391,718 $302,788 $424,985 $419,021

$1,538,512 $1,630,707 $1,651,026 $1,552,847

11/30/22

Q12023

$261,774

13,045

76,725

51,183

9

$402,736

16,675

TITIN

5,574

08/31/19 05/31/19

Q4 2019

$85,880

Q3 2019

$78,551

18.513

17,702

16,826

29,105

41,050

(16,582)

369

41,181

(23,394)

15

840

$143,971 $69,333 $65,536 $107,046

7,342

4,215

5,791

5,679

5,475

10,315

08/31/22 05/31/22 02/28/22

Q4 2022 Q3 2022 Q2 2022

$288,630 $312,429 $383,314

14,230

13,433

12,011

49,991

92,590 126,432

49,081 43,583

41,134

453

$402,385

9.122

02/28/19

Q2 2019

$14.928

11/30/18 08/31/18

Q12019 Q4 2018

$19.420 $51,260

15,654

18,495

16,663

18,141

5,609

6,682

41,245

32,610

35,176

(23,476) (11,332)

1,008

6,506

27,970

TIT

10,907

Core EBITDA¹

$159,180 $153,649

$90,914

$97,721 $123,632

Trailing Four-Quarter Core EBITDA from Continuing Operations $501,464 $465,916 $422,123 $417,105 $412,237

3,245

$465,280

11,986

4,478

2,169

05/31/18 02/28/18

Q3 2018 Q2 2018

$42.325 $9,781

11,511

7.181

1,728

13.312

32,949

34,050

935

$101,032

5,376

TIT

4,975

$483,913 $323,107 $326,806 $255,916 $230,464

$1,389,742 $1,136,293 $984.273 $814,028 $734,106

1,473

(3,000)

1,228

$564,119 $314,022

16,251

9,619

16,052

(273,315)

[1] See page 28 for definitions of non-GAAP measures

[2] Net of interest, taxes, depreciation and amortization, impairments, and non-cash equity compensation

3 MONTHS ENDED

11/30/21 08/31/21 05/31/21

Q12022 Q4 2021 Q3 2021

$232,889 $152,313 $130,408

11,035

11,659

11,965

28,872

40.444 38,175

41,226

42,437

41,804

(1,495) (1,508)

2,439

277

$247,797 $221,121

8,119

13,800

5,905

3,165

6,565

12,136

461

$64,876 $79,267

8,550

4,433

3 MONTHS ENDED

11/30/17 8/31/20217 05/31/17

Q12018 Q4 2017 Q3 2017

$31,871 ($10,070) $31,567

6,611

5,939

12.448

8.425

(5.955) 11,006

31,899

31,880

32,116

III

3,720

III||

5,433

(4,457)

III

1,182

70

$22,976 $87,207

4,211

3,560

22,672

|||||II

02/28/21

Q2 2021 Q12021

$66,233 $63,911

14,021

14,259

20,941

21.593

41,573

41,799

(1,509) (1,523)

474

3,594

$141,733 $143,633

12,696

9,062

16,841

(5,877)

5,694

11/30/20 08/31/20 05/31/20 02/29/20 11/30/19

Q4 2020 Q3 2020 Q2 2020 Q12020

$67,782 $64,169 $63,596 $82,755

13,962

15,409

15,888 16,578

18,495

23,804

22.845 27.332

41,654 41,765

41,389

(10,691) (4,348) (5,997)

1,098

5,983

$132,300 $146,782 $137,721

9,875

6.170

7.536

1,778

40,941

(8,331)

530

$159,805

8,269

91

$73,651

7,911

5.214

||||||

(1,348)

02/28/17 11/30/16 08/31/16 05/31/16

Q2 2017 Q12017 Q4 2016 Q3 2016

$22.992 $4.936 ($9.592) $35.111

12.439

13,292

13.307 14,737

7.772

2,100 (10,536) 10,676

30,357 30,282 30,835 31,883

2.903

32,123

(2,985)

388

$50,998

8,245

8,129

$109,856 $85,896 $92,853 $57,988 $90,767 $81,562 $59,243

$346,593 $327,504 $323,170 $289,560 $301,195 $310,774 $308,568

$171,087 $156,561 $175,994 $154,815 $145,257 $174,413

$658,457 $632,627 $650,479 $633.665 $632,499 $578,156

1,863

(789)

IIIIIIII

$69,623

39,952

76

$63,966 $92,483 $61,088

6,446

6,783

6,840

115

11,365

965

63

IIIIII

|||||

Q2 2016

$10,849

16,625

2,064

31,550

02/29/16 11/30/15

Q12016

$25,633

18.304

11.772

31,991

|||||

6.339

$100,346 $79,356

|||||||

$87,700

6,266

(2,830)

IIIIIII

CMC: Investor Overview 23

$91,136View entire presentation