Selina SPAC

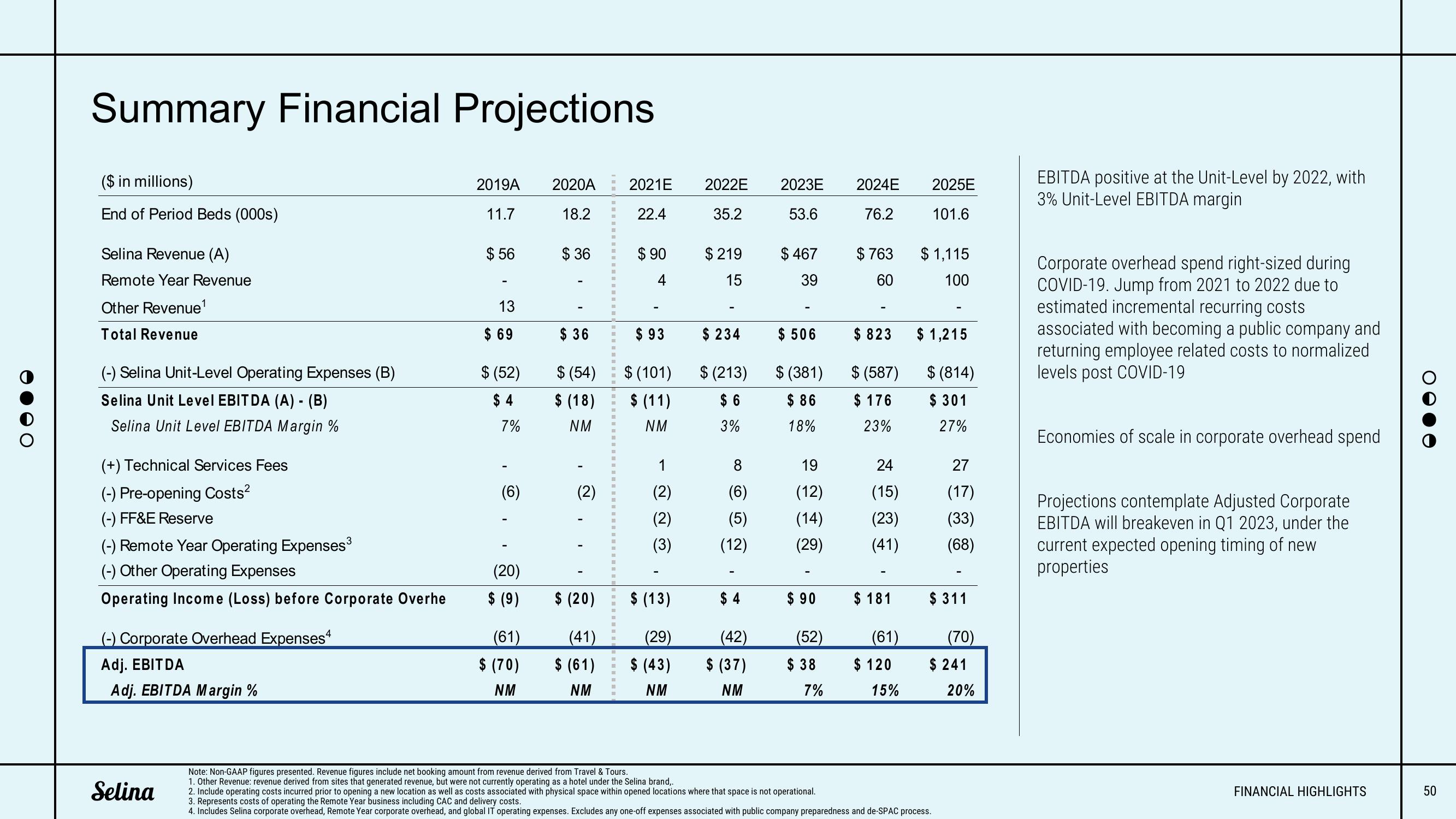

Summary Financial Projections

($ in millions)

End of Period Beds (000s)

Selina Revenue (A)

Remote Year Revenue

Other Revenue¹

Total Revenue

(-) Selina Unit-Level Operating Expenses (B)

Selina Unit Level EBITDA (A) - (B)

Selina Unit Level EBITDA Margin %

(+) Technical Services Fees

(-) Pre-opening Costs²

(-) FF&E Reserve

(-) Remote Year Operating Expenses³

(-) Other Operating Expenses

Operating Income (Loss) before Corporate Overhe

(-) Corporate Overhead Expenses

Adj. EBITDA

Adj. EBITDA Margin %

Selina

2019A

11.7

$ 56

13

$ 69

$ (52)

$4

7%

(6)

"

(20)

$ (9)

(61)

$ (70)

NM

2020A

18.2

$36

$36

$ (54)

$(18)

NM

(2)

$ (20)

(41)

$ (61)

NM

■

2021E

22.4

$90

4

$93

$ (101)

$ (11)

NM

1

(2)

(2)

(3)

$ (13)

(29)

$ (43)

NM

2022E 2023E 2024E 2025E

53.6 76.2 101.6

35.2

$219

15

$ 234

$ (213)

$6

3%

8

(6)

(5)

(12)

$4

(42)

$ (37)

NM

$467

39

$ 506

$ (381)

$86

18%

19

(12)

(14)

(29)

$90

(52)

$ 38

7%

$763

60

$823

$ (587)

$ 176

23%

24

(15)

(23)

(41)

$ 181

(61)

$120

15%

$1,115

100

$ 1,215

$ (814)

$ 301

27%

27

(17)

(33)

(68)

$ 311

Note: Non-GAAP figures presented. Revenue figures include net booking amount from revenue derived from Travel & Tours.

1. Other Revenue: revenue derived from sites that generated revenue, but were not currently operating as a hotel under the Selina brand,.

2. Include operating costs incurred prior to opening a new location as well as costs associated with physical space within opened locations where that space is not operational.

3. Represents costs of operating the Remote Year business including CAC and delivery costs.

4. Includes Selina corporate overhead, Remote Year corporate overhead, and global IT operating expenses. Excludes any one-off expenses associated with public company preparedness and de-SPAC process.

(70)

$ 241

20%

EBITDA positive at the Unit-Level by 2022, with

3% Unit-Level EBITDA margin

Corporate overhead spend right-sized during

COVID-19. Jump from 2021 to 2022 due to

estimated incremental recurring costs

associated with becoming a public company and

returning employee related costs to normalized

levels post COVID-19

Economies of scale in corporate overhead spend

Projections contemplate Adjusted Corporate

EBITDA will breakeven in Q1 2023, under the

current expected opening timing of new

properties

FINANCIAL HIGHLIGHTS

50View entire presentation