Bridge Investment Group Results Presentation Deck

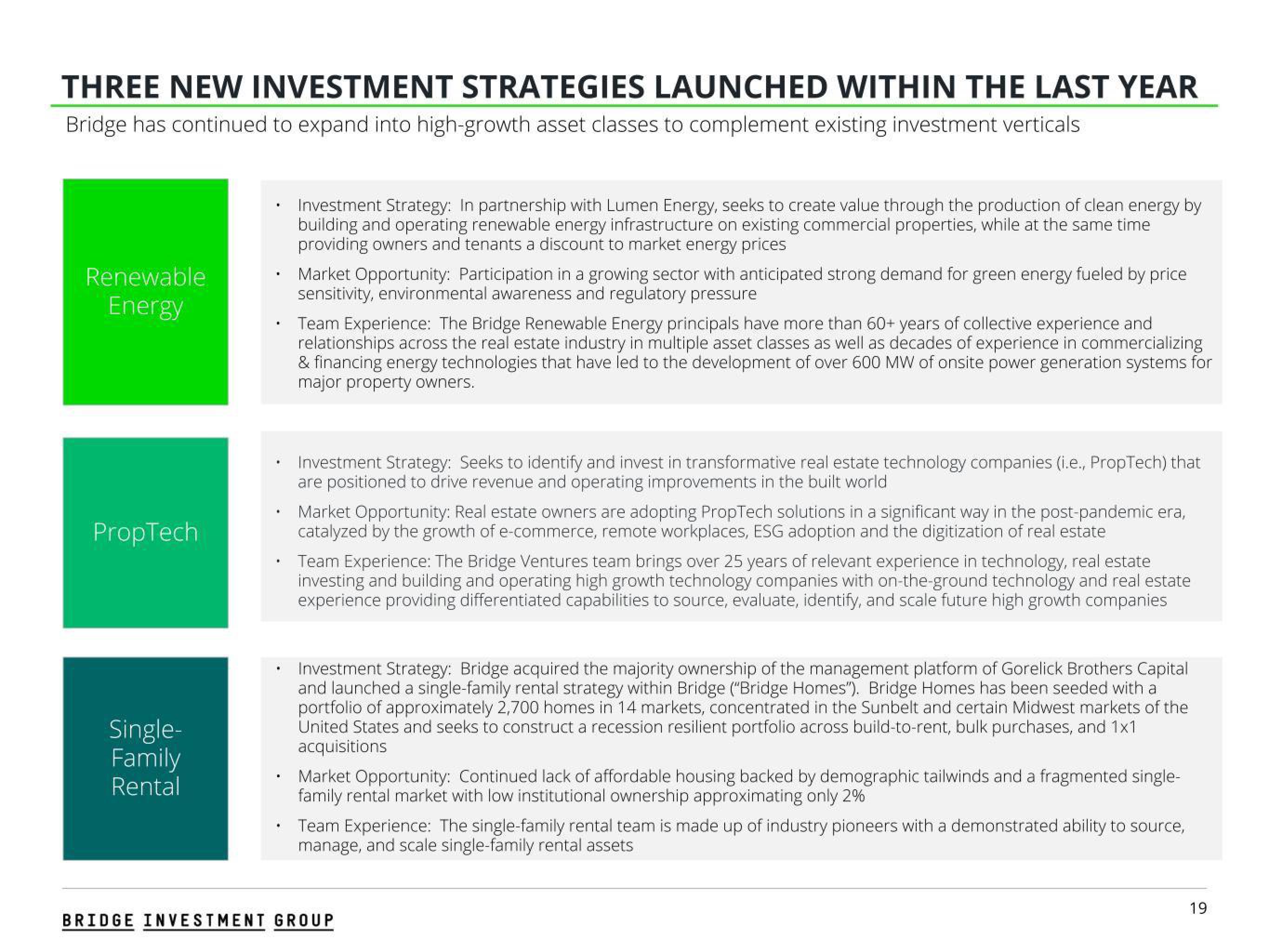

THREE NEW INVESTMENT STRATEGIES LAUNCHED WITHIN THE LAST YEAR

Bridge has continued to expand into high-growth asset classes to complement existing investment verticals

Renewable

Energy

PropTech

Single-

Family

Rental

Investment Strategy: In partnership with Lumen Energy, seeks to create value through the production of clean energy by

building and operating renewable energy infrastructure on existing commercial properties, while at the same time

providing owners and tenants a discount to market energy prices

Market Opportunity: Participation in a growing sector with anticipated strong demand for green energy fueled by price

sensitivity, environmental awareness and regulatory pressure

Team Experience: The Bridge Renewable Energy principals have more than 60+ years of collective experience and

relationships across the real estate industry in multiple asset classes as well as decades of experience in commercializing

& financing energy technologies that have led to the development of over 600 MW of onsite power generation systems for

major property owners.

Investment Strategy: Seeks to identify and invest in transformative real estate technology companies (i.e., PropTech) that

are positioned to drive revenue and operating improvements in the built world

Market Opportunity: Real estate owners are adopting PropTech solutions in a significant way in the post-pandemic era,

catalyzed by the growth of e-commerce, remote workplaces, ESG adoption and the digitization of real estate

Team Experience: The Bridge Ventures team brings over 25 years of relevant experience in technology, real estate

investing and building and operating high growth technology companies with on-the-ground technology and real estate

experience providing differentiated capabilities to source, evaluate, identify, and scale future high growth companies

Investment Strategy: Bridge acquired the majority ownership of the management platform of Gorelick Brothers Capital

and launched a single-family rental strategy within Bridge ("Bridge Homes"). Bridge Homes has been seeded with a

portfolio of approximately 2,700 homes in 14 markets, concentrated in the Sunbelt and certain Midwest markets of the

United States and seeks to construct a recession resilient portfolio across build-to-rent, bulk purchases, and 1x1

acquisitions

Market Opportunity: Continued lack of affordable housing backed by demographic tailwinds and a fragmented single-

family rental market with low institutional ownership approximating only 2%

Team Experience: The single-family rental team is made up of industry pioneers with a demonstrated ability to source,

manage, and scale single-family rental assets

BRIDGE INVESTMENT GROUP

19View entire presentation