Q4 2020 Investor Presentation

Revenue

$

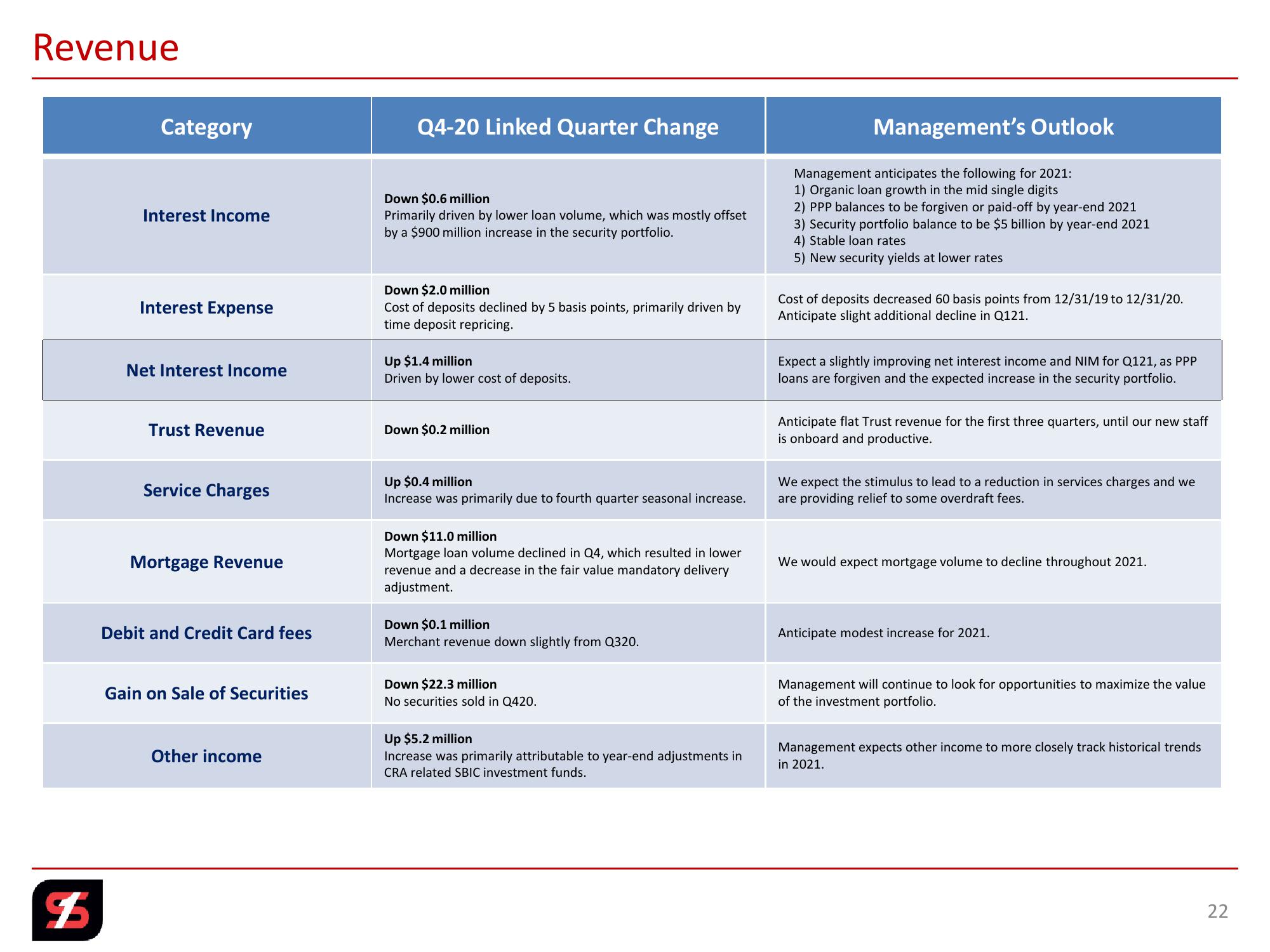

Category

Interest Income

Interest Expense

Net Interest Income

Trust Revenue

Service Charges

Mortgage Revenue

Debit and Credit Card fees

Gain on Sale of Securities

Other income

Q4-20 Linked Quarter Change

Down $0.6 million

Primarily driven by lower loan volume, which was mostly offset

by a $900 million increase in the security portfolio.

Down $2.0 million

Cost of deposits declined by 5 basis points, primarily driven by

time deposit repricing.

Up $1.4 million

Driven by lower cost of deposits.

Down $0.2 million

Up $0.4 million

Increase was primarily due to fourth quarter seasonal increase.

Down $11.0 million

Mortgage loan volume declined in Q4, which resulted in lower

revenue and a decrease in the fair value mandatory delivery

adjustment.

Down $0.1 million

Merchant revenue down slightly from Q320.

Down $22.3 million

No securities sold in Q420.

Up $5.2 million

Increase was primarily attributable to year-end adjustments in

CRA related SBIC investment funds.

Management's Outlook

Management anticipates the following for 2021:

1) Organic loan growth in the mid single digits

2) PPP balances to be forgiven or paid-off by year-end 2021

3) Security portfolio balance to be $5 billion by year-end 2021

4) Stable loan rates

5) New security yields at lower rates

Cost of deposits decreased 60 basis points from 12/31/19 to 12/31/20.

Anticipate slight additional decline in Q121.

Expect a slightly improving net interest income and NIM for Q121, as PPP

loans are forgiven and the expected increase in the security portfolio.

Anticipate flat Trust revenue for the first three quarters, until our new staff

is onboard and productive.

We expect the stimulus to lead to a reduction in services charges and we

are providing relief to some overdraft fees.

We would expect mortgage volume to decline throughout 2021.

Anticipate modest increase for 2021.

Management will continue to look for opportunities to maximize the value

of the investment portfolio.

Management expects other income to more closely track historical trends

in 2021.

22View entire presentation