J.P.Morgan Software Investment Banking

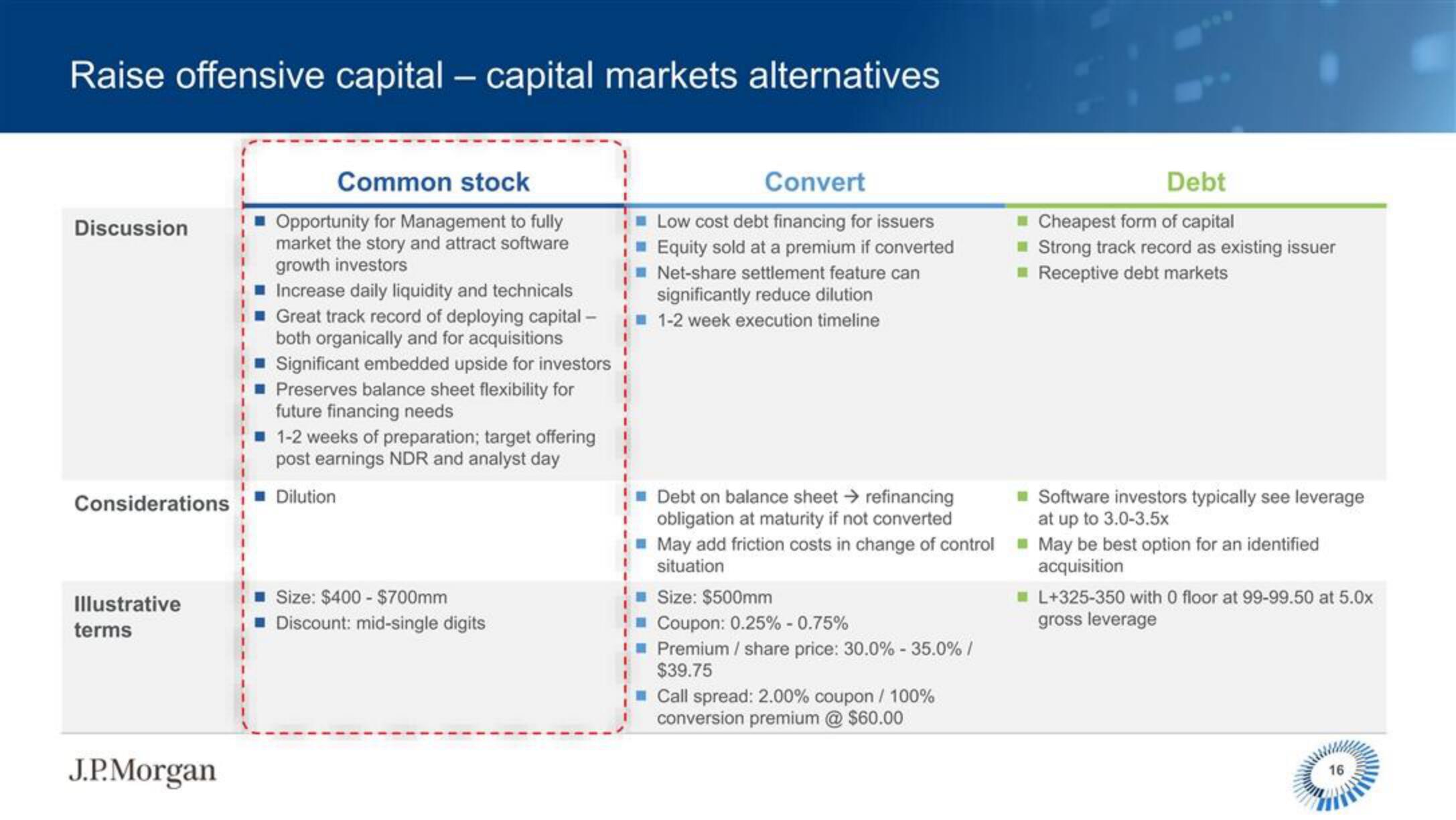

Raise offensive capital - capital markets alternatives

Discussion

Considerations

Illustrative

terms

J.P.Morgan

Common stock

Opportunity for Management to fully

market the story and attract software

growth investors

Increase daily liquidity and technicals

Great track record of deploying capital -

both organically and for acquisitions

■ Significant embedded upside for investors

Preserves balance sheet flexibility for

future financing needs

1-2 weeks of preparation; target offering

post earnings NDR and analyst day

Dilution

Size: $400-$700mm

Discount: mid-single digits

Convert

Low cost debt financing for issuers

Equity sold at a premium if converted

Net-share settlement feature can

significantly reduce dilution

1-2 week execution timeline

Debt on balance sheet → refinancing

obligation at maturity if not converted

May add friction costs in change of control

situation

Size: $500mm

Coupon: 0.25% - 0.75%

Premium/share price: 30.0% - 35.0% /

$39.75

Call spread: 2.00% coupon / 100%

conversion premium @ $60.00

Debt

Cheapest form of capital

Strong track record as existing issuer

■ Receptive debt markets

Software investors typically see leverage

at up to 3.0-3.5x

May be best option for an identified

acquisition

L+325-350 with O floor at 99-99.50 at 5.0x

gross leverage

16View entire presentation