Melrose Results Presentation Deck

Sustainability: overview

Driving sustainable improvements in our businesses' financial, operational and environmental performance is at the heart of the Melrose

"Buy, Improve, Sell" model

Melrose

I

I

I

■

Buy

Improve

Sell

All of our businesses have a major opportunity and responsibility to decarbonise their industries - we are playing an exciting and

important role in addressing climate change

We deliver environmental improvements through setting Group sustainability targets and allocating capital accordingly

Environmental targets are set for all our businesses aligned with their sectors - these extend beyond our ownership and management

teams are accountable for their delivery

Melrose is actively engaging with key stakeholders, including ESG rating agencies our investors rely on

Inaugural standalone Melrose Sustainability Report will be published in April, which includes detailed plans and progress, plus case

studies, TCFD disclosures and further information on our activities

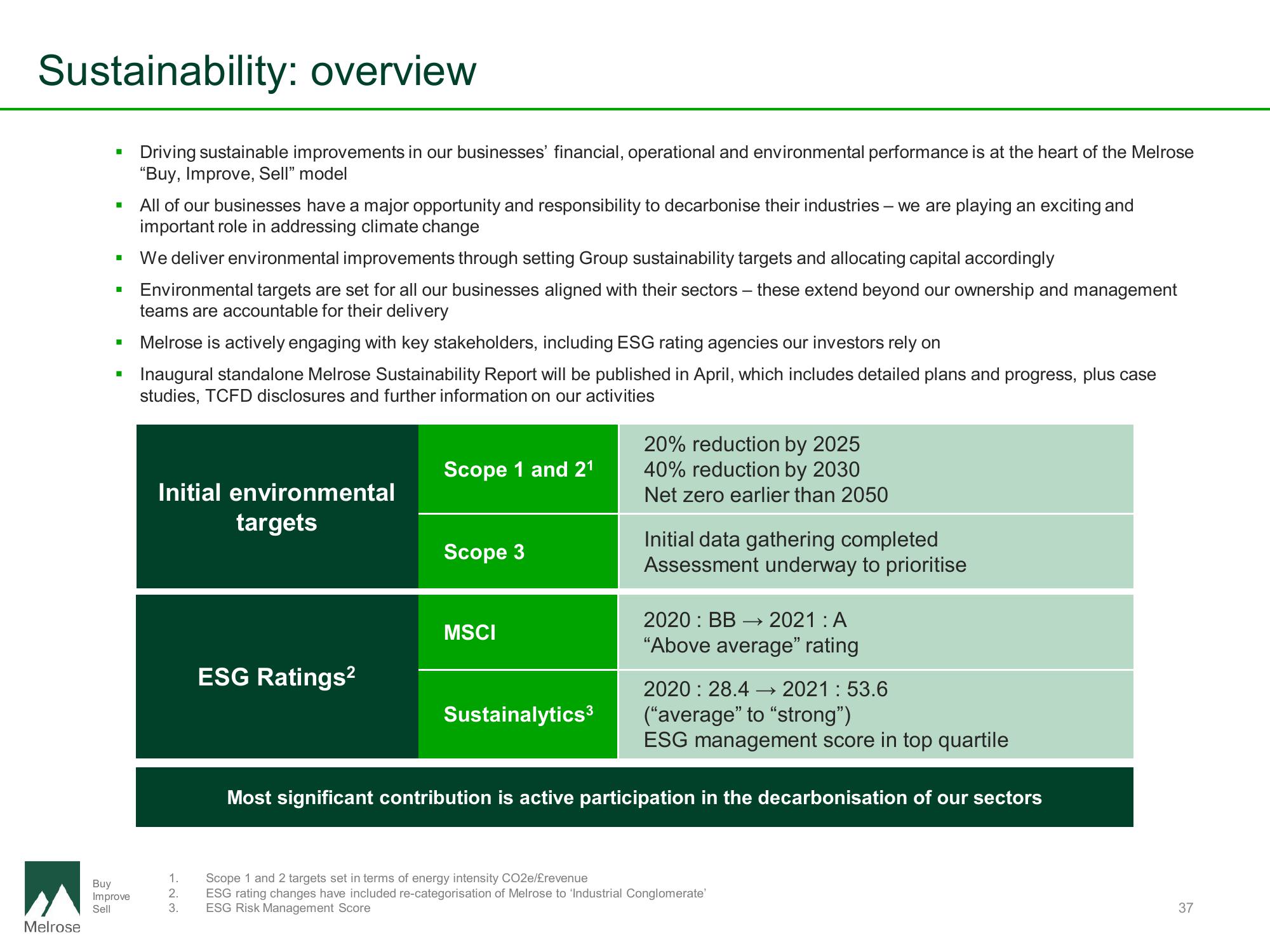

Initial environmental

targets

1.

2.

3.

ESG Ratings²

Scope 1 and 2¹

Scope 3

MSCI

Sustainalytics³

20% reduction by 2025

40% reduction by 2030

Net zero earlier than 2050

Initial data gathering completed

Assessment underway to prioritise

2020 BB 2021 : A

"Above average" rating

2020 28.4 → 2021 : 53.6

("average" to "strong")

ESG management score in top quartile

Most significant contribution is active participation in the decarbonisation of our sectors

Scope 1 and 2 targets set in terms of energy intensity CO2e/£revenue

ESG rating changes have included re-categorisation of Melrose to 'Industrial Conglomerate'

ESG Risk Management Score

37View entire presentation