SmileDirectClub Results Presentation Deck

Q1 2020 results.

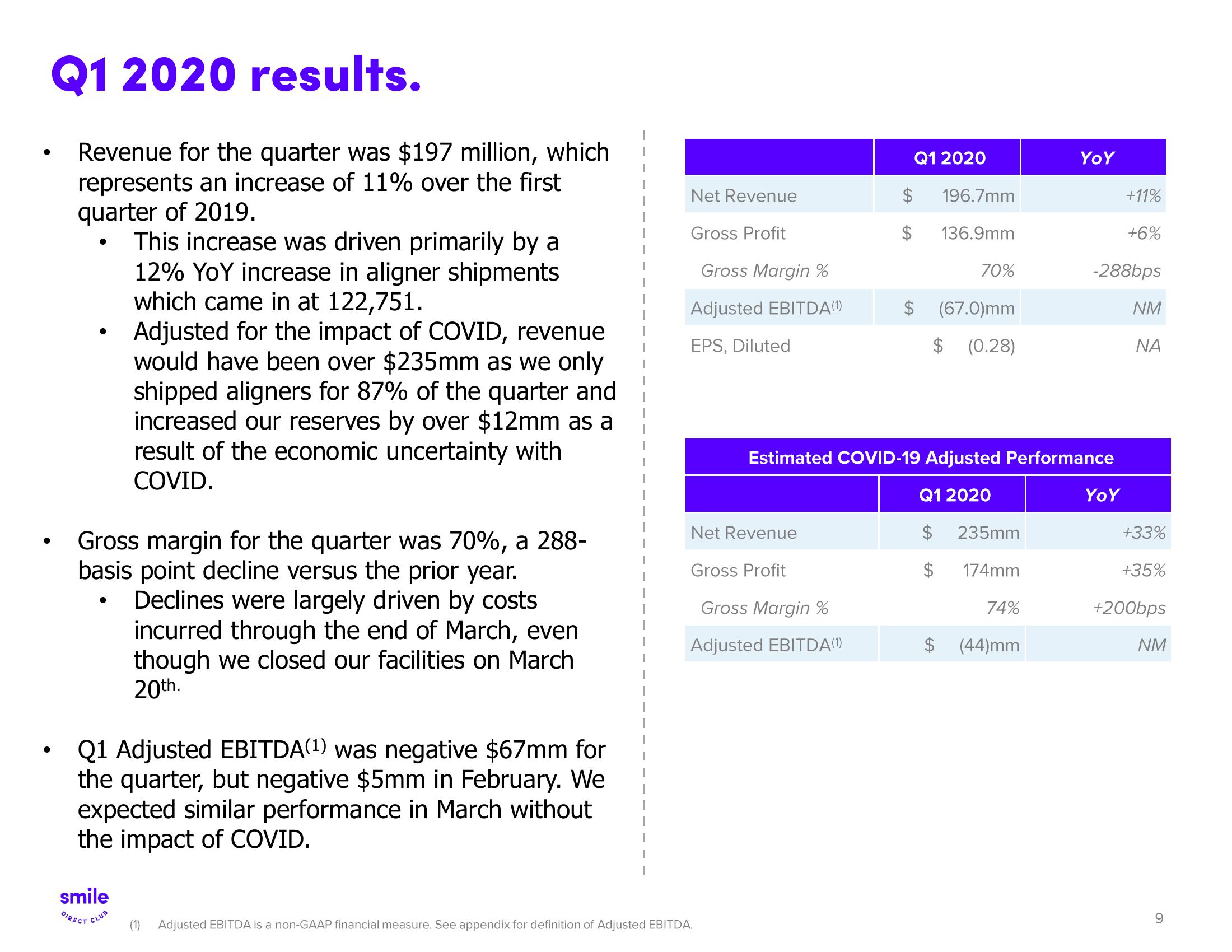

Revenue for the quarter was $197 million, which

represents an increase of 11% over the first

quarter of 2019.

●

●

●

This increase was driven primarily by a

12% YoY increase in aligner shipments

which came in at 122,751.

Adjusted for the impact of COVID, revenue

would have been over $235mm as we only

shipped aligners for 87% of the quarter and

increased our reserves by over $12mm as a

result of the economic uncertainty with

COVID.

Gross margin for the quarter was 70%, a 288-

basis point decline versus the prior year.

Declines were largely driven by costs

incurred through the end of March, even

though we closed our facilities on March.

20th.

smile

DIRECT CLUB

Q1 Adjusted EBITDA(¹) was negative $67mm for

the quarter, but negative $5mm in February. We

expected similar performance in March without

the impact of COVID.

I

Net Revenue

Gross Profit

Gross Margin %

Adjusted EBITDA (1)

EPS, Diluted

Net Revenue

Gross Profit

Gross Margin %

Adjusted EBITDA(1)

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA.

Q1 2020

$

$

196.7mm

136.9mm

70%

(67.0)mm

$ (0.28)

GA

Estimated COVID-19 Adjusted Performance

Q1 2020

$

$

YOY

235mm

174mm

74%

(44)mm

-288bps

+11%

+6%

YOY

NM

ΝΑ

+33%

+35%

+200bps

NM

9View entire presentation