Baird Investment Banking Pitch Book

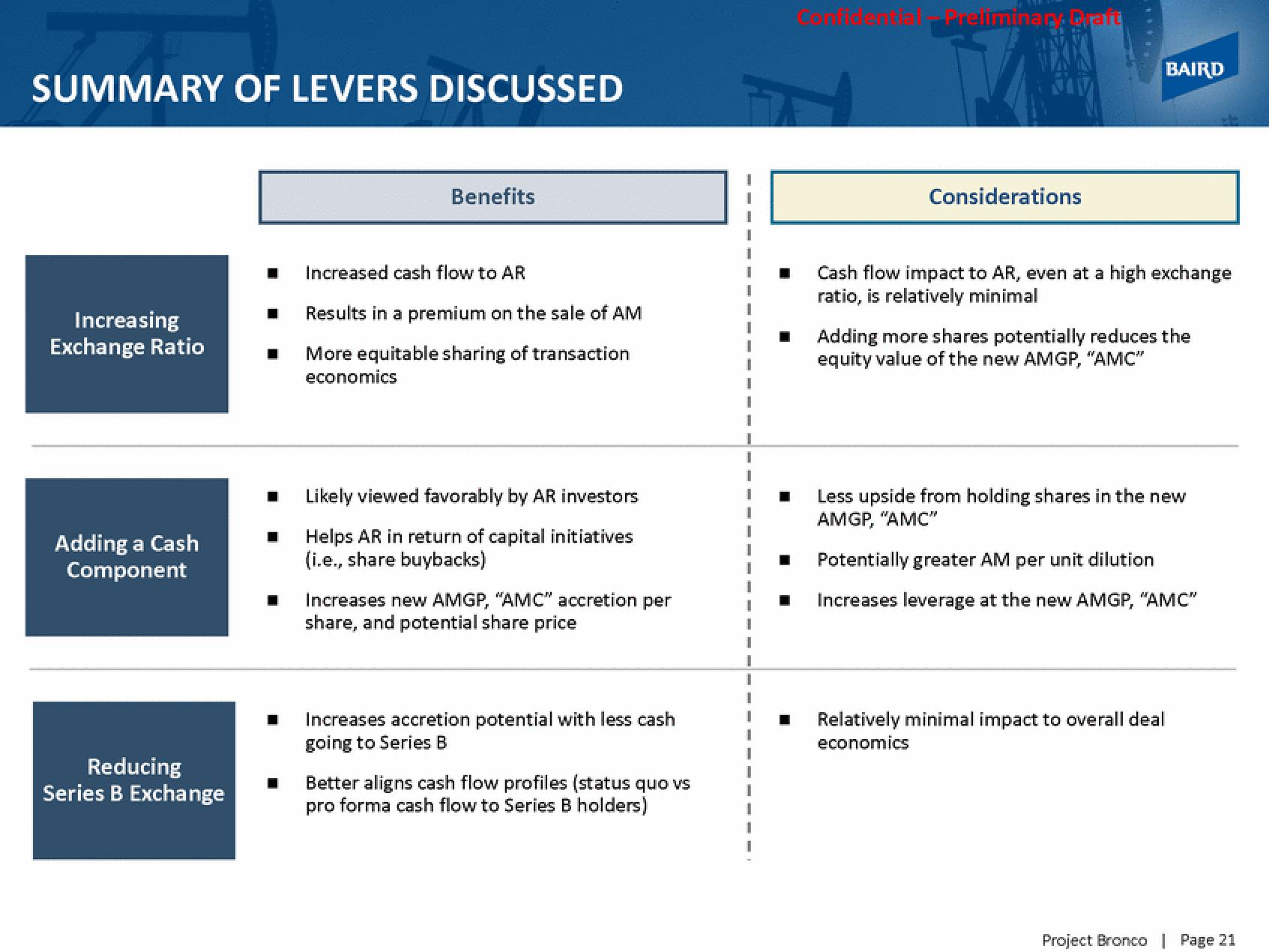

SUMMARY OF LEVERS DISCUSSED

Increasing

Exchange Ratio

Adding a Cash

Component

Reducing

Series B Exchange

Benefits

■ Increased cash flow to AR

Results in a premium on the sale of AM

More equitable sharing of transaction

economics

■ Likely viewed favorably by AR investors

Helps AR in return of capital initiatives

(i.e., share buybacks)

■ Increases new AMGP, "AMC" accretion per

share, and potential share price

Increases accretion potential with less cash

going to Series B

Better aligns cash flow profiles (status quo vs

pro forma cash flow to Series B holders)

■

Preliminar. Draft

Considerations

BAIRD

Cash flow impact to AR, even at a high exchange

ratio, is relatively minimal

Adding more shares potentially reduces the

equity value of the new AMGP, "AMC"

Less upside from holding shares in the new

AMGP, "AMC"

I Potentially greater AM per unit dilution

Increases leverage at the new AMGP, "AMC"

Relatively minimal impact to overall deal

economics

Project Bronco | Page 21View entire presentation