Fastly Investor Day Presentation Deck

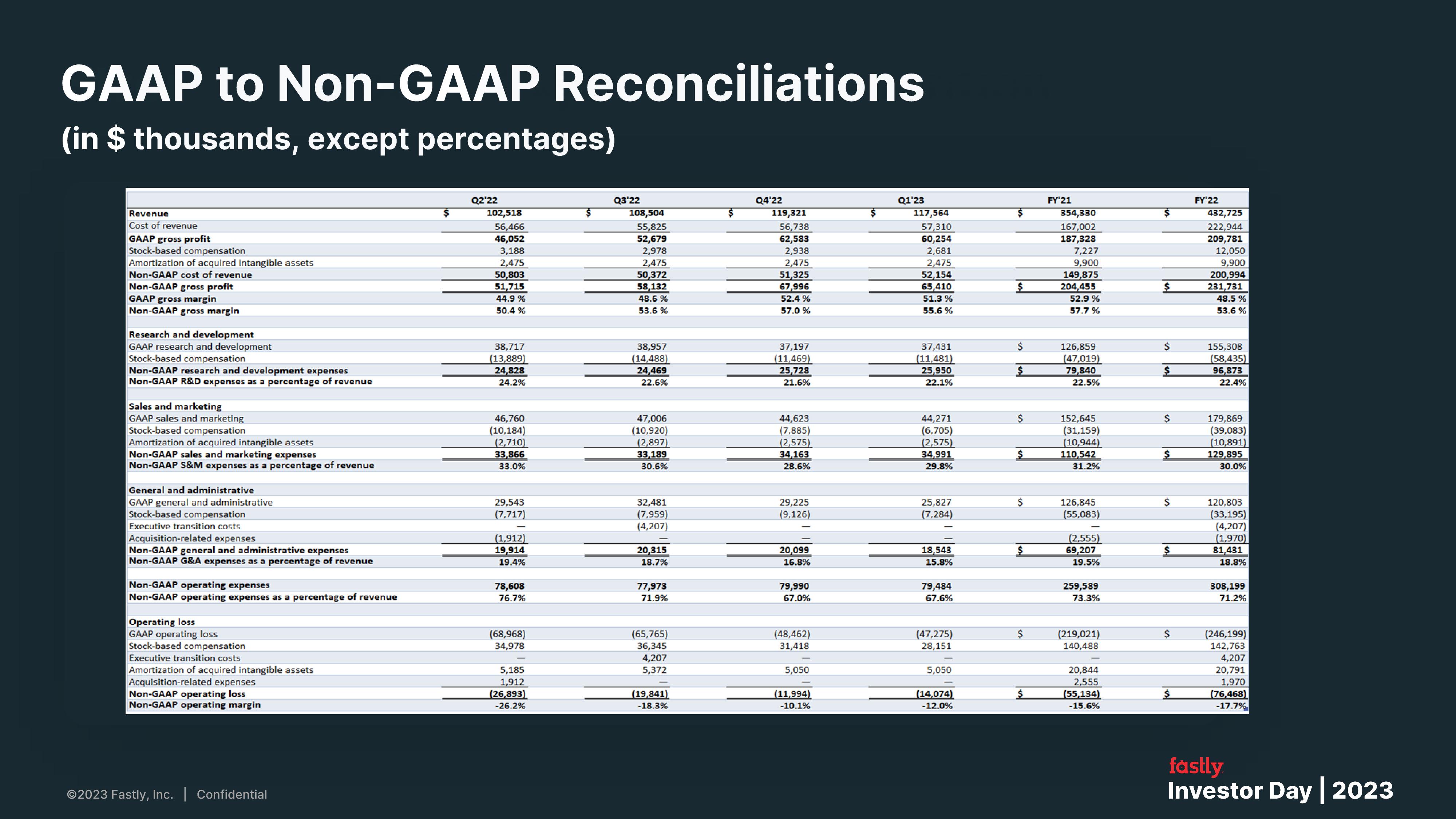

GAAP to Non-GAAP Reconciliations

(in $ thousands, except percentages)

Revenue

Cost of revenue

GAAP gross profit

Stock-based compensation

Amortization of acquired intangible assets

Non-GAAP cost of revenue

Non-GAAP gross profit

GAAP gross margin

Non-GAAP gross margin

Research and development

GAAP research and development

Stock-based compensation

Non-GAAP research and development expenses

Non-GAAP R&D expenses as a percentage of revenue

Sales and marketing

GAAP sales and marketing

Stock-based compensation

Amortization of acquired intangible assets

Non-GAAP sales and marketing expenses

Non-GAAP S&M expenses as a percentage of revenue

General and administrative

GAAP general and administrative

Stock-based compensation

Executive transition costs

Acquisition-related expenses

Non-GAAP general and administrative expenses

Non-GAAP G&A expenses as a percentage of revenue

Non-GAAP operating expenses

Non-GAAP operating expenses as a percentage of revenue

Operating loss

GAAP operating loss

Stock-based compensation

Executive transition costs

Amortization of acquired intangible assets

Acquisition-related expenses

Non-GAAP operating loss

Non-GAAP operating margin

Ⓒ2023 Fastly, Inc. | Confidential

Q2'22

102,518

56,466

46,052

3,188

2,475

50,803

51,715

44.9 %

50.4 %

38,717

(13,889)

24,828

24.2%

46,760

(10,184)

(2,710)

33,866

33.0%

29,543

(7,717)

(1,912)

19,914

19.4%

78,608

76.7%

(68,968)

34,978

5,185

1,912

(26,893)

-26.2%

Q3'22

108,504

55,825

52,679

2,978

2,475

50,372

58,132

48.6%

53.6%

38,957

(14,488)

24,469

22.6%

47,006

(10,920)

(2,897)

33,189

30.6%

32,481

(7,959)

(4,207)

20,315

18.7%

77,973

71.9%

(65,765)

36,345

4,207

5,372

(19,841)

-18.3%

$

Q4'22

119,321

56,738

62,583

2,938

2,475

51,325

67,996

52.4 %

57.0 %

37,197

(11,469)

25,728

21.6%

44,623

(7,885)

(2,575)

34,163

28.6%

29,225

(9,126)

20,099

16.8%

79,990

67.0%

(48,462)

31,418

5,050

(11,994)

-10.1%

Q1'23

117,564

57,310

60,254

2,681

2,475

52,154

65,410

51.3 %

55.6 %

37,431

(11,481)

25,950

22.1%

44,271

(6,705)

(2,575)

34,991

29.8%

25,827

(7,284)

18,543

15.8%

79,484

67.6%

(47,275)

28,151

5,050

(14,074)

-12.0%

$

$

$

$

$

$

$

$

FY'21

354,330

167,002

187,328

7,227

9,900

149,875

204,455

52.9 %

57.7 %

126,859

(47,019)

79,840

22.5%

152,645

(31,159)

(10,944)

110,542

31.2%

126,845

(55,083)

(2,555)

69,207

19.5%

259,589

73.3%

(219,021)

140,488

20,844

2,555

(55,134)

-15.6%

$

Ś

$

$

$

$

$

$

FY'22

432,725

222,944

209,781

12,050

9,900

200,994

231,731

48.5 %

53.6%

155,308

(58,435)

96,873

22.4%

179,869

(39,083)

(10,891)

129,895

30.0%

120,803

(33,195)

(4,207)

(1,970)

81,431

18.8%

308,199

71.2%

(246,199)

142,763

4,207

20,791

1,970

(76,468)

-17.7%

fastly

Investor Day | 2023View entire presentation