Goldman Sachs Results Presentation Deck

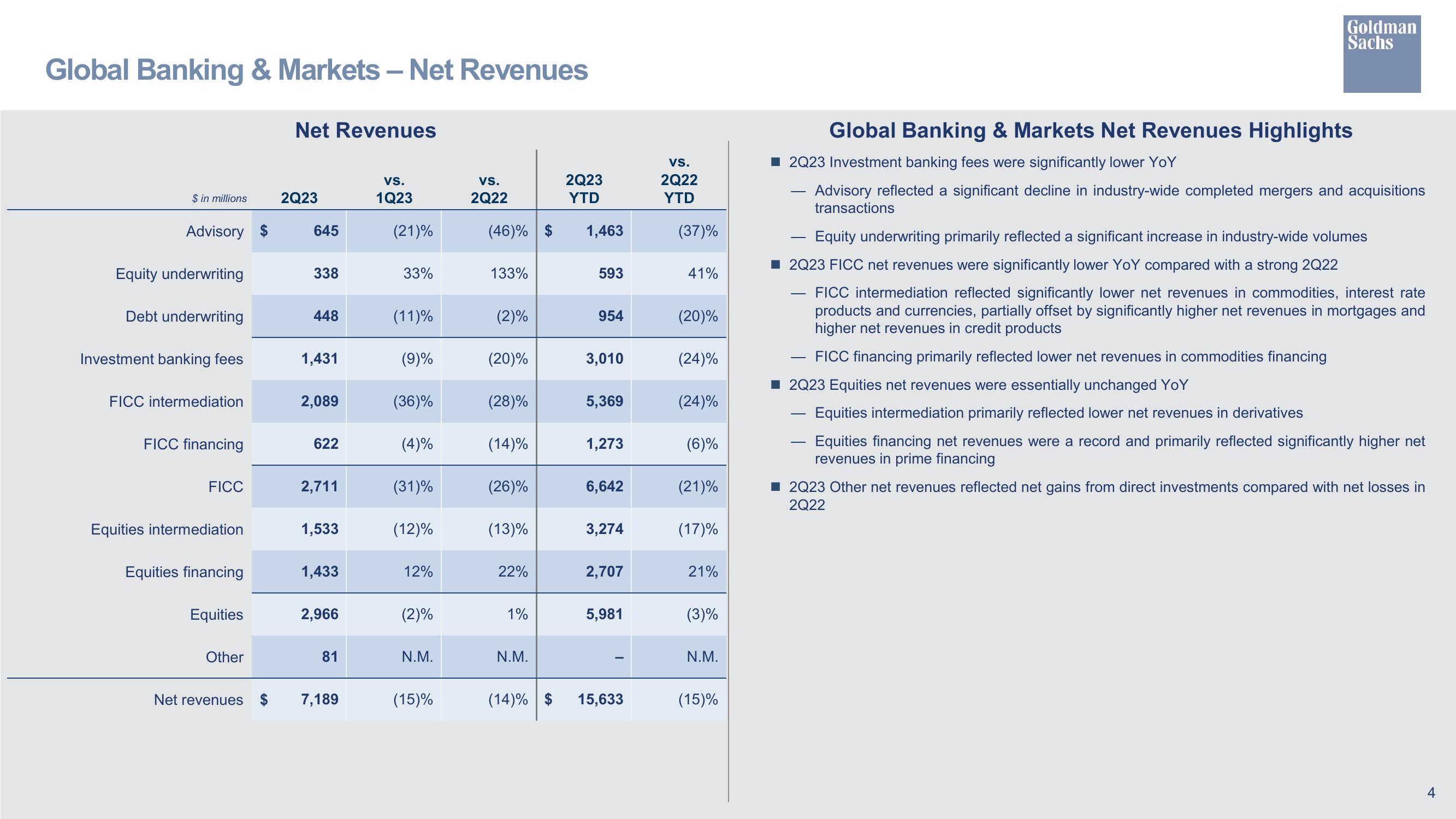

Global Banking & Markets - Net Revenues

$ in millions

Advisory $

Equity underwriting

Debt underwriting

Investment banking fees

FICC intermediation

FICC financing

FICC

Equities intermediation

Equities financing

Equities

Other

Net revenues

Net Revenues

2Q23

645

338

448

1,431

2,089

622

2,711

1,533

1,433

2,966

81

7,189

VS.

1Q23

(21)%

33%

(11)%

(9)%

(36)%

(4)%

(31)%

(12)%

12%

(2)%

N.M.

(15)%

2Q23

YTD

(46)%$ 1,463

VS.

2Q22

133%

(2)%

(20)%

(28)%

(14)%

(26)%

(13)%

22%

1%

N.M.

593

954

3,010

5,369

1,273

6,642

3,274

2,707

5,981

(14)%$ 15,633

VS.

2Q22

YTD

(37)%

41%

(20)%

(24)%

(24)%

(6)%

(21)%

(17)%

21%

(3)%

N.M.

(15)%

Global Banking & Markets Net Revenues Highlights

2Q23 Investment banking fees were significantly lower YoY

-

Goldman

Sachs

Equity underwriting primarily reflected a significant increase in industry-wide volumes

2Q23 FICC net revenues were significantly lower YoY compared with a strong 2Q22

FICC intermediation reflected significantly lower net revenues in commodities, interest rate

products and currencies, partially offset by significantly higher net revenues in mortgages and

higher net revenues in credit products

FICC financing primarily reflected lower net revenues in commodities financing

■2Q23 Equities net revenues were essentially unchanged YoY

Equities intermediation primarily reflected lower net revenues in derivatives

Equities financing net revenues were a record and primarily reflected significantly higher net

revenues in prime financing

-

-

Advisory reflected a significant decline in industry-wide completed mergers and acquisitions

transactions

■ 2Q23 Other net revenues reflected net gains from direct investments compared with net losses in

2Q22

4View entire presentation