BAT Results Presentation Deck

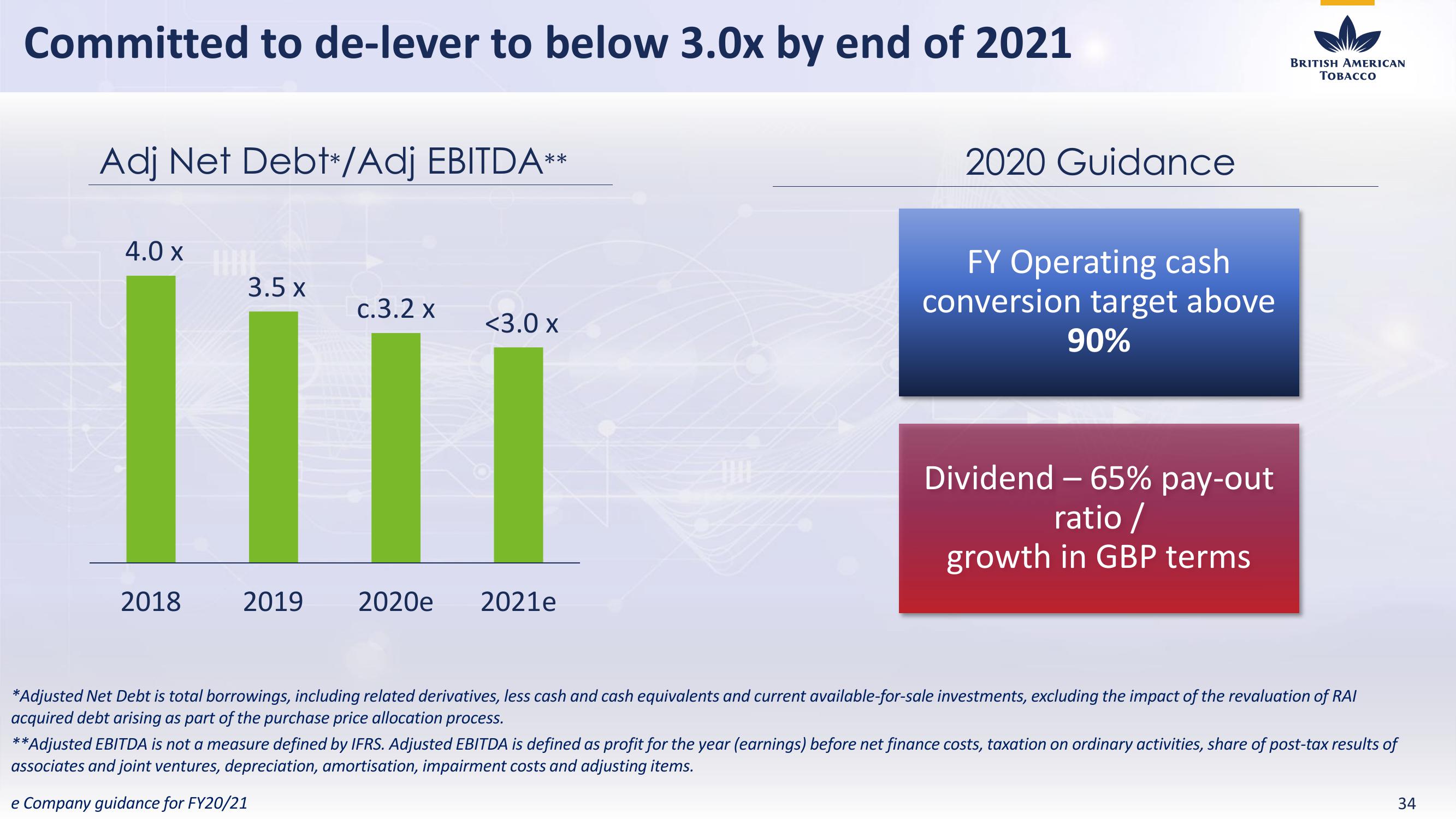

Committed to de-lever to below 3.0x by end of 2021

Adj Net Debt*/Adj EBITDA**

4.0 x

2018

IIIII

3.5 X

2019

c.3.2 x

2020e

<3.0 x

2021e

2020 Guidance

FY Operating cash

conversion target above

90%

Dividend - 65% pay-out

ratio /

growth in GBP terms

BRITISH AMERICAN

TOBACCO

*Adjusted Net Debt is total borrowings, including related derivatives, less cash and cash equivalents and current available-for-sale investments, excluding the impact of the revaluation of RAI

acquired debt arising as part of the purchase price allocation process.

**Adjusted EBITDA is not a measure defined by IFRS. Adjusted EBITDA is defined as profit for the year (earnings) before net finance costs, taxation on ordinary activities, share of post-tax results of

associates and joint ventures, depreciation, amortisation, impairment costs and adjusting items.

e Company guidance for FY20/21

34View entire presentation