Centrica Results Presentation Deck

Balance sheet and pension deficit focus continues

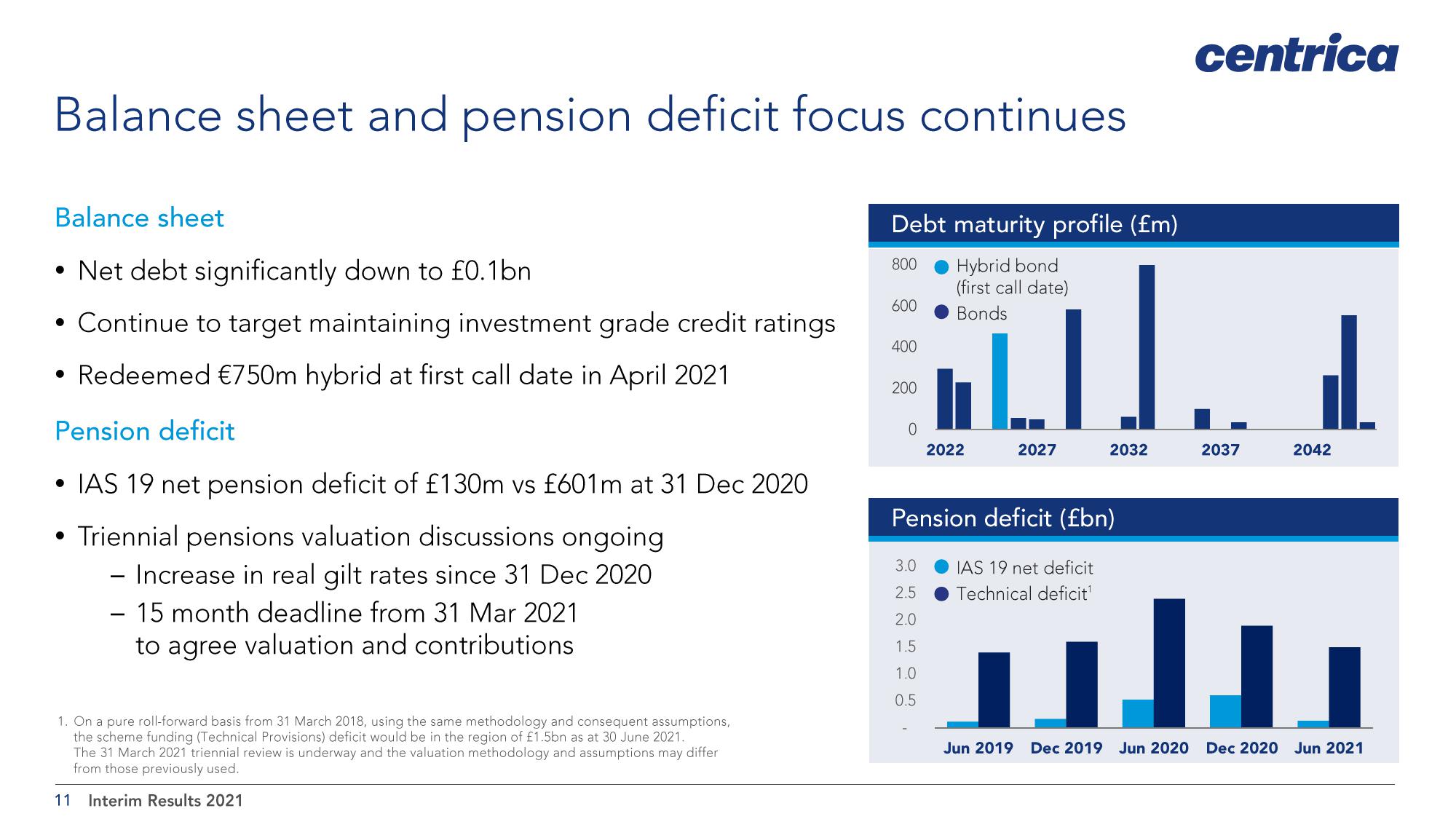

Balance sheet

• Net debt significantly down to £0.1bn

• Continue to target maintaining investment grade credit ratings

Redeemed €750m hybrid at first call date in April 2021

●

Pension deficit

IAS 19 net pension deficit of £130m vs £601m at 31 Dec 2020

●

●

Triennial pensions valuation discussions ongoing

- Increase in real gilt rates since 31 Dec 2020

- 15 month deadline from 31 Mar 2021

to agree valuation and contributions

1. On a pure roll-forward basis from 31 March 2018, using the same methodology and consequent assumptions,

the scheme funding (Technical Provisions) deficit would be in the region of £1.5bn as at 30 June 2021.

The 31 March 2021 triennial review is underway and the valuation methodology and assumptions may differ

from those previously used.

Interim Results 2021

11

Debt maturity profile (£m)

Hybrid bond

(first call date)

Bonds

800

600

400

200

0

2022

3.0

2.5

2.0

1.5

1.0

0.5

2027

Pension deficit (£bn)

2032

IAS 19 net deficit

Technical deficit¹

centrica

2037

1

2042

Jun 2019 Dec 2019 Jun 2020 Dec 2020 Jun 2021View entire presentation