Cannae SPAC Presentation Deck

1 Cannae is led by William P. Foley, Il

●

●

William P. Foley, Il

Best-In-Class Manager

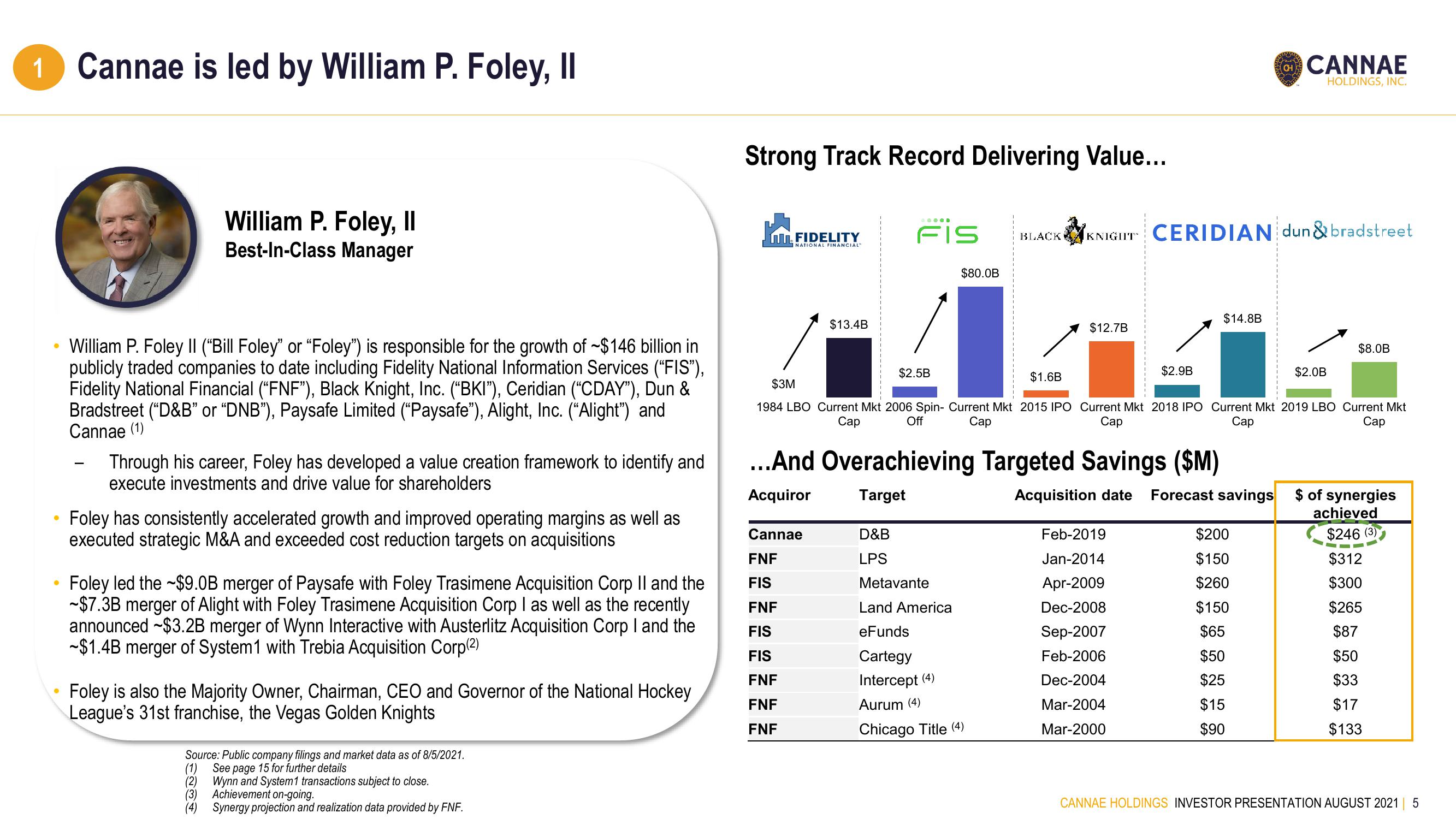

William P. Foley II ("Bill Foley" or "Foley") is responsible for the growth of ~$146 billion in

publicly traded companies to date including Fidelity National Information Services (“FIS”),

Fidelity National Financial (“FNF”), Black Knight, Inc. (“"BKI"), Ceridian ("CDAY”), Dun &

Bradstreet ("D&B" or "DNB"), Paysafe Limited ("Paysafe”), Alight, Inc. (“Alight") and

Cannae (1)

Through his career, Foley has developed a value creation framework to identify and

execute investments and drive value for shareholders

Foley has consistently accelerated growth and improved operating margins as well as

executed strategic M&A and exceeded cost reduction targets on acquisitions

Foley led the $9.0B merger of Paysafe with Foley Trasimene Acquisition Corp II and the

~$7.3B merger of Alight with Foley Trasimene Acquisition Corp I as well as the recently

announced -$3.2B merger of Wynn Interactive with Austerlitz Acquisition Corp I and the

~$1.4B merger of System1 with Trebia Acquisition Corp(2)

Foley is also the Majority Owner, Chairman, CEO and Governor of the National Hockey

League's 31st franchise, the Vegas Golden Knights

Source: Public company filings and market data as of 8/5/2021.

(1) See page 15 for further details

(2) Wynn and System1 transactions subject to close.

(3) Achievement on-going.

(4) Synergy projection and realization data provided by FNF.

Strong Track Record Delivering Value...

FIDELITY

NATIONAL FINANCIAL"

$13.4B

Cannae

FNF

FIS

FNF

FIS

FIS

FNF

FNF

FNF

FIS BLACK

$2.5B

D&B

LPS

$80.0B

$1.6B

Metavante

Land America

eFunds

Cartegy

Intercept (4)

Aurum (4)

Chicago Title (4)

$12.7B

...And Overachieving Targeted Savings ($M)

Acquiror

Target

Acquisition date

KNIGHT CERIDIAN dun & bradstreet

$2.9B

Feb-2019

Jan-2014

Apr-2009

Dec-2008

$3M

1984 LBO Current Mkt 2006 Spin- Current Mkt 2015 IPO Current Mkt 2018 IPO Current Mkt 2019 LBO Current Mkt

Cap

Off

Cap

Cap

Cap

Cap

Sep-2007

Feb-2006

Dec-2004

Mar-2004

Mar-2000

$14.8B

CH

Forecast savings

CANNAE

HOLDINGS, INC.

$200

$150

$260

$150

$65

$50

$25

$15

$90

$2.0B

$8.0B

$ of synergies

achieved

$246 (3)

$312

$300

$265

$87

$50

$33

$17

$133

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 5View entire presentation