Amplitude Results Presentation Deck

A

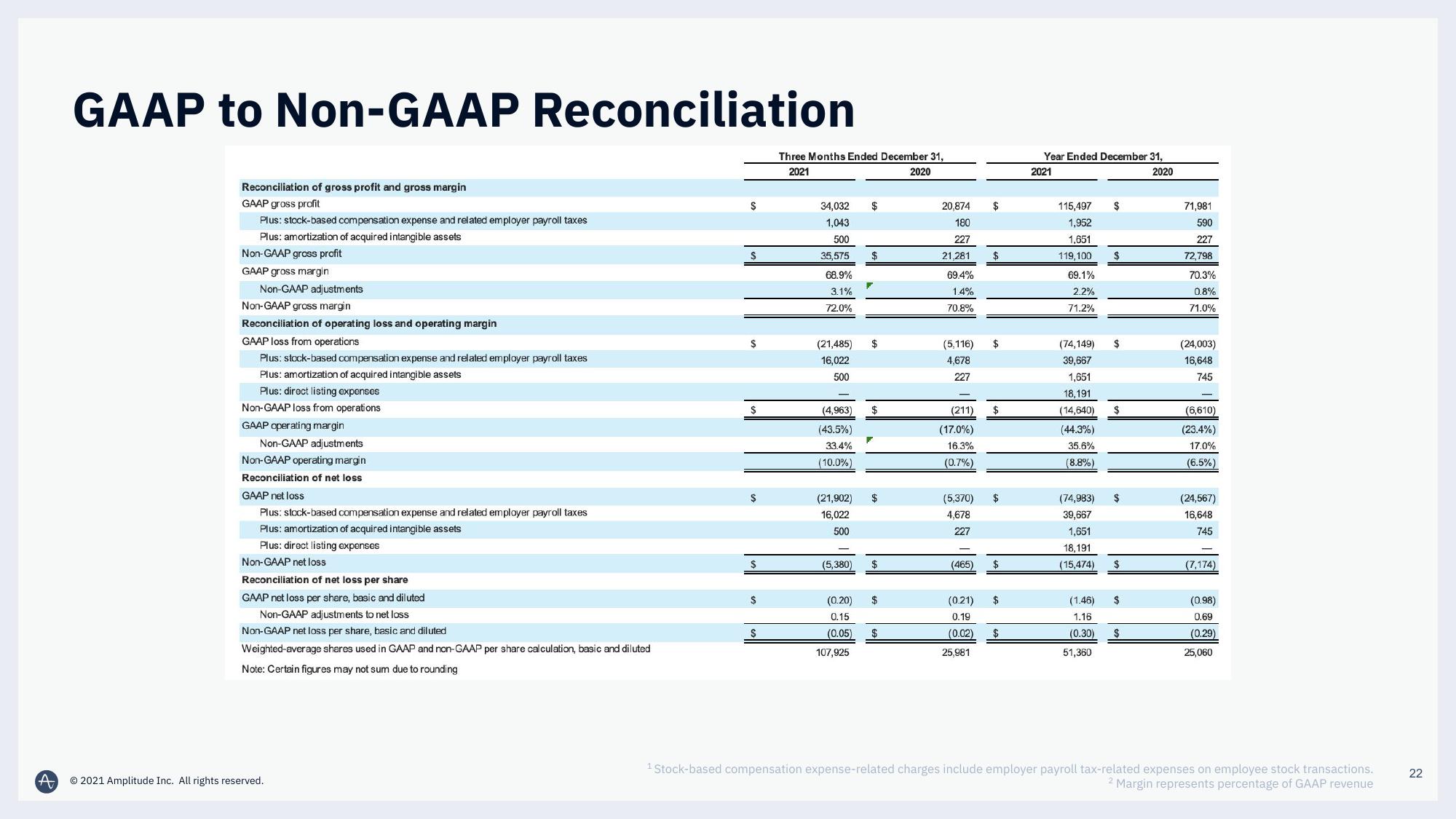

GAAP to Non-GAAP Reconciliation

Reconciliation of gross profit and gross margin

GAAP gross profit

Plus: stock-based compensation expense and related employer payroll taxes

Plus: amortization of acquired intangible assets

Non-GAAP gross profit

GAAP gross margin

Non-GAAP adjustments

Non-GAAP gross margin

Reconciliation of operating loss and operating margin

GAAP loss from operations

Plus: stock-based compensation expense and related employer payroll taxes

Plus: amortization of acquired intangible assets

Plus: direct listing expenses

Non-GAAP loss from operations

GAAP operating margin

Non-GAAP adjustments

Non-GAAP operating margin

Reconciliation of net loss

GAAP net loss

Plus: stock-based compensation expense and related employer payroll taxes

Plus: amortization of acquired intangible assets

Plus: direct listing expenses

Non-GAAP net loss

Reconciliation of net loss per share

GAAP net loss per share, basic and diluted

Non-GAAP adjustments to net loss

Non-GAAP net loss per share, basic and diluted

Weighted average shares used in GAAP and non-GAAP per share calculation, basic and diluted

Note: Certain figures may not sum due to rounding

© 2021 Amplitude Inc. All rights reserved.

S

S

$

S

$

$

$

Three Months Ended December 31,

2021

2020

34,032

1,043

500

35,575

68.9%

3.1%

72.0%

(21,485)

16,022

500

(4,963)

(43.5%)

33.4%

(10.0%)

(21,902)

16,022

500

$

$

$

(5,380) $

(0.20)

0.15

(0.05) $

107,925

$

20.874

180

227

21.281

69.4%

1.4%

70.8%

(5,116)

4,678

227

(211)

(17.0%)

16.3%

(0.7%)

(5,370)

4,678

227

(465)

$

(0.02)

25,981

$

$

$

$

$

(0.21) $

0.19

$

Year Ended December 31,

2020

2021

115,497

1,952

1,651

119,100

69.1%

2.2%

71.2%

(44.3%)

35.6%

(8.8%)

$

(74,149)

39,667

1,651

18,191

(14,640) $

$

51,360

$

(74,983)

39,667

1,651

18,191

(15,474) $

$

(1.46)

1.16

(0.30) $

$

71,981

590

227

72,798

70.3%

0.8%

71.0%

(24,003)

16,648

745

(6,610)

(23.4%)

17.0%

(6.5%)

(24,567)

16,648

745

(7,174)

(0.98)

0.69

(0.29)

25,060

¹ Stock-based compensation expense-related charges include employer payroll tax-related expenses on employee stock transactions.

2 Margin represents percentage of GAAP revenue

22View entire presentation